Region:Global

Author(s):Rebecca

Product Code:KRAB0301

Pages:92

Published On:August 2025

By Type:The market is segmented into various types of platforms that cater to different aspects of wealth management. The subsegments include Full-Service Wealth Management Platforms, Robo-Advisory Platforms, Investment Management Platforms, Financial Planning Software, Portfolio Management Tools, Tax Optimization Solutions, Compliance & Risk Management Solutions, Reporting & Analytics Platforms, and Others. Each of these subsegments addresses the diverse needs of clients by integrating portfolio management, risk assessment, financial planning, tax optimization, compliance, and advanced analytics. These platforms increasingly leverage artificial intelligence and automation to deliver personalized investment strategies, streamline operations, and enhance regulatory compliance .

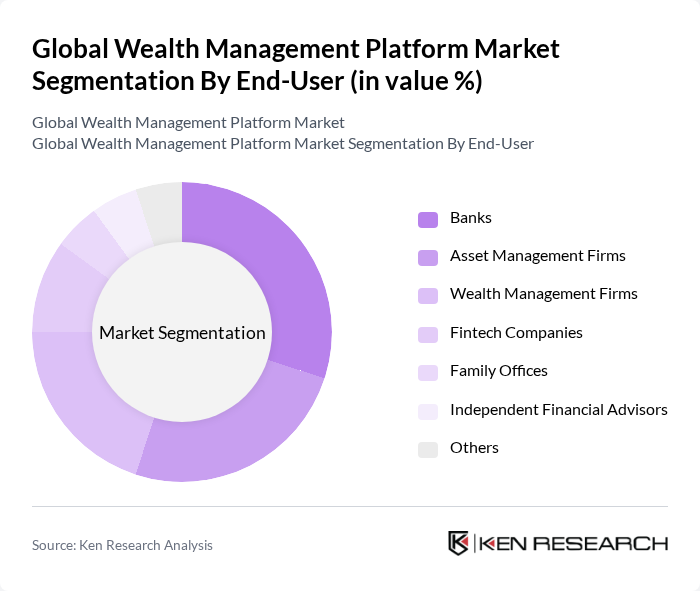

By End-User:The wealth management platform market is also segmented by end-users, which include Banks, Asset Management Firms, Wealth Management Firms, Fintech Companies, Family Offices, Independent Financial Advisors, and Others. Each end-user category has unique requirements and preferences, influencing the types of platforms they adopt for managing client assets and providing financial advice. Banks and asset management firms prioritize integrated solutions for regulatory compliance and large-scale portfolio management, while fintech companies and independent advisors focus on agility, automation, and client engagement through digital channels .

The Global Wealth Management Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as BlackRock, Inc., Vanguard Group, Inc., Charles Schwab Corporation, Fidelity Investments, UBS Group AG, Morgan Stanley, JPMorgan Chase & Co., Wells Fargo & Company, Goldman Sachs Group, Inc., Citigroup Inc., BNY Mellon, State Street Corporation, T. Rowe Price Group, Inc., Raymond James Financial, Inc., Ameriprise Financial, Inc., Fiserv, Inc., Temenos AG, SEI Investments Company, SS&C Technologies Holdings, Inc., FNZ Group, Envestnet, Inc., Broadridge Financial Solutions, Inc., Avaloq Group AG, InvestCloud, Inc., Objectway S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wealth management sector is poised for significant transformation, driven by technological advancements and changing client expectations. As firms increasingly adopt digital solutions, the demand for seamless, user-friendly platforms will rise. Additionally, the focus on sustainable investing is expected to grow, with clients seeking investments that align with their values. Firms that can adapt to these trends and leverage technology effectively will likely thrive in this evolving landscape, enhancing client engagement and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Wealth Management Platforms Robo-Advisory Platforms Investment Management Platforms Financial Planning Software Portfolio Management Tools Tax Optimization Solutions Compliance & Risk Management Solutions Reporting & Analytics Platforms Others |

| By End-User | Banks Asset Management Firms Wealth Management Firms Fintech Companies Family Offices Independent Financial Advisors Others |

| By Service Model | Subscription-Based Services Commission-Based Services Fee-Only Services Hybrid Models |

| By Deployment Mode | Cloud-Based Platforms On-Premise Platforms |

| By Client Demographics | High Net-Worth Individuals (HNWIs) Mass Affluent Retail Investors Institutional Investors Family Offices |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Type | Equities Fixed Income Real Estate Alternative Investments Cash & Cash Equivalents Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individual Insights | 100 | Wealth Managers, Financial Advisors |

| Institutional Investor Perspectives | 60 | Portfolio Managers, Investment Analysts |

| Wealth Management Technology Adoption | 50 | IT Managers, Digital Transformation Leads |

| Regulatory Compliance Challenges | 40 | Compliance Officers, Risk Management Executives |

| Market Trends and Consumer Behavior | 60 | Market Researchers, Financial Planners |

The Global Wealth Management Platform Market is valued at approximately USD 5.5 billion, driven by the increasing demand for personalized financial services and the adoption of advanced technologies like artificial intelligence and automation in wealth management.