Region:Global

Author(s):Dev

Product Code:KRAB0339

Pages:81

Published On:August 2025

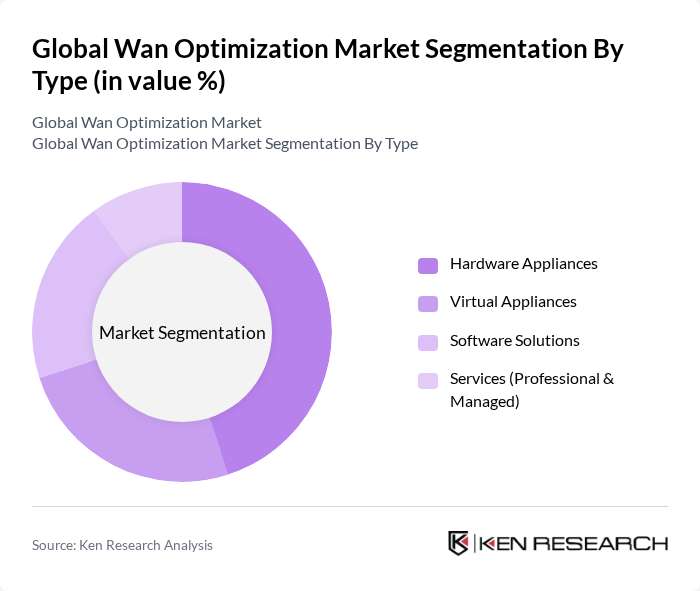

By Type:

The WAN optimization market is segmented into four main types: Hardware Appliances, Virtual Appliances, Software Solutions, and Services (Professional & Managed). Hardware Appliances continue to hold the largest market share due to their reliability, performance, and ability to optimize network traffic for large enterprises with high data loads. However, the demand for Software Solutions and Virtual Appliances is rising rapidly as businesses seek flexible, scalable, and cloud-integrated options that can be easily deployed across distributed IT environments. Services, including professional and managed offerings, are increasingly adopted to support complex deployments and ongoing network optimization.

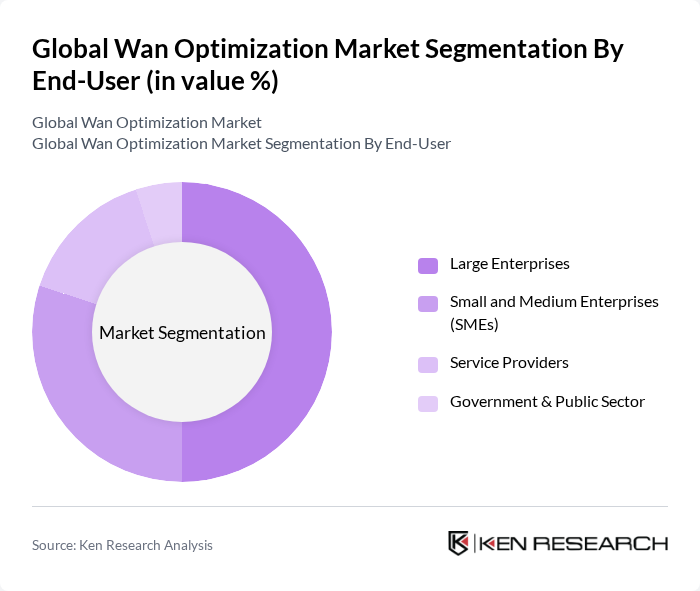

By End-User:

The end-user segmentation includes Large Enterprises, Small and Medium Enterprises (SMEs), Service Providers, and Government & Public Sector. Large Enterprises account for the largest share due to their extensive network requirements and the need for robust WAN optimization solutions to manage vast amounts of data traffic. SMEs are increasingly adopting WAN optimization to enhance productivity, support cloud migration, and improve customer satisfaction. Service Providers and the Government & Public Sector are also expanding their use of WAN optimization to address bandwidth-intensive applications, improve security, and support digital transformation initiatives.

The Global Wan Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Riverbed Technology, Inc., Citrix Systems, Inc., Silver Peak Systems, Inc. (now part of Aruba, a Hewlett Packard Enterprise company), Aryaka Networks, Inc., VMware, Inc., Nokia Corporation, Huawei Technologies Co., Ltd., Fortinet, Inc., Juniper Networks, Inc., A10 Networks, Inc., Infovista S.A., Cato Networks, Ltd., Peplink International Ltd., Talari Networks, Inc. (now part of Oracle Corporation), Array Networks, Inc., Symantec Corporation (now part of Broadcom Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The WAN optimization market is poised for significant evolution, driven by technological advancements and changing business needs. The shift towards SD-WAN solutions is expected to redefine network management, offering enhanced flexibility and cost-effectiveness. Additionally, the growing emphasis on network security will likely lead to the integration of advanced security features within WAN optimization solutions. As organizations continue to embrace digital transformation, the demand for efficient and secure WAN optimization technologies will remain strong, shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Appliances Virtual Appliances Software Solutions Services (Professional & Managed) |

| By End-User | Large Enterprises Small and Medium Enterprises (SMEs) Service Providers Government & Public Sector |

| By Application | Data Center Optimization Cloud Services Acceleration Remote Office/Branch Office (ROBO) Connectivity Disaster Recovery & Business Continuity |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Industry Vertical | BFSI (Banking, Financial Services & Insurance) IT & Telecom Healthcare Government Manufacturing Retail Others |

| By Pricing Model | Subscription-Based One-Time License Pay-As-You-Go |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise WAN Optimization Solutions | 120 | IT Managers, Network Engineers |

| Cloud-Based WAN Services | 90 | Cloud Architects, Service Delivery Managers |

| Telecommunications Infrastructure | 60 | Telecom Engineers, Network Operations Managers |

| SMB WAN Optimization Adoption | 50 | Small Business Owners, IT Consultants |

| Industry-Specific WAN Solutions | 70 | Industry Analysts, Solution Architects |

The Global WAN Optimization Market is valued at approximately USD 3.55 billion, driven by the increasing demand for efficient data transfer, network performance optimization, and the expansion of digital infrastructure and remote work capabilities.