Region:Global

Author(s):Geetanshi

Product Code:KRAA1188

Pages:99

Published On:August 2025

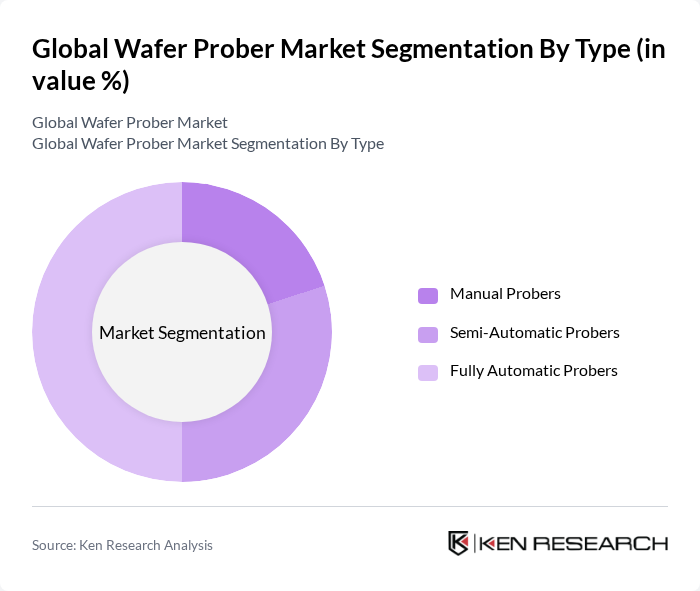

By Type:The market is segmented into Manual Probers, Semi-Automatic Probers, and Fully Automatic Probers. Among these, Fully Automatic Probers are leading the market due to their efficiency and precision in handling high-volume production. The trend towards automation in semiconductor manufacturing is driving the demand for fully automatic solutions, as they reduce human error and increase throughput. Fully automatic wafer probers are particularly favored in mass-production environments for their high precision and speed, while semi-automatic and manual probers are more commonly used in research, development, and low-volume production settings .

By End-User:The end-user segmentation includes Semiconductor Manufacturers, Research & Development Institutions, and Electronics & Device Manufacturers. Semiconductor Manufacturers dominate this segment, driven by the increasing demand for chips in various applications such as smartphones, automotive electronics, and industrial automation. The continuous innovation in semiconductor technology, particularly in advanced node manufacturing and integration of AI functionalities, further fuels the growth of this segment .

The Global Wafer Prober Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tokyo Electron Limited (TEL), Tokyo Seimitsu Co., Ltd. (Accretech), FormFactor, Inc., Micronics Japan Co., Ltd. (MJC), MPI Corporation, Wentworth Laboratories Ltd., Advantest Corporation, Chroma ATE Inc., SUSS MicroTec SE, Cohu, Inc., Lake Shore Cryotronics, Inc., ESDEMC Technology LLC, Hprobe, Shenzhen Sidea Semiconductor Co., Ltd., and Psaic (Precision Systems Industrial Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wafer prober market appears promising, driven by technological advancements and increasing demand for semiconductor devices. As industries such as automotive and telecommunications expand, the need for efficient testing solutions will grow. Additionally, the integration of artificial intelligence in manufacturing processes is expected to enhance operational efficiency. Companies that invest in innovative probing technologies will likely gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Probers Semi-Automatic Probers Fully Automatic Probers |

| By End-User | Semiconductor Manufacturers Research & Development Institutions Electronics & Device Manufacturers |

| By Application | Wafer Testing (IC/Chip Testing) Device Characterization Failure Analysis MEMS & Sensor Testing |

| By Component | Probe Cards Probing Stations Control & Automation Systems Chuck Systems |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Probers Mid-Range Probers High-End Probers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Memory Chip Manufacturing | 100 | Process Engineers, Production Managers |

| Logic Device Production | 80 | Quality Assurance Managers, Equipment Technicians |

| RF Device Testing | 60 | Test Engineers, R&D Managers |

| Wafer Prober Suppliers | 50 | Sales Directors, Product Development Engineers |

| Semiconductor Equipment Distributors | 40 | Supply Chain Managers, Business Development Executives |

The Global Wafer Prober Market is valued at approximately USD 2.4 billion, reflecting a significant growth trend driven by the increasing demand for semiconductor devices across various industries, including consumer electronics, automotive, and telecommunications.