Region:Global

Author(s):Geetanshi

Product Code:KRAA1264

Pages:96

Published On:August 2025

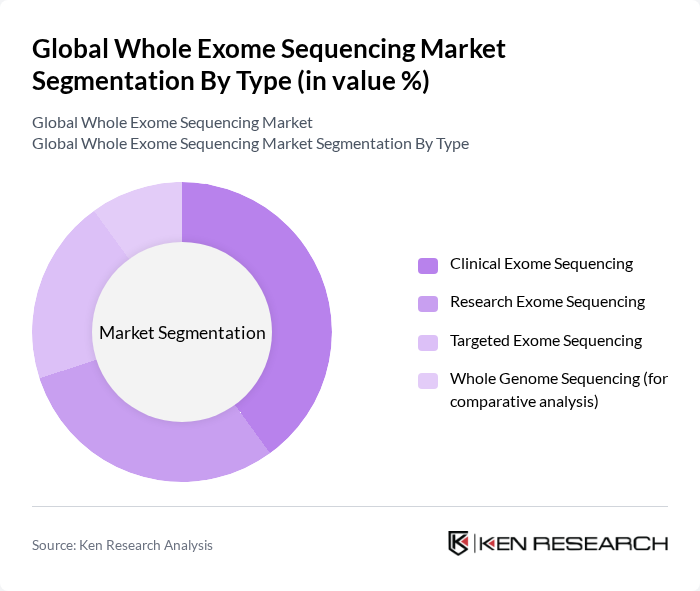

By Type:The market is segmented into Clinical Exome Sequencing, Research Exome Sequencing, Targeted Exome Sequencing, and Whole Genome Sequencing (for comparative analysis). Clinical Exome Sequencing is gaining traction due to its application in diagnosing genetic disorders, while Research Exome Sequencing is pivotal for academic studies. Targeted Exome Sequencing is preferred for specific gene analysis, and Whole Genome Sequencing is often used for comparative studies, providing a comprehensive view of genetic variations .

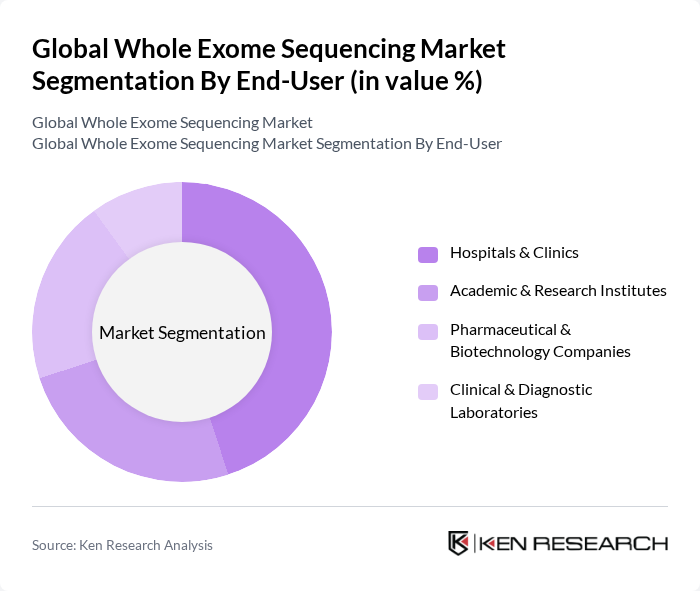

By End-User:The market is categorized into Hospitals & Clinics, Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, and Clinical & Diagnostic Laboratories. Hospitals & Clinics are the largest end-users due to the increasing demand for genetic testing in patient care. Academic & Research Institutes play a crucial role in advancing genomic research, while Pharmaceutical & Biotechnology Companies utilize whole exome sequencing for drug development. Clinical & Diagnostic Laboratories are essential for providing testing services to healthcare providers .

The Global Whole Exome Sequencing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., BGI Genomics Co., Ltd., Roche Sequencing Solutions, QIAGEN N.V., PerkinElmer, Inc., Eurofins Scientific SE, Genomatix Software GmbH, GENEWIZ, Inc. (Azenta US Inc.), Macrogen, Inc., Personalis, Inc., Invitae Corporation, Fulgent Genetics, Inc., Myriad Genetics, Inc., Novogene Co., Ltd., Oxford Nanopore Technologies plc, Pacific Biosciences of California, Inc. (PacBio), CD Genomics, Eurofins Genomics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the whole exome sequencing market appears promising, driven by technological advancements and increasing healthcare investments. As the demand for personalized medicine continues to rise, healthcare providers are likely to adopt WES more widely. Additionally, the integration of artificial intelligence in genomic data analysis is expected to enhance data interpretation, making WES more efficient and accessible. These trends indicate a robust growth trajectory for the market in the None region, fostering innovation and improved patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Clinical Exome Sequencing Research Exome Sequencing Targeted Exome Sequencing Whole Genome Sequencing (for comparative analysis) |

| By End-User | Hospitals & Clinics Academic & Research Institutes Pharmaceutical & Biotechnology Companies Clinical & Diagnostic Laboratories |

| By Application | Oncology Rare Disease Diagnostics Drug Discovery & Development Neurological Disorders Cardiovascular Diseases |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Next-Generation Sequencing (NGS) Sanger Sequencing Third-Generation Sequencing Microarray Technology Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Model | Subscription-Based Pricing Pay-Per-Use Pricing Bundled Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 150 | Laboratory Directors, Genetic Counselors |

| Healthcare Providers | 120 | Oncologists, Pediatricians |

| Research Institutions | 90 | Research Scientists, Lab Managers |

| Biotechnology Firms | 60 | Product Development Managers, R&D Directors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Whole Exome Sequencing Market is valued at approximately USD 2.4 billion, driven by advancements in genomic technologies, the rising prevalence of genetic disorders, and the increasing demand for personalized medicine.