Region:Global

Author(s):Shubham

Product Code:KRAA1092

Pages:84

Published On:August 2025

By Type:The market is segmented into various types, including Automated Storage and Retrieval Systems (AS/RS), Warehouse Management Systems (WMS), Material Handling Equipment, Robotics and Automation Solutions, Inventory Management Software, IoT and Sensor Solutions, and Others. Among these, Warehouse Management Systems (WMS) are currently leading the market due to their critical role in optimizing warehouse operations and improving inventory accuracy. The increasing complexity of supply chains and the need for real-time data analytics are driving the demand for WMS solutions. Automation, robotics, and IoT integration are also rapidly gaining traction, supporting the transition toward smart warehouses and data-driven operations .

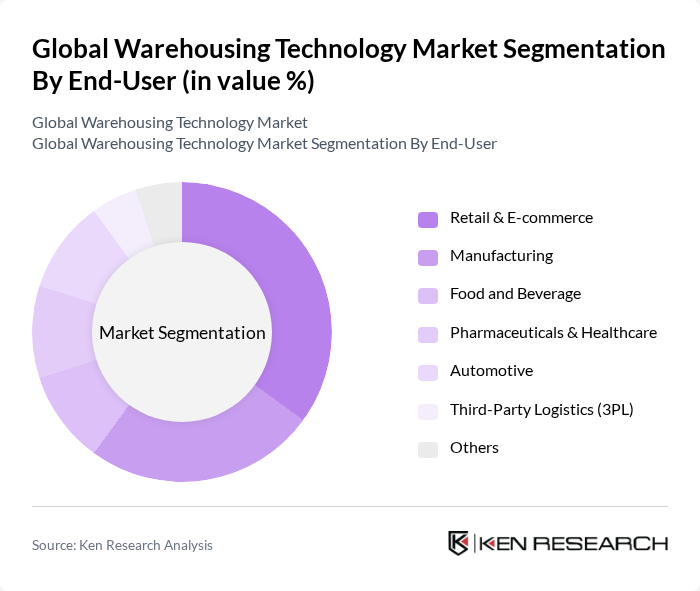

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals & Healthcare, Automotive, Third-Party Logistics (3PL), and Others. The Retail & E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient order fulfillment processes. Companies are increasingly investing in advanced warehousing technologies to meet consumer demands for faster delivery and improved service levels. Manufacturing and third-party logistics are also significant adopters, leveraging automation and digitalization to enhance operational efficiency and scalability .

The Global Warehousing Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dematic, Honeywell Intelligrated, Siemens Logistics, Swisslog, Vanderlande, Knapp AG, SSI Schaefer, Murata Machinery, Interroll, KION Group, TGW Logistics Group, Bastian Solutions, 3M, Zebra Technologies, Blue Yonder, Manhattan Associates, Oracle, SAP, Daifuku Co., Ltd., Geek+ contribute to innovation, geographic expansion, and service delivery in this space.

The future of the warehousing technology market is poised for transformative growth, driven by the integration of smart technologies and the increasing emphasis on sustainability. As companies adopt more sophisticated data analytics and automation solutions, operational efficiencies are expected to improve significantly. Additionally, the rise of omni-channel distribution strategies will necessitate further investments in flexible warehousing solutions. In future, the focus on sustainable practices will also reshape the market, as businesses seek to minimize their environmental impact while enhancing supply chain resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Storage and Retrieval Systems (AS/RS) Warehouse Management Systems (WMS) Material Handling Equipment (Conveyors, Forklifts, AGVs) Robotics and Automation Solutions (Mobile Robots, Cobots, Drones) Inventory Management Software IoT and Sensor Solutions Others |

| By End-User | Retail & E-commerce Manufacturing Food and Beverage Pharmaceuticals & Healthcare Automotive Third-Party Logistics (3PL) Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Centers Retail Chains Others |

| By Component | Hardware Software Services (Integration, Maintenance, Consulting) |

| By Application | Order Fulfillment Inventory Management Shipping and Receiving Returns Management Cold Storage & Temperature-Controlled Logistics Others |

| By Sales Channel | Online Sales Offline Sales |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Automation Solutions | 100 | Warehouse Managers, Operations Directors |

| Inventory Management Software | 80 | IT Managers, Supply Chain Analysts |

| Cold Chain Logistics Technologies | 70 | Logistics Coordinators, Quality Assurance Managers |

| Robotics in Warehousing | 50 | Automation Engineers, Project Managers |

| Data Analytics in Supply Chain | 60 | Data Scientists, Business Intelligence Analysts |

The Global Warehousing Technology Market is valued at approximately USD 1.7 trillion, reflecting significant growth driven by the demand for automation and efficiency in supply chain operations, particularly due to the rise of e-commerce.