Region:Global

Author(s):Shubham

Product Code:KRAA1834

Pages:97

Published On:August 2025

By Type:The market is segmented into various types of water testing methods, including chemical testing, microbiological testing, physical testing, radiological testing, and emerging contaminants & organics. Each of these sub-segments plays a crucial role in ensuring water quality and safety .

The chemical testing segment is currently dominating the market due to the increasing need for monitoring various chemical contaminants in water sources. This includes testing for heavy metals, disinfectants, and emerging pollutants like PFAS, which have gained significant attention due to their harmful effects on human health and the environment. The growing regulatory requirements and public awareness regarding water quality are driving the demand for chemical testing solutions, making it a critical focus area for water testing companies .

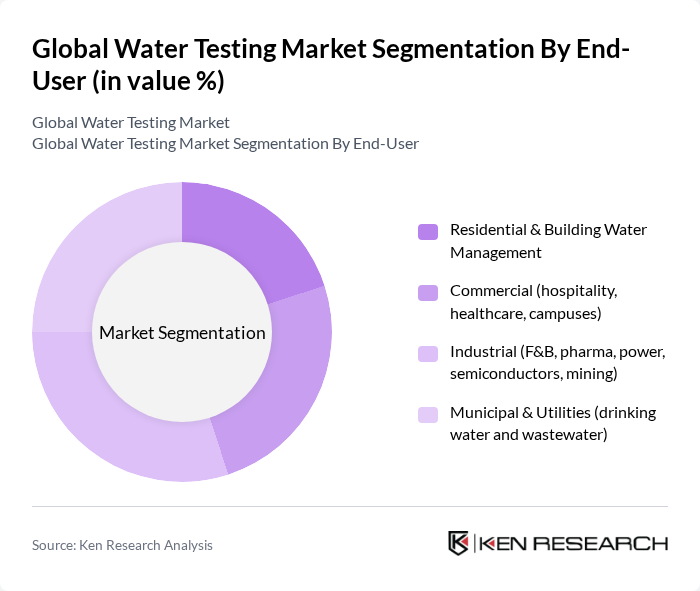

By End-User:The market is segmented based on end-users, including residential & building water management, commercial (hospitality, healthcare, campuses), industrial (F&B, pharma, power, semiconductors, mining), and municipal & utilities (drinking water and wastewater). Each segment has unique requirements and applications for water testing .

The industrial segment is leading the market due to the stringent regulations imposed on industries regarding water quality and discharge standards. Industries such as food and beverage, pharmaceuticals, and power generation require regular water testing to ensure compliance with environmental regulations and to maintain operational efficiency. The increasing focus on sustainability and environmental responsibility among industries is further driving the demand for advanced water testing solutions .

The Global Water Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hach (a Danaher company), Thermo Fisher Scientific Inc., Xylem Inc. (incl. YSI, Aanderaa, Ozone/analytics), Agilent Technologies, Inc., Revvity, Inc. (formerly PerkinElmer, Inc.), IDEXX Laboratories, Inc., Danaher Corporation, Merck KGaA (MilliporeSigma), Eurofins Scientific SE, SGS S.A., Intertek Group plc, ALS Limited, Bureau Veritas S.A., Tetra Tech, Inc., Ecolab Inc. (incl. Nalco Water), Shimadzu Corporation, HORIBA, Ltd., Emerson Electric Co. (Rosemount, analytical), Endress+Hauser Group, Veolia Environnement S.A. (including SUEZ), TÜV SÜD AG, Pace Analytical Services, LLC, NSF International, Lovibond (Tintometer GmbH), Hanna Instruments contribute to innovation, geographic expansion, and service delivery in this space.

The future of the water testing market is poised for significant transformation, driven by technological innovations and increasing regulatory pressures. As IoT and AI technologies become more integrated into water quality monitoring, the efficiency and accuracy of testing will improve. Additionally, the growing emphasis on sustainable water management practices will further propel investments in advanced testing solutions, consistent with UN and OECD guidance on resilient and digital water systems. Companies that adapt to these trends will likely gain a competitive edge, ensuring they meet the evolving demands of consumers and regulatory bodies alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Testing (e.g., nutrients, metals, disinfectants, PFAS) Microbiological Testing (e.g., total coliform, E. coli, Legionella) Physical Testing (e.g., turbidity, conductivity, TDS, temperature) Radiological Testing (gross alpha/beta, radionuclides) Emerging Contaminants & Organics (e.g., PFAS, VOCs, pesticides) |

| By End-User | Residential & Building Water Management Commercial (hospitality, healthcare, campuses) Industrial (F&B, pharma, power, semiconductors, mining) Municipal & Utilities (drinking water and wastewater) |

| By Application | Drinking Water Testing (source, treatment, distribution) Wastewater & Effluent Testing (industrial and municipal) Environmental Monitoring (surface water, groundwater) Process Water & CIP Validation (industrial QA/QC) |

| By Distribution Channel | Direct Sales (OEMs and enterprise contracts) Online Sales (e-commerce and vendor portals) Retail & Trade (laboratory supply, industrial distributors) System Integrators & VARs |

| By Region | North America Europe Asia-Pacific Latin America |

| By Technology | Electrochemical Sensors (pH, DO, ORP, conductivity, ion-selective) Spectroscopy & Chromatography (UV-Vis, ICP-MS, GC/LC) Microbiological Methods (culture, IDEXX Colilert, qPCR) Rapid/On-site & Portable (colorimetric kits, handheld meters) Online/Continuous Monitoring (IoT probes, SCADA-integrated) |

| By Price Range | Entry (field kits, basic handheld meters) Mid (benchtop analyzers, multi-parameter sondes) Premium (advanced lab systems, ICP-MS, TOC analyzers) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Testing | 150 | Water Quality Managers, Environmental Engineers |

| Industrial Water Quality Management | 100 | Compliance Officers, Plant Managers |

| Private Water Testing Services | 80 | Laboratory Technicians, Business Development Managers |

| Research Institutions and Academia | 70 | Research Scientists, Professors in Environmental Science |

| Regulatory Bodies and NGOs | 60 | Policy Makers, Environmental Advocates |

The Global Water Testing Market is valued at approximately USD 7.6 billion, driven by increasing concerns over water quality, regulatory compliance, and the prevalence of waterborne diseases. This market is expected to grow as industries and municipalities seek advanced testing solutions.