Global Wearable and Body Worn Cameras Market Overview

- The Global Wearable and Body Worn Cameras Market is valued at USD 7.3 billion, based on a five-year historical analysis. This growth is primarily driven by increasing demand for security and surveillance solutions across sectors such as law enforcement, military, healthcare, and commercial applications. The surge in public safety initiatives, the need for accountability in public services, and the proliferation of real-time evidence collection have further propelled the adoption of these devices. Recent trends also highlight the integration of advanced features such as live streaming, cloud connectivity, and AI-powered analytics, which are enhancing operational efficiency and user experience .

- Key players in this market include the United States, the United Kingdom, and Germany. The dominance of these countries is attributed to advanced technological infrastructure, significant investment in security measures, and a strong presence of leading manufacturers. North America holds the largest market share, driven by extensive adoption among law enforcement agencies and early technological adoption. Europe, including the United Kingdom and Germany, has also seen substantial deployment, supported by regulatory frameworks and public safety initiatives .

- The European Union’s Law Enforcement Directive (Directive (EU) 2016/680, issued by the European Parliament and Council) provides a binding framework for the processing of personal data by law enforcement authorities, including the use of body-worn cameras. This directive mandates strict compliance with data protection and transparency requirements during the use of such devices in public interactions, aiming to enhance accountability and public trust in law enforcement practices .

Global Wearable and Body Worn Cameras Market Segmentation

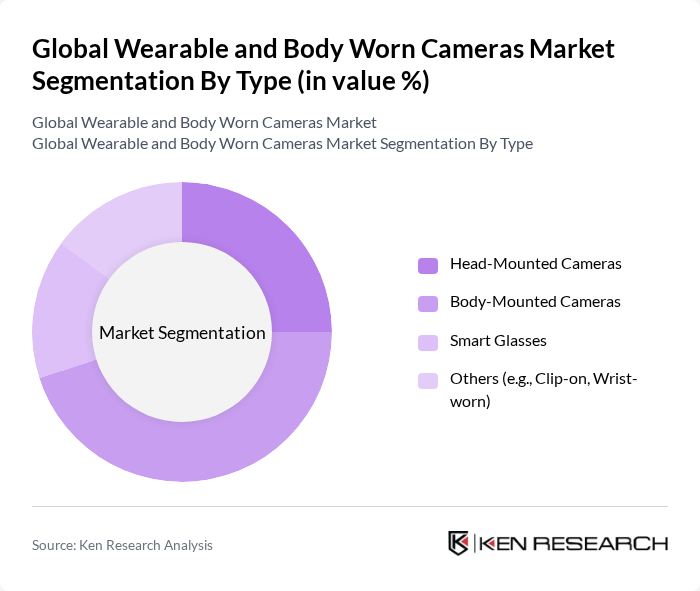

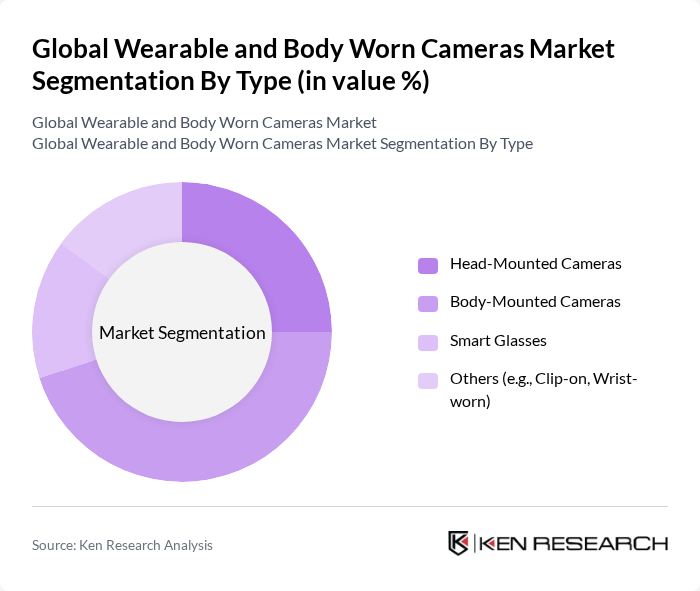

By Type:The market is segmented into Head-Mounted Cameras, Body-Mounted Cameras, Smart Glasses, and Others (e.g., Clip-on, Wrist-worn). Body-Mounted Cameras lead the market, primarily due to their widespread use in law enforcement and security applications, where real-time evidence collection and enhanced personnel safety are critical. Head-Mounted Cameras are gaining traction in training, industrial, and adventure sports scenarios, offering hands-free operation and first-person perspective recording. Smart Glasses represent a growing niche, especially for specialized applications in healthcare, logistics, and field services, leveraging augmented reality and real-time data integration .

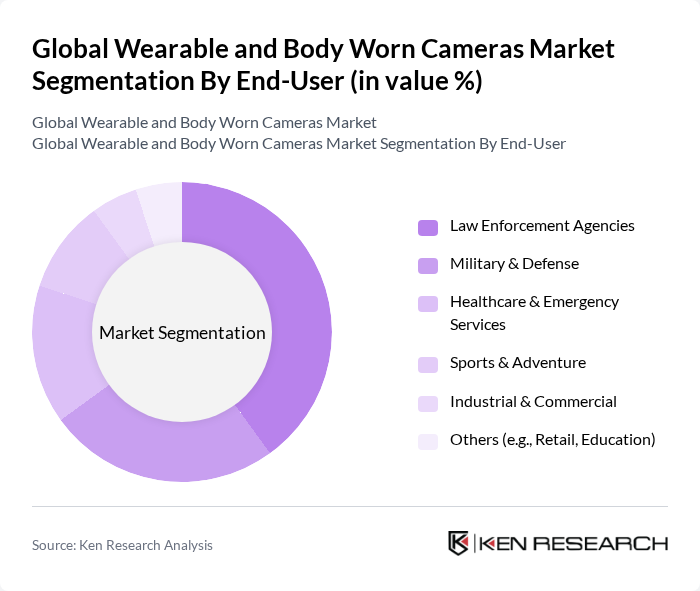

By End-User:The end-user segmentation includes Law Enforcement Agencies, Military & Defense, Healthcare & Emergency Services, Sports & Adventure, Industrial & Commercial, and Others (e.g., Retail, Education). Law Enforcement Agencies dominate the market, driven by the need for accountability, transparency, and real-time documentation in policing. The Military & Defense sector leverages these cameras for operational training, situational awareness, and mission documentation. Healthcare & Emergency Services are emerging as significant users, utilizing body-worn cameras for patient monitoring, incident documentation, and emergency response. Industrial and commercial sectors are adopting wearable cameras for safety compliance, workflow optimization, and quality assurance .

Global Wearable and Body Worn Cameras Market Competitive Landscape

The Global Wearable and Body Worn Cameras Market is characterized by a dynamic mix of regional and international players. Leading participants such as Axon Enterprise, Inc., Panasonic Corporation, Motorola Solutions, Inc., Digital Ally, Inc., Vievu LLC, GoPro, Inc., Reveal Media Ltd., Wolfcom Enterprises, Pinnacle Response Ltd., Shenzhen Mijia Technology Co., Ltd. (Xiaomi), Hytera Communications Corporation Limited, Edesix Ltd., Infinova Corporation, Hikvision Digital Technology Co., Ltd., WatchGuard Video (Motorola Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

Global Wearable and Body Worn Cameras Market Industry Analysis

Growth Drivers

- Increasing Demand for Security and Surveillance:The global security market is projected to reach $300 billion in future, driven by rising crime rates and the need for enhanced safety measures. In urban areas, the demand for surveillance solutions has surged, with cities like New York investing over $200 million in security technologies. This trend is reflected in the increasing adoption of wearable cameras, which provide real-time monitoring and evidence collection, crucial for both public safety and private security sectors.

- Technological Advancements in Camera Quality:The wearable camera industry is experiencing rapid technological improvements, with resolutions reaching up to 4K and features like night vision and image stabilization. For instance, the introduction of cameras with 120-degree field of view has enhanced usability in various applications. The global camera sensor market is expected to grow to $20 billion in future, indicating a strong correlation between sensor advancements and the proliferation of high-quality wearable cameras in diverse sectors.

- Rising Adoption in Law Enforcement Agencies:Law enforcement agencies are increasingly integrating body-worn cameras into their operations, with over 50% of police departments in the U.S. adopting this technology in future. This shift is supported by federal funding, which allocated $20 million in grants for body camera programs in future. The transparency and accountability provided by these devices are crucial in building public trust and improving police-community relations, further driving market growth.

Market Challenges

- High Initial Investment Costs:The upfront costs associated with deploying wearable cameras can be significant, often exceeding $1,000 per unit, not including additional expenses for storage and maintenance. Many organizations, particularly smaller businesses and local law enforcement agencies, struggle to allocate budgets for these investments. This financial barrier can hinder widespread adoption, despite the long-term benefits of enhanced security and accountability provided by these devices.

- Privacy Concerns and Regulatory Hurdles:The use of wearable cameras raises significant privacy issues, with 70% of consumers expressing concerns about surveillance in public spaces. Regulatory frameworks are evolving, with countries like the UK implementing strict guidelines on data protection and usage of surveillance technology. Compliance with these regulations can be complex and costly, posing a challenge for organizations looking to implement body-worn cameras while ensuring they respect individual privacy rights.

Global Wearable and Body Worn Cameras Market Future Outlook

The future of the wearable and body-worn cameras market appears promising, driven by technological innovations and increasing demand across various sectors. As organizations prioritize safety and accountability, the integration of advanced features such as AI-driven analytics and cloud storage solutions will enhance the functionality of these devices. Additionally, the growing trend of smart technology adoption will likely facilitate seamless connectivity and data management, further propelling market growth in the coming years.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for wearable cameras. With urbanization rates projected to reach 60% in future in these regions, the demand for security solutions is expected to rise sharply. This trend is supported by increasing investments in infrastructure and public safety initiatives, creating a favorable environment for market expansion.

- Integration with Smart Technologies:The convergence of wearable cameras with smart technologies, such as IoT and AI, offers substantial market potential. In future, the global IoT market is expected to reach $1.1 trillion, facilitating enhanced data collection and analysis capabilities. This integration will not only improve operational efficiency but also provide users with actionable insights, making wearable cameras more appealing across various sectors, including healthcare and security.