Region:Global

Author(s):Shubham

Product Code:KRAC0756

Pages:83

Published On:August 2025

By Type:The market is segmented into various types of water-soluble films, including Polyvinyl Alcohol (PVA), Polyvinyl Alcohol Blends, Starch-Based Films, Cellulose Derivatives, Cold-Water Soluble Films, Hot-Water Soluble Films, and Others. PVA-based films are the most widely used owing to their water solubility, film-forming capability, and suitability for unit-dose applications across detergents, agrochemicals, and healthcare. Industry coverage consistently identifies PVA as the dominant material in water-soluble films.

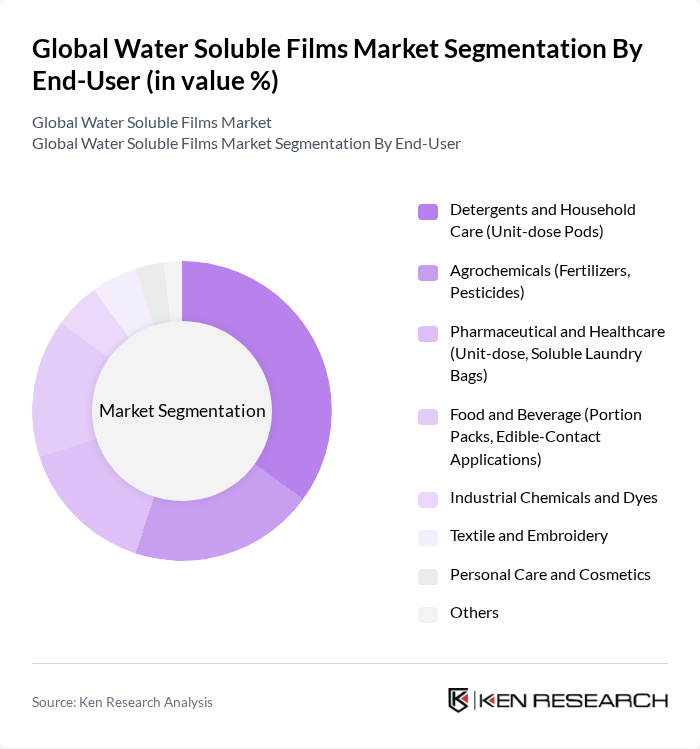

By End-User:The end-user segmentation includes various industries such as Detergents and Household Care, Agrochemicals, Pharmaceutical and Healthcare, Food and Beverage, Industrial Chemicals and Dyes, Textile and Embroidery, Personal Care and Cosmetics, and Others. Detergents and Household Care lead due to the widespread adoption of unit-dose pods that rely on PVA-based soluble films for controlled dosing, user convenience, and reduced contact with concentrates; agriculture and healthcare also represent core use cases for safety, hygiene, and portability.

The Global Water Soluble Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuraray Co., Ltd., Aicello Corporation, Sekisui Chemical Co., Ltd., Mitsubishi Chemical Group Corporation, Cortec Corporation, Changzhou Wujin EHU Special Chemical Co., Ltd., Foshan Polyva Materials Co., Ltd., Jiangmen Proudly Water-Soluble Plastic Co., Ltd., Arrow PVA (Arrow GreenTech Ltd.), Lithey Inc., Soltec (Soltec Srl), Neenah, Inc. (Mativ Holdings, Inc.), Aquapak Polymers Ltd., Lactips, and Mondi plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the water-soluble films market appears promising, driven by increasing regulatory pressures and consumer demand for sustainable solutions. As e-commerce continues to expand, the need for eco-friendly packaging will grow, presenting opportunities for innovation. Additionally, advancements in biodegradable materials will likely enhance product offerings, making them more appealing to a broader audience. Collaborations with sustainable brands will further accelerate market penetration, fostering a more environmentally conscious packaging landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyvinyl Alcohol (PVA) Polyvinyl Alcohol Blends (e.g., PVA+Starch, PVA+PVOH Copolymers) Starch-Based Films Cellulose Derivatives (e.g., HPMC) Cold-Water Soluble Films Hot-Water Soluble Films Others (Bio-based and Modified PVA Grades) |

| By End-User | Detergents and Household Care (Unit-dose Pods) Agrochemicals (Fertilizers, Pesticides) Pharmaceutical and Healthcare (Unit-dose, Soluble Laundry Bags) Food and Beverage (Portion Packs, Edible-Contact Applications) Industrial Chemicals and Dyes Textile and Embroidery Personal Care and Cosmetics Others |

| By Application | Packaging (Unit-dose Sachets, Bags, Pouches) Embroidery and Textile Processing Films Water-Transfer Printing/Coatings Laundry and Infection-Control Bags Seed Coating and Agricultural Mulch Films Detergent Pods and Dishwashing Capsules Others |

| By Dissolution Profile | Fast-Soluble Films Medium-Soluble Films Difficult/Slow-Soluble Films |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Thickness | ?25 microns –50 microns >50 microns |

| By Regulatory/Compliance | FDA and Food-Contact Approvals (where applicable) EU Regulations (REACH, food-contact where applicable) Biodegradability/Compostability Certifications (e.g., EN 13432, ASTM) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Applications | 100 | Agronomists, Farm Managers |

| Pharmaceutical Packaging | 80 | Quality Assurance Managers, Packaging Engineers |

| Food Industry Usage | 90 | Food Technologists, Supply Chain Managers |

| Consumer Goods Sector | 70 | Product Managers, Marketing Directors |

| Environmental Impact Studies | 60 | Sustainability Analysts, Environmental Scientists |

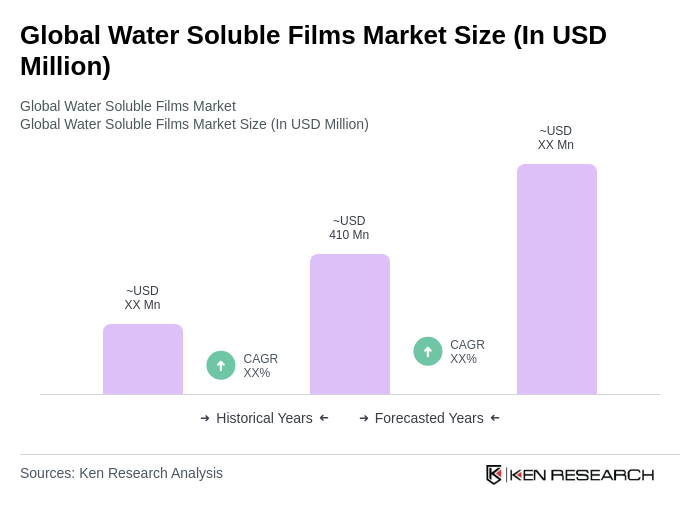

The Global Water Soluble Films Market is valued at approximately USD 410 million, based on a five-year historical analysis. This valuation reflects the growing demand for sustainable packaging solutions across various industries.