Region:Global

Author(s):Shubham

Product Code:KRAC0814

Pages:80

Published On:August 2025

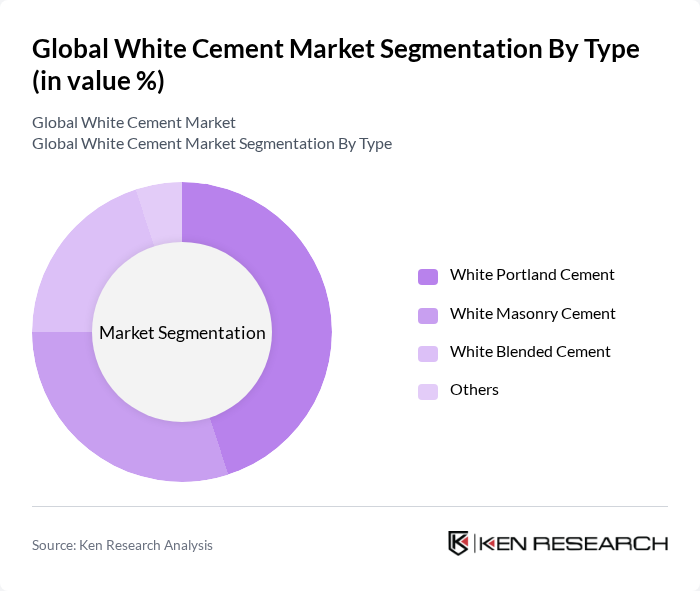

By Type:The market is segmented into White Portland Cement, White Masonry Cement, White Blended Cement, and Others. Among these,White Portland Cementis the most dominant due to its extensive use in high-end construction projects, offering superior aesthetic appeal and durability. The demand for White Masonry Cement is also significant, driven by its application in decorative masonry works. White Blended Cement is gaining traction as consumers and builders seek more sustainable and eco-friendly options, while the 'Others' category includes niche products tailored for specialized applications such as artistic or restoration works .

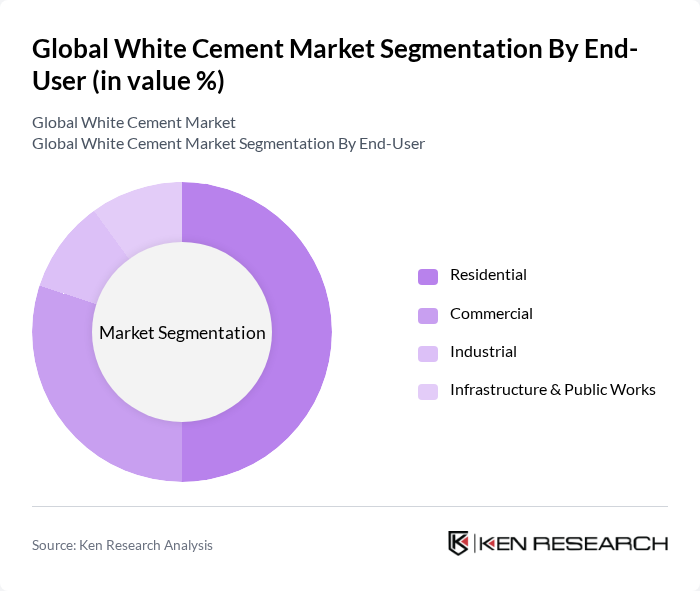

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Infrastructure & Public Works. TheResidentialsegment leads the market, driven by the growing trend of luxury housing, aesthetic building designs, and urban migration. The Commercial sector follows closely, supported by increasing investments in commercial real estate and hospitality. The Industrial segment is also significant, particularly for specialty flooring and factory construction, while Infrastructure & Public Works is bolstered by government projects focusing on urban development and public amenities .

The Global White Cement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cementir Holding N.V., JK Cement Ltd., Çimsa Çimento Sanayi ve Ticaret A.?., Cemex S.A.B. de C.V., Heidelberg Materials AG, UltraTech Cement Limited, Aditya Birla Group, Buzzi Unicem S.p.A., Royal El Minya Cement Co., Federal White Cement Ltd., Ras Al Khaimah Co. for White Cement and Construction Materials PSC, Saveh White Cement Co., Saudi White Cement Company, Sotacib (Carthage Cement), Aalborg Portland A/S contribute to innovation, geographic expansion, and service delivery in this space.

The future of the white cement market appears promising, driven by the increasing emphasis on sustainable construction and innovative building practices. As urbanization continues to rise, particularly in developing regions, the demand for high-quality, aesthetically pleasing materials will likely grow. Additionally, advancements in production technologies and a shift towards eco-friendly practices will further enhance market dynamics, positioning white cement as a key player in the construction industry.

| Segment | Sub-Segments |

|---|---|

| By Type | White Portland Cement White Masonry Cement White Blended Cement Others |

| By End-User | Residential Commercial Industrial Infrastructure & Public Works |

| By Application | Decorative Concrete & Architectural Elements Precast Concrete Products Flooring & Tiling Infrastructure Projects Others |

| By Distribution Channel | Direct Sales Distributors & Dealers Online Sales Others |

| By Price Range | Premium Mid-Range Economy |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Packaging Type | Bags Bulk Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Architects, Builders, Project Managers |

| Commercial Infrastructure Developments | 80 | Construction Managers, Developers, Engineers |

| Public Sector Infrastructure Initiatives | 70 | Government Officials, Urban Planners, Contractors |

| Export Markets for White Cement | 50 | Export Managers, Trade Analysts, Logistics Coordinators |

| Green Building Projects | 60 | Sustainability Consultants, Architects, Developers |

The Global White Cement Market is valued at approximately USD 9.4 billion, reflecting a significant demand for high-quality construction materials, particularly in residential and commercial sectors, driven by urbanization and infrastructure development.