Region:Global

Author(s):Shubham

Product Code:KRAD0613

Pages:86

Published On:August 2025

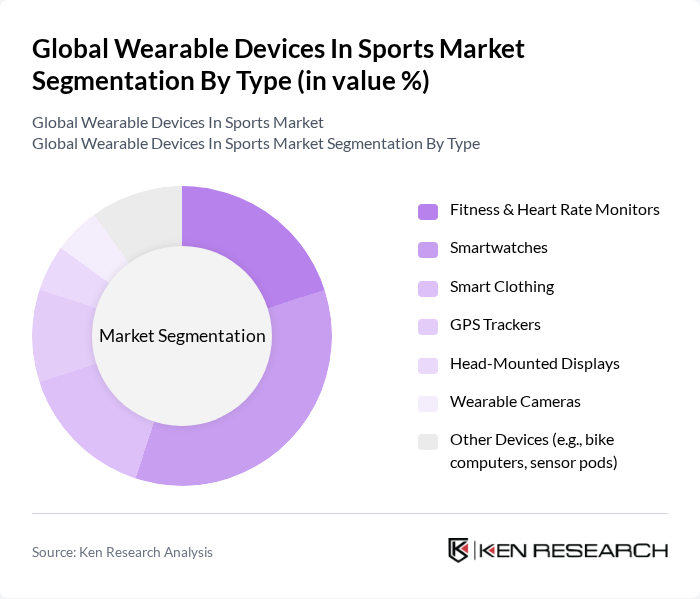

By Type:The wearable devices in sports market can be segmented into various types, including Fitness & Heart Rate Monitors, Smartwatches, Smart Clothing, GPS Trackers, Head-Mounted Displays, Wearable Cameras, and Other Devices (e.g., bike computers, sensor pods). Among these, Smartwatches have emerged as the leading sub-segment due to their multifunctionality—combining fitness tracking, communication, and app ecosystems—which appeals to a broad consumer base. The integration of advanced health monitoring (e.g., ECG, SpO2, sleep staging), GNSS accuracy improvements, and training analytics in mainstream smartwatches has further propelled demand.

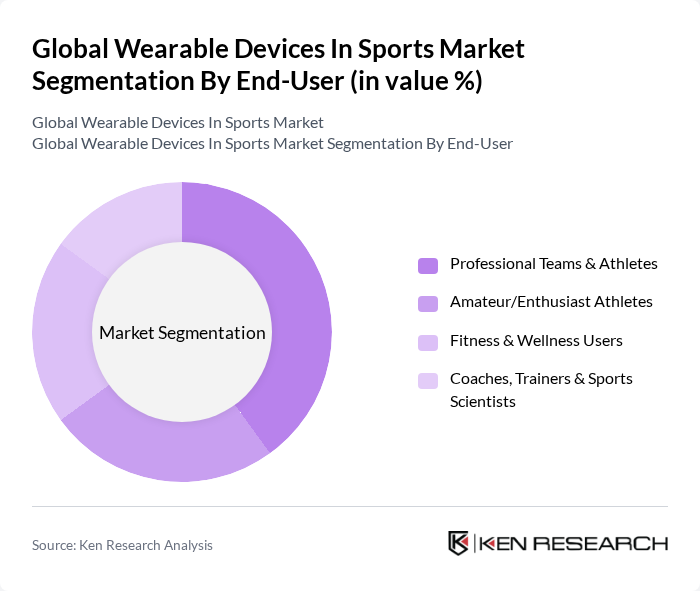

By End-User:The market can also be segmented by end-users, which include Professional Teams & Athletes, Amateur/Enthusiast Athletes, Fitness & Wellness Users, and Coaches, Trainers & Sports Scientists. The Professional Teams & Athletes segment is currently the most significant, driven by increased investment in sports technology, real-time athlete monitoring, load management, and performance analytics across elite leagues and clubs. Demand for precise biometrics and positional data to optimize training and reduce injury risk supports this segment’s prominence, while consumer adoption continues to expand via fitness trackers and smartwatches.

The Global Wearable Devices In Sports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Garmin Ltd., Fitbit (Google LLC), Samsung Electronics Co., Ltd., Polar Electro Oy, Suunto Oy, Whoop, Inc., Wahoo Fitness LLC, Catapult Group International Ltd., STATSports Group, Zepp Health Corporation (Amazfit), Huawei Technologies Co., Ltd., Xiaomi Corporation, Withings SA, Oura Health Oy, Form Athletica Inc. (FORM Smart Swim Goggles), Valencell, Inc., Playermaker Technologies Ltd., Shot Scope Technologies Ltd., COROS Wearables Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of wearable devices in sports is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the integration of AI and machine learning enhances device capabilities, users will benefit from more personalized health insights. Additionally, the growing trend of remote health monitoring will likely expand the market, particularly in telehealth applications. Companies that prioritize user experience and data security will be well-positioned to capture market share in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness & Heart Rate Monitors Smartwatches Smart Clothing GPS Trackers Head-Mounted Displays Wearable Cameras Other Devices (e.g., bike computers, sensor pods) |

| By End-User | Professional Teams & Athletes Amateur/Enthusiast Athletes Fitness & Wellness Users Coaches, Trainers & Sports Scientists |

| By Application | Performance Tracking & Analytics Fitness & Health Monitoring Training Optimization & Load Management Injury Prevention & Rehabilitation Safety, Navigation & Communication |

| By Distribution Channel | Online Sales Channels (e-commerce, brand stores) Offline Retail (specialty sports, electronics, hypermarkets) Direct/Enterprise Sales (to teams, leagues, institutions) |

| By Price Range | Budget (Sub-$150) Mid-Range ($150–$399) Premium ($400 and above) |

| By Wear Location (Site) | Arm & Wrist Chest & Apparel Head & Eye Footwear & Shoe Sensors Other Sites (e.g., bike-mounted, handheld) |

| By Sport | Running & Track Cycling & Triathlon Team Sports (Football/Soccer, Basketball, Rugby, etc.) Swimming & Aquatics Outdoor & Adventure (Hiking, Skiing, Climbing) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Professional Athletes | 90 | Elite Athletes, Coaches |

| Amateur Sports Enthusiasts | 140 | Fitness Trainers, Recreational Athletes |

| Sports Technology Developers | 80 | Product Managers, R&D Engineers |

| Health and Fitness Experts | 70 | Nutritionists, Sports Scientists |

| Retailers of Wearable Devices | 60 | Store Managers, Sales Representatives |

The Global Wearable Devices in Sports Market is valued at approximately USD 90 billion, reflecting a significant growth trend driven by the increasing adoption of fitness tracking technologies and advancements in multi-sensor systems for performance monitoring.