Region:Global

Author(s):Rebecca

Product Code:KRAC0164

Pages:95

Published On:August 2025

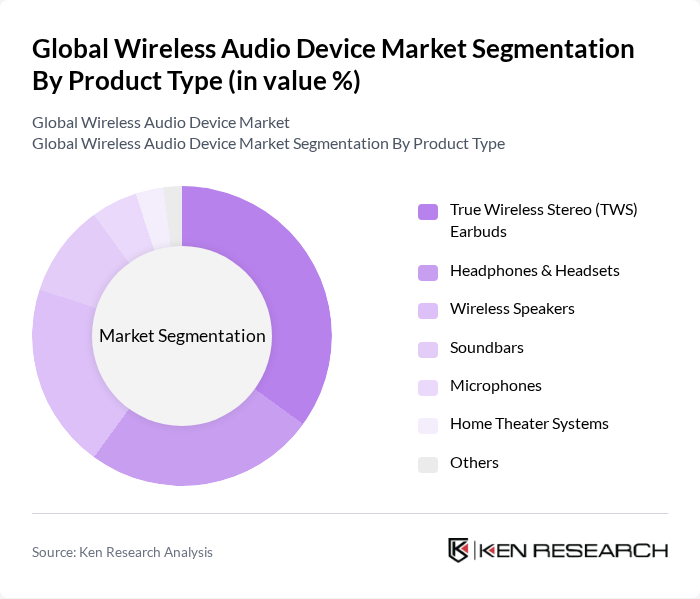

By Product Type:The product type segmentation includes various categories such as True Wireless Stereo (TWS) Earbuds, Headphones & Headsets, Wireless Speakers, Soundbars, Microphones, Home Theater Systems, and Others. Among these, True Wireless Stereo (TWS) Earbuds have gained significant popularity due to their compact design, convenience, and integration with smart assistants, appealing to consumers seeking mobility and ease of use. The demand for wireless speakers is also on the rise, driven by the increasing trend of home entertainment systems and the popularity of multi-room audio solutions .

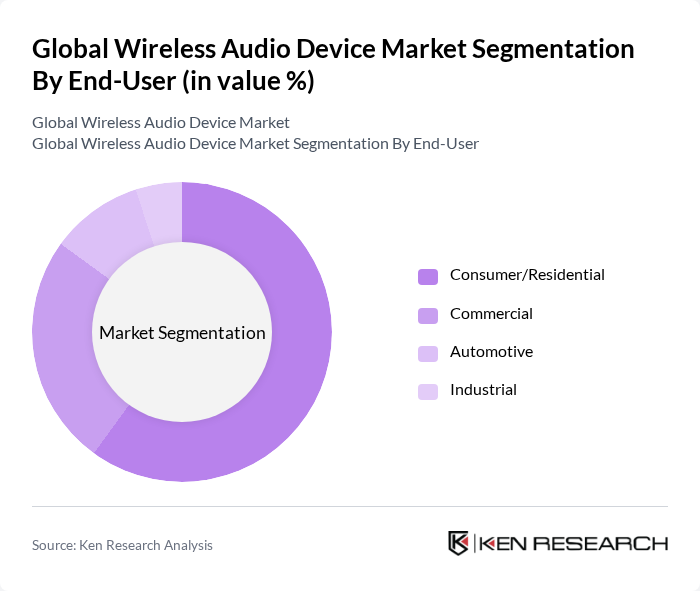

By End-User:The end-user segmentation encompasses Consumer/Residential, Commercial, Automotive, and Industrial categories. The Consumer/Residential segment dominates the market, driven by the increasing demand for personal audio devices, smart home integration, and streaming services among consumers. The rise in remote work and home entertainment has further fueled this demand, as individuals seek high-quality audio solutions for leisure and professional use. The Commercial segment is also growing, particularly in sectors like hospitality, retail, and education, where audio solutions enhance customer and user experience .

The Global Wireless Audio Device Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Sony Corporation, Bose Corporation, Samsung Electronics Co., Ltd., Sennheiser electronic GmbH & Co. KG, JBL (HARMAN International Industries, Incorporated), Bang & Olufsen A/S, Anker Innovations Limited, Amazon.com, Inc., Google LLC, Microsoft Corporation, Audio-Technica Corporation, Plantronics, Inc. (Poly, now part of HP Inc.), Ultimate Ears (Logitech International S.A.), Skullcandy, Inc., GN Store Nord A/S (Jabra), Sonos, Inc., Xiaomi Corporation, Shure Incorporated, Imagine Marketing Limited (boAt), Panasonic Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wireless audio device market appears promising, driven by continuous technological innovations and evolving consumer preferences. As the demand for seamless connectivity and high-quality audio experiences grows, manufacturers are likely to invest in research and development. Additionally, the integration of artificial intelligence and machine learning in audio devices is expected to enhance personalization, making products more appealing to consumers. This trend will likely shape the market landscape in None, fostering a competitive environment focused on innovation.

| Segment | Sub-Segments |

|---|---|

| By Product Type | True Wireless Stereo (TWS) Earbuds Headphones & Headsets Wireless Speakers Soundbars Microphones Home Theater Systems Others |

| By End-User | Consumer/Residential Commercial Automotive Industrial |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Application | Personal Use Professional/Studio Use Events and Entertainment Automotive Audio |

| By Connectivity Technology | Bluetooth Wi-Fi AirPlay NFC Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wireless Headphones Market | 100 | Audio Product Managers, Retail Buyers |

| Bluetooth Speakers Segment | 90 | Consumer Electronics Retailers, Marketing Executives |

| Smart Soundbars Analysis | 60 | Home Theater Specialists, Product Developers |

| Market for Audiophile Equipment | 50 | High-End Audio Retailers, Sound Engineers |

| Trends in Wireless Audio Accessories | 40 | Accessory Manufacturers, Consumer Insights Analysts |

The Global Wireless Audio Device Market is valued at approximately USD 61 billion, reflecting significant growth driven by the increasing adoption of wireless technology and demand for portable audio solutions.