Region:Global

Author(s):Rebecca

Product Code:KRAB0258

Pages:84

Published On:August 2025

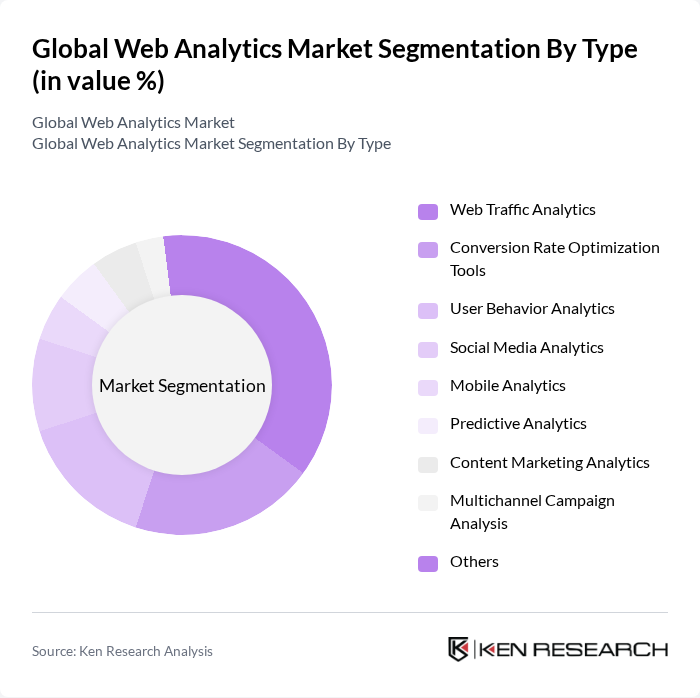

By Type:The web analytics market can be segmented into various types, each serving distinct purposes for businesses. The primary subsegments include Web Traffic Analytics, Conversion Rate Optimization Tools, User Behavior Analytics, Social Media Analytics, Mobile Analytics, Predictive Analytics, Content Marketing Analytics, Multichannel Campaign Analysis, and Others. Among these, Web Traffic Analytics is the most dominant segment, as it provides essential insights into user interactions and traffic sources, enabling businesses to optimize their online presence effectively. Conversion Rate Optimization Tools and User Behavior Analytics are also experiencing strong growth due to the increasing focus on maximizing digital marketing ROI and enhancing customer engagement .

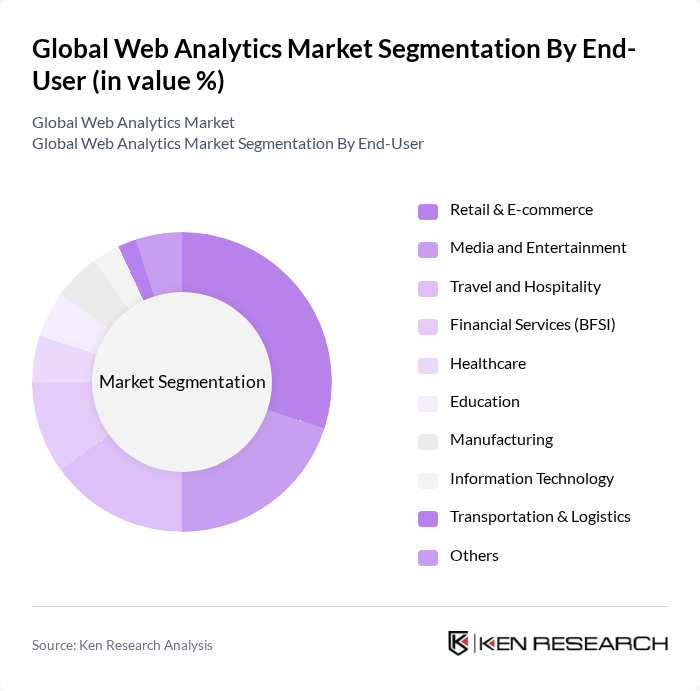

By End-User:The end-user segmentation of the web analytics market includes various industries such as Retail & E-commerce, Media and Entertainment, Travel and Hospitality, Financial Services (BFSI), Healthcare, Education, Manufacturing, Information Technology, Transportation & Logistics, and Others. The Retail & E-commerce sector is the leading end-user, driven by the need for businesses to analyze customer behavior, optimize sales funnels, and enhance overall user experience on their platforms. Media and Entertainment, as well as Travel and Hospitality, are also significant adopters due to their reliance on digital engagement and content performance analytics .

The Global Web Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Adobe Inc., IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, HubSpot, Inc., SAS Institute Inc., Matomo, Clicky (Roxr Software Ltd.), Piwik PRO, Woopra, Crazy Egg, Inc., Kissmetrics (Space Pencil, Inc.), Hotjar Ltd., Mixpanel, Inc., Contentsquare, Amplitude, Inc., AT Internet (Piano Software, Inc.), Heap Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the web analytics market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As organizations increasingly adopt AI and machine learning, the ability to derive actionable insights from data will enhance. Furthermore, the growing emphasis on real-time analytics will enable businesses to respond swiftly to market changes, fostering a more agile operational environment. This dynamic landscape will likely see a surge in innovative analytics solutions tailored to meet diverse industry needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Web Traffic Analytics Conversion Rate Optimization Tools User Behavior Analytics Social Media Analytics Mobile Analytics Predictive Analytics Content Marketing Analytics Multichannel Campaign Analysis Others |

| By End-User | Retail & E-commerce Media and Entertainment Travel and Hospitality Financial Services (BFSI) Healthcare Education Manufacturing Information Technology Transportation & Logistics Others |

| By Application | Marketing Optimization Customer Experience Management Performance Measurement Content Optimization SEO Analytics E-mail Marketing Analytics Targeting and Behavioral Analysis Display Advertising Optimization Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | E-commerce Telecommunications Automotive Government Manufacturing BFSI Healthcare Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Freemium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Australia & New Zealand Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise-Level Web Analytics | 100 | Digital Marketing Directors, Data Analysts |

| SME Web Analytics Adoption | 80 | Business Owners, Marketing Managers |

| Sector-Specific Analytics (E-commerce) | 60 | E-commerce Managers, IT Specialists |

| Analytics Tool Evaluation | 50 | Product Managers, UX Designers |

| Data Privacy and Compliance Insights | 40 | Compliance Officers, Legal Advisors |

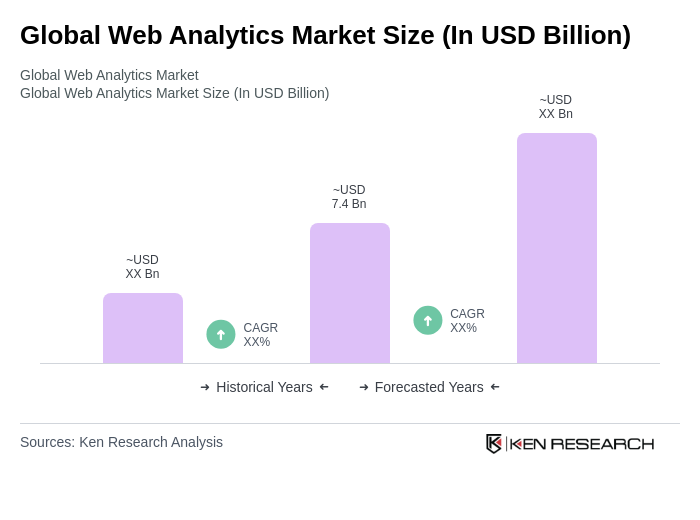

The Global Web Analytics Market is valued at approximately USD 7.4 billion, reflecting a significant growth trend driven by the increasing need for businesses to understand consumer behavior and optimize marketing strategies through data-driven insights.