Region:Global

Author(s):Dev

Product Code:KRAA1563

Pages:98

Published On:August 2025

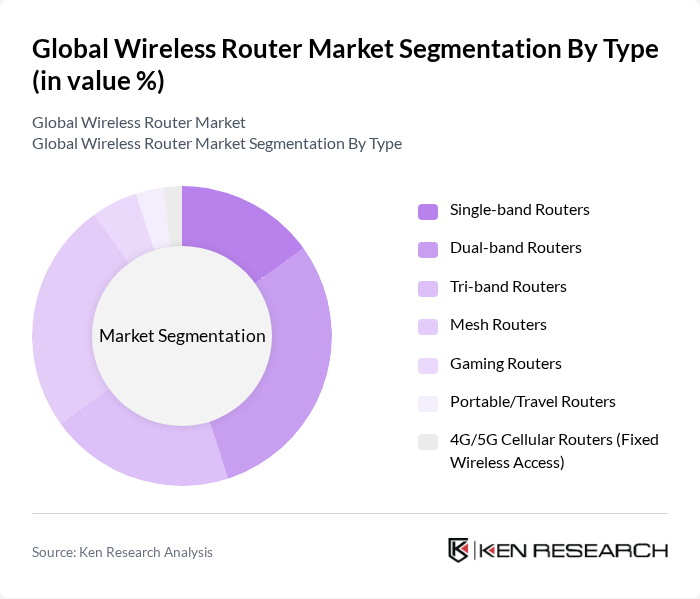

By Type:The market can be segmented into various types of wireless routers, including Single-band Routers, Dual-band Routers, Tri-band Routers, Mesh Routers, Gaming Routers, Portable/Travel Routers, and 4G/5G Cellular Routers (Fixed Wireless Access). Each type serves different consumer needs and preferences, with specific features catering to various use cases .

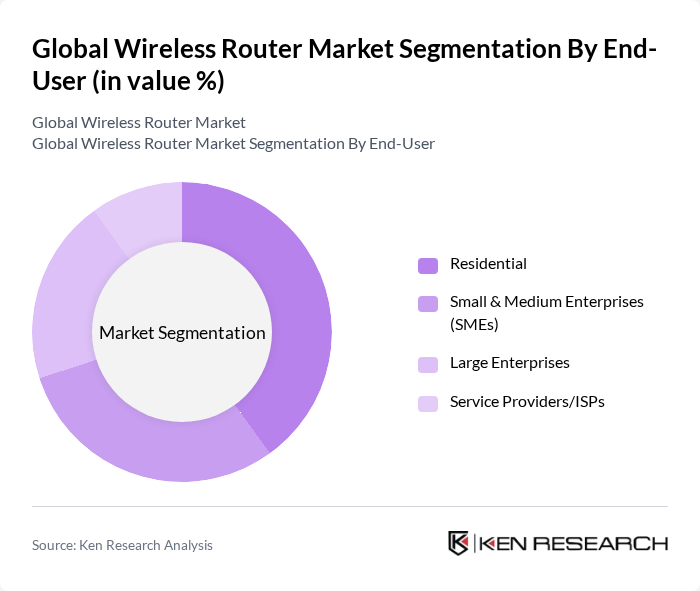

By End-User:The end-user segmentation includes Residential, Small & Medium Enterprises (SMEs), Large Enterprises, and Service Providers/ISPs. Each segment has unique requirements, with residential users focusing on affordability and ease of use, while enterprises prioritize performance and security .

The Global Wireless Router Market is characterized by a dynamic mix of regional and international players. Leading participants such as TP-Link Technologies Co., Ltd., NETGEAR, Inc., ASUSTeK Computer Inc., Linksys (Belkin International, Inc.), D-Link Corporation, Huawei Technologies Co., Ltd., Xiaomi Corporation, Cisco Systems, Inc., Ubiquiti Inc., CommScope (ARRIS/RUCKUS Networks), Motorola (Minim Inc. brand licensing), ZTE Corporation, Shenzhen Tenda Technology Co., Ltd., Buffalo Inc. (Melco Holdings), Synology Inc., Zyxel Communications Corp., Nokia Corporation, Google LLC (Nest Wi?Fi), Amazon.com, Inc. (eero), Honor Device Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wireless router market appears promising, driven by technological advancements and evolving consumer needs. The integration of AI capabilities into routers is expected to enhance user experience by optimizing network performance and security. Additionally, the increasing focus on energy-efficient devices aligns with global sustainability goals, encouraging manufacturers to innovate. As 5G technology becomes more widespread, the demand for high-performance routers will likely escalate, further propelling market growth and transforming connectivity standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-band Routers Dual-band Routers Tri-band Routers Mesh Routers Gaming Routers Portable/Travel Routers G/5G Cellular Routers (Fixed Wireless Access) |

| By End-User | Residential Small & Medium Enterprises (SMEs) Large Enterprises Service Providers/ISPs |

| By Distribution Channel | Online Retail/Marketplaces Offline Retail (Electronics & IT Stores) Direct to Enterprise/Carrier Value-Added Resellers/Distributors |

| By Price Range | Budget Routers (Entry-level) Mid-range Routers Premium/Flagship Routers |

| By Application | Home Networking/Smart Home Office/Enterprise Networking Public Wi?Fi/Hotspots IoT/Industrial Connectivity |

| By Brand Positioning | Established Global Brands Challenger/Emerging Brands Private Labels/Operator-Branded CPE |

| By Technology | Wi?Fi 5 (802.11ac) Wi?Fi 6 (802.11ax) Wi?Fi 6E (6 GHz) Wi?Fi 7 (802.11be) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Wireless Router Users | 140 | Homeowners, Renters, Tech Enthusiasts |

| Small Business Network Administrators | 100 | IT Managers, Business Owners, Network Technicians |

| Enterprise IT Decision Makers | 80 | Chief Information Officers, Network Architects |

| Retail Electronics Managers | 70 | Store Managers, Product Buyers, Sales Executives |

| Telecommunications Service Providers | 90 | Product Development Managers, Service Delivery Managers |

The Global Wireless Router Market is valued at approximately USD 14.5 billion, reflecting a significant growth driven by the increasing demand for high-speed internet, smart devices, and IoT applications, particularly accelerated by remote work and online education trends.