Region:Global

Author(s):Dev

Product Code:KRAD5099

Pages:94

Published On:December 2025

Market.png)

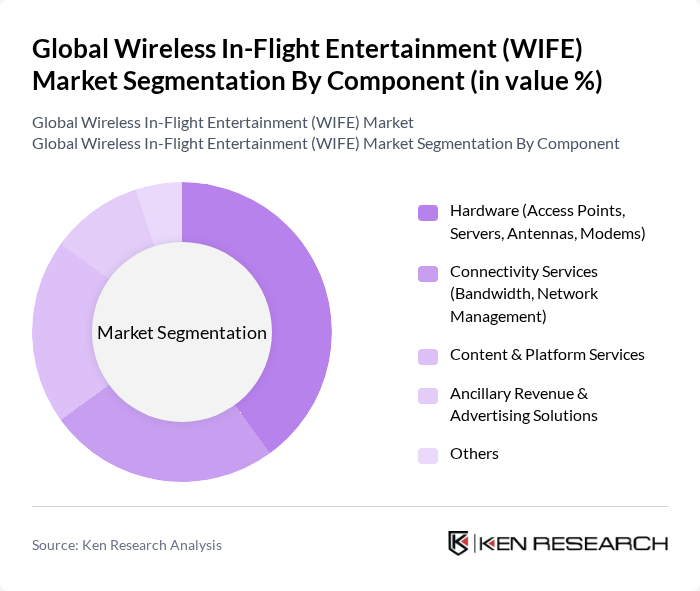

By Component:The components of the market include Hardware, Connectivity Services, Content & Platform Services, Ancillary Revenue & Advertising Solutions, and Others. Among these, Hardware, which encompasses access points, servers, antennas, and modems, remains a core sub-segment as airlines continue to retrofit and line-fit fleets with next-generation Wi?Fi, satellite terminals, and high-throughput modems to support streaming and real-time services. The increasing demand for high-quality streaming services, low-latency connectivity, and higher bandwidth per passenger has driven airlines to invest heavily in hardware upgrades, including Ka-band and Ku-band antenna systems and advanced airborne network equipment. Connectivity Services, which include bandwidth provisioning, network management, and service-level optimization, also play a crucial role in ensuring seamless passenger experiences, as carriers work with satellite operators and service providers to improve coverage and speed. The growing trend of personalized content, integration of over-the-top streaming platforms, targeted advertising, and e-commerce portals is expected to further enhance the market landscape for Content & Platform Services and Ancillary Revenue & Advertising Solutions, enabling airlines to monetize engagement and differentiate their digital offerings.

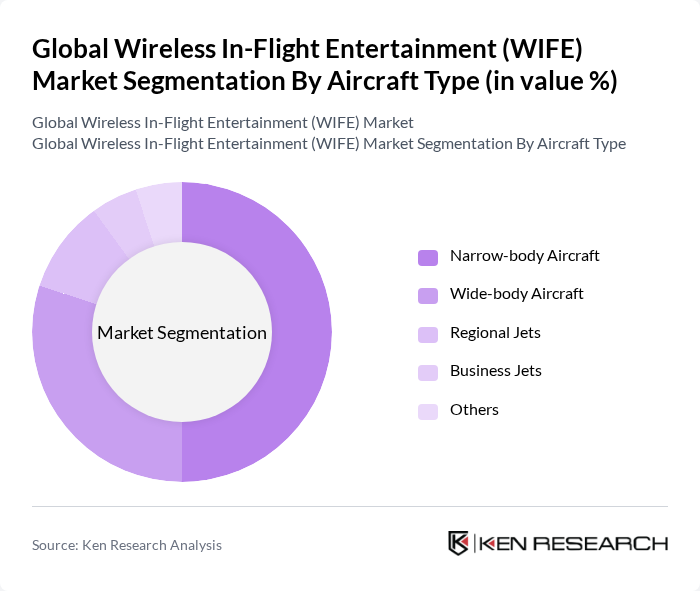

By Aircraft Type:The market is segmented by aircraft type into Narrow-body Aircraft, Wide-body Aircraft, Regional Jets, Business Jets, and Others. Narrow-body Aircraft dominate the market due to their extensive use in short- and medium-haul flights, which constitute a significant portion of global air travel and increasingly feature wireless streaming and connectivity as standard passenger expectations. The demand for in-flight entertainment systems in these aircraft is driven by the need to enhance passenger satisfaction, support BYOD usage, and differentiate service offerings in highly competitive domestic and regional markets. Wide-body Aircraft also hold a substantial share, primarily due to long-haul flights where passengers expect comprehensive entertainment options, higher bandwidth connectivity, and premium digital services. The increasing number of regional jets and business jets being retrofitted with compact wireless IFE and connectivity solutions is expected to contribute to the market's growth as airlines and operators seek to provide consistent, premium digital experiences across fleet segments.

The Global Wireless In-Flight Entertainment (WIFE) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gogo Inc., Viasat Inc., Panasonic Avionics Corporation, Thales Group, Lufthansa Systems GmbH & Co. KG, Inmarsat Group Holdings Limited, Global Eagle Entertainment Inc. (Anuvu), SITAONAIR, ThinKom Solutions, Inc., Honeywell International Inc., Collins Aerospace (Raytheon Technologies), Safran Passenger Innovations (formerly Zodiac Inflight Innovations), BAE Systems plc, IFE Services Ltd (part of Global Eagle / Anuvu), Immfly S.L. contribute to innovation, geographic expansion, and service delivery in this space through developments in high-throughput satellite capacity, advanced antennas, cloud-based content platforms, and integrated IFEC solutions.

The future of the wireless in-flight entertainment market appears promising, driven by technological advancements and evolving consumer preferences. As airlines increasingly adopt cloud-based solutions, the flexibility and scalability of WIFE systems will improve. Furthermore, the integration of augmented reality experiences is expected to enhance passenger engagement significantly. With a focus on sustainability, airlines are likely to explore eco-friendly entertainment solutions, aligning with global environmental goals and enhancing their brand image in a competitive market.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Access Points, Servers, Antennas, Modems) Connectivity Services (Bandwidth, Network Management) Content & Platform Services Ancillary Revenue & Advertising Solutions Others |

| By Aircraft Type | Narrow-body Aircraft Wide-body Aircraft Regional Jets Business Jets Others |

| By End-User | Commercial Airlines Low-Cost Carriers (LCCs) Charter Operators Corporate & Private Jet Operators Others |

| By Connectivity Technology | Air-to-Ground (ATG) Systems Satellite-based Systems (Ka-band, Ku-band, Others) Hybrid Connectivity Solutions Others |

| By Business Model | Free-to-Passenger (Sponsored) Pay-per-Use Subscription-based Advertising-supported Others |

| By Installation Type | Line-fit Retrofit Mixed Fleet Programs Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airline Executives | 100 | CEOs, CTOs, and Heads of In-Flight Services |

| In-Flight Entertainment Providers | 80 | Product Managers, Business Development Directors |

| Passenger Experience Managers | 70 | Customer Experience Officers, Cabin Crew Trainers |

| Regulatory Bodies | 50 | Aviation Safety Inspectors, Compliance Officers |

| Technology Innovators | 60 | R&D Managers, Technology Strategists |

The Global Wireless In-Flight Entertainment (WIFE) Market is valued at approximately USD 2.1 billion, reflecting a significant growth trend driven by increasing demand for high-speed internet connectivity and enhanced passenger experiences during flights.