Region:Global

Author(s):Dev

Product Code:KRAD0572

Pages:97

Published On:August 2025

By Type:The whisky market is segmented into various types, including Scotch, Bourbon, Irish Whiskey, Japanese Whisky, Rye Whiskey, Tennessee Whiskey, Canadian Whisky, Blended (Other than Scotch), and Other World Whiskies. Among these, Scotch whisky, particularly Single Malt and Blended Scotch, maintains leading share globally due to its recognition, protected geographical indication, and strong premium positioning. Growing whisky appreciation, collectibles, and cask-finish experimentation are further supporting Scotch demand across both on-trade and off-trade channels .

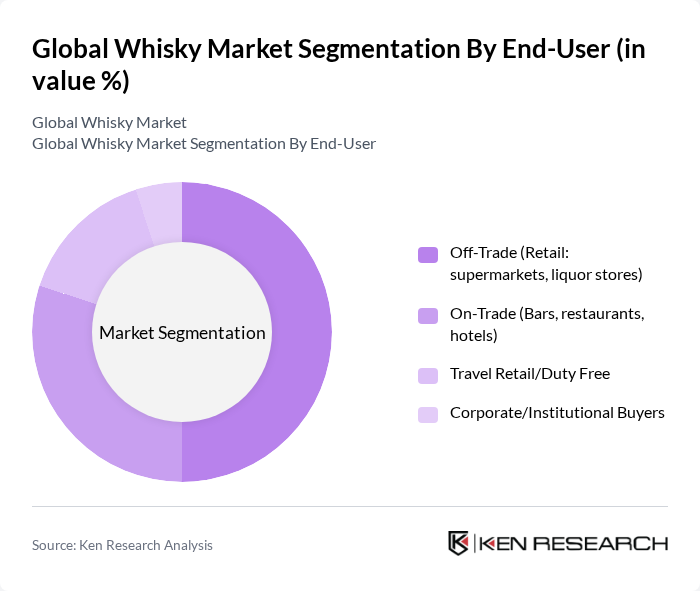

By End-User:The whisky market is further segmented by end-user categories, including Off-Trade (Retail: supermarkets, liquor stores), On-Trade (Bars, restaurants, hotels), Travel Retail/Duty Free, and Corporate/Institutional Buyers. The Off-Trade segment is currently leading the market, supported by home consumption habits, broad retail assortment, and growing e-commerce availability and direct-to-consumer channels for spirits in many markets .

The Global Whisky Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diageo plc, Pernod Ricard S.A., Brown?Forman Corporation, William Grant & Sons Ltd., Beam Suntory, Inc., Bacardi Limited, The Edrington Group Limited, Davide Campari?Milano N.V. (Campari Group), Sazerac Company, Inc., Constellation Brands, Inc., Moët Hennessy (LVMH), Rémy Cointreau S.A., Chivas Brothers Ltd. (Pernod Ricard), Whyte & Mackay Ltd., La Martiniquaise-Bardinet, The Loch Lomond Group, Inver House Distillers (International Beverage), Nikka Whisky Distilling Co., Ltd. (Asahi), Suntory Spirits Ltd. (Japan), John Distilleries Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the whisky market appears promising, driven by evolving consumer preferences and innovative marketing strategies. As the trend towards premiumization continues, brands are likely to invest in unique flavor profiles and sustainable production methods. Additionally, the rise of whisky tourism and experiential marketing will enhance brand engagement. Companies that adapt to these trends and leverage digital platforms for outreach will likely capture a larger share of the market, ensuring sustained growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Scotch (Single Malt, Blended Malt, Blended Scotch) Bourbon Irish Whiskey Japanese Whisky Rye Whiskey Tennessee Whiskey Canadian Whisky Blended (Other than Scotch) Other World Whiskies (e.g., Indian, Taiwanese) |

| By End-User | Off-Trade (Retail: supermarkets, liquor stores) On-Trade (Bars, restaurants, hotels) Travel Retail/Duty Free Corporate/Institutional Buyers |

| By Price Range | Economy/Standard Premium Super-Premium & Ultra-Premium |

| By Packaging Type | Glass Bottles Cans (RTD whisky-based beverages) Tetra Packs (selected markets) Miniatures and Gift Packs |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty & Liquor Stores Online/E-commerce HoReCa/On-Premise Distributors Travel Retail |

| By Occasion | Celebrations & Social Events Gifting & Collectibles Casual/Home Consumption Mixology/Cocktail Use |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others (including Travel Retail) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Whisky Retailers | 140 | Store Managers, Purchasing Agents |

| Whisky Distributors | 110 | Sales Directors, Distribution Managers |

| Distillery Operations | 90 | Master Distillers, Production Managers |

| Whisky Enthusiasts | 120 | Brand Ambassadors, Whisky Club Members |

| Market Analysts | 60 | Industry Analysts, Market Researchers |

The Global Whisky Market is valued at approximately USD 71 billion, reflecting a significant growth trend driven by consumer interest in premium and craft spirits, as well as whisky tourism.