Region:Global

Author(s):Shubham

Product Code:KRAC0763

Pages:82

Published On:August 2025

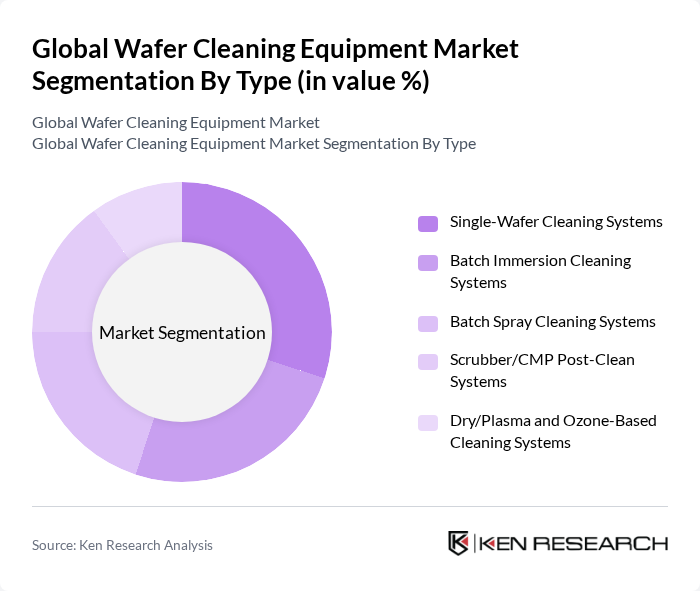

By Type:The market is segmented into various types of cleaning systems, including Single-Wafer Cleaning Systems, Batch Immersion Cleaning Systems, Batch Spray Cleaning Systems, Scrubber/CMP Post-Clean Systems, and Dry/Plasma and Ozone-Based Cleaning Systems. Each type serves specific cleaning needs in semiconductor manufacturing.

The Single-Wafer Cleaning Systems segment is currently dominating the market due to their ability to provide precise and effective cleaning for individual wafers, which is crucial in high-tech semiconductor manufacturing. The increasing complexity of semiconductor devices and the need for stringent cleanliness standards have led to a growing preference for single-wafer systems. Additionally, advancements in technology have improved the efficiency and effectiveness of these systems, making them a preferred choice among manufacturers.

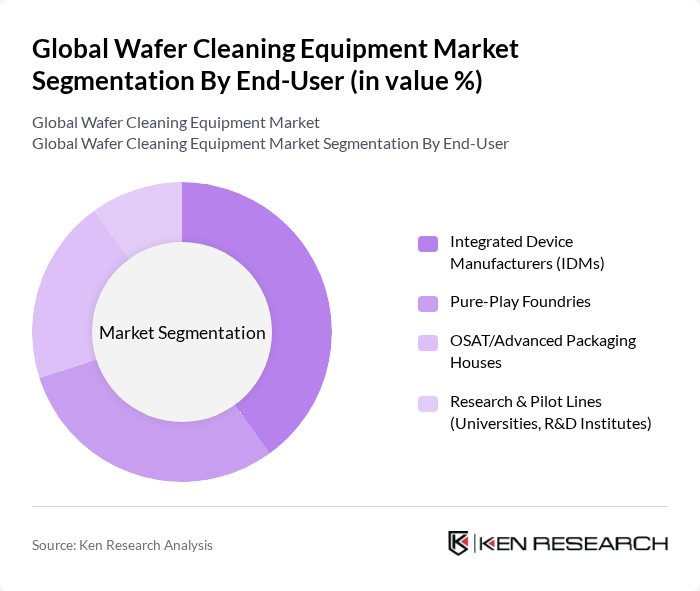

By End-User:The market is segmented based on end-users, including Integrated Device Manufacturers (IDMs), Pure-Play Foundries, OSAT/Advanced Packaging Houses, and Research & Pilot Lines (Universities, R&D Institutes). Each end-user category has distinct requirements for wafer cleaning processes.

The Integrated Device Manufacturers (IDMs) segment leads the market due to their extensive production capabilities and the need for high-quality cleaning processes to ensure the reliability of their semiconductor products. IDMs are increasingly investing in advanced cleaning technologies to meet the growing demand for smaller, more powerful chips. This trend is further supported by the rising complexity of semiconductor manufacturing processes, which necessitate stringent cleaning standards to prevent defects and ensure optimal performance.

The Global Wafer Cleaning Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as SCREEN Semiconductor Solutions Co., Ltd., Tokyo Electron Limited (TEL), Lam Research Corporation, Applied Materials, Inc., KCTech Co., Ltd., ACM Research, Inc., NAURA Technology Group Co., Ltd., Modutek Corporation, JST Manufacturing, Inc., Ultron Systems, Inc., PCT Systems, Inc., Akrion Technologies, LLC, Entegris, Inc. (Process and filtration systems), Semes Co., Ltd., AP&S International GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wafer cleaning equipment market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt integrated cleaning systems and IoT-enabled solutions, operational efficiencies are expected to improve significantly. Furthermore, the rising demand for eco-friendly cleaning solutions will likely shape product development, aligning with global sustainability initiatives. This evolving landscape presents opportunities for companies to innovate and capture market share in a competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Wafer Cleaning Systems Batch Immersion Cleaning Systems Batch Spray Cleaning Systems Scrubber/CMP Post-Clean Systems Dry/Plasma and Ozone-Based Cleaning Systems |

| By End-User | Integrated Device Manufacturers (IDMs) Pure-Play Foundries OSAT/Advanced Packaging Houses Research & Pilot Lines (Universities, R&D Institutes) |

| By Application | Front-End-of-Line (RCA, Pre-epi, Pre-diffusion) Back-End-of-Line (Post-etch, Post-ash, Metal Clean) CMP Post-Clean Advanced Packaging and Wafer-Level Packaging |

| By Distribution Channel | Direct (OEM to Fab) System Integrators and Local Representatives Aftermarket/Refurbished Tool Providers Online & Framework Agreements |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level/Refurbished Tools Mid-Range Production Tools High-End/Leading-Edge Nodes Tools |

| By Technology | Wet Bench and Chemical Immersion Megasonic/Ultrasonic Cleaning Ozone, Supercritical CO2, and Dry Cleaning Automation and Advanced Process Control |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Fabrication Plants | 120 | Process Engineers, Production Managers |

| Wafer Cleaning Equipment Manufacturers | 90 | Product Development Managers, Sales Directors |

| Research Institutions in Semiconductor Technology | 60 | Research Scientists, Technical Advisors |

| End-users in Electronics Manufacturing | 100 | Quality Assurance Managers, Operations Supervisors |

| Industry Experts and Consultants | 50 | Market Analysts, Technology Consultants |

The Global Wafer Cleaning Equipment Market is valued at approximately USD 6.1 billion, reflecting a significant growth driven by the increasing demand for semiconductor devices and advancements in cleaning technologies essential for high-quality production.