Region:Global

Author(s):Dev

Product Code:KRAB0490

Pages:98

Published On:August 2025

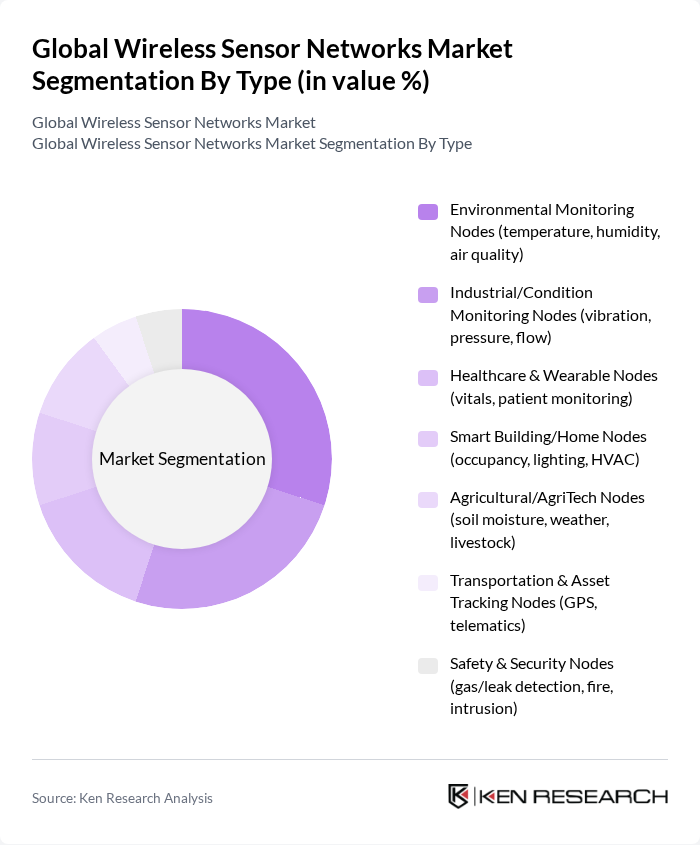

By Type:The market is segmented into various types of wireless sensor nodes, each serving distinct applications and industries. The primary subsegments include Environmental Monitoring Nodes, Industrial/Condition Monitoring Nodes, Healthcare & Wearable Nodes, Smart Building/Home Nodes, Agricultural/AgriTech Nodes, Transportation & Asset Tracking Nodes, and Safety & Security Nodes. Among these, Environmental Monitoring Nodes are gaining traction due to increasing environmental concerns, air quality monitoring initiatives, and regulatory requirements in smart city and industrial contexts .

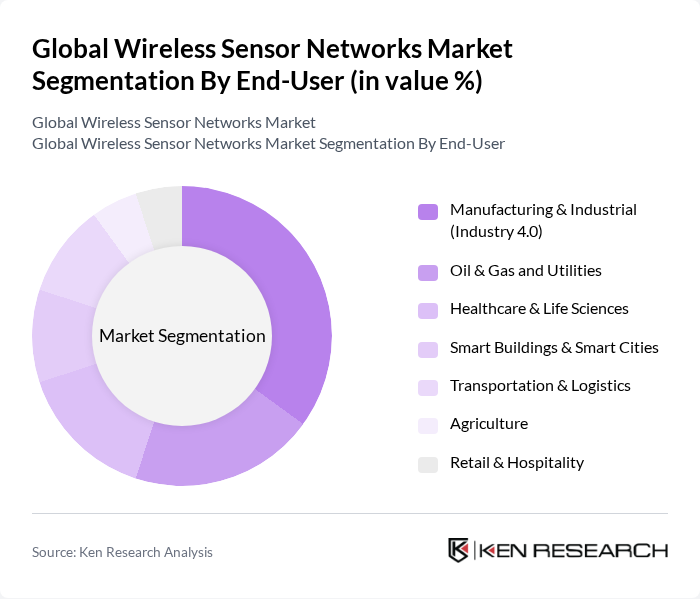

By End-User:The end-user segmentation includes various industries that utilize wireless sensor networks for enhanced operational efficiency. The primary subsegments are Manufacturing & Industrial, Oil & Gas and Utilities, Healthcare & Life Sciences, Smart Buildings & Smart Cities, Transportation & Logistics, Agriculture, and Retail & Hospitality. The Manufacturing & Industrial segment is leading due to the ongoing trend of Industry 4.0, predictive maintenance, and real-time monitoring in factories and process industries .

The Global Wireless Sensor Networks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Siemens AG, Honeywell International Inc., IBM Corporation, Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., Bosch Sensortec GmbH, Analog Devices, Inc., Qualcomm Technologies, Inc., Schneider Electric SE, General Electric Company (GE Vernova for Grid/Utilities), ABB Ltd., EnOcean GmbH, Advantech Co., Ltd., Samsara Inc., Murata Manufacturing Co., Ltd., Monnit Corporation, Libelium Comunicaciones Distribuidas S.L., u-blox Holding AG, Semtech Corporation (LoRa), Sierra Wireless (Semtech, LPWA/Cellular IoT), Digi International Inc., Silicon Labs, Telit Cinterion contribute to innovation, geographic expansion, and service delivery in this space.

The future of wireless sensor networks is poised for significant transformation, driven by technological advancements and increasing integration with AI. The focus on energy-efficient sensors and enhanced data analytics capabilities will likely reshape applications across industries. Moreover, the growing emphasis on sustainability and environmental monitoring will further propel the adoption of these networks, as organizations seek to optimize resource usage and minimize their ecological footprint, ensuring a more resilient infrastructure for future generations.

| Segment | Sub-Segments |

|---|---|

| By Type | Environmental Monitoring Nodes (temperature, humidity, air quality) Industrial/Condition Monitoring Nodes (vibration, pressure, flow) Healthcare & Wearable Nodes (vitals, patient monitoring) Smart Building/Home Nodes (occupancy, lighting, HVAC) Agricultural/AgriTech Nodes (soil moisture, weather, livestock) Transportation & Asset Tracking Nodes (GPS, telematics) Safety & Security Nodes (gas/leak detection, fire, intrusion) |

| By End-User | Manufacturing & Industrial (Industry 4.0) Oil & Gas and Utilities Healthcare & Life Sciences Smart Buildings & Smart Cities Transportation & Logistics Agriculture Retail & Hospitality |

| By Application | Predictive Maintenance & Condition Monitoring Environmental & Structural Health Monitoring Smart Metering & Utilities Management Process & Industrial Automation Home/Building Automation (lighting, HVAC, security) Healthcare & Remote Patient Monitoring Asset Tracking & Cold Chain Monitoring |

| By Component | Hardware (sensor nodes, MCUs, radios) Gateways & Edge Devices Software & Platforms (network management, analytics) Services (deployment, managed services) Power Solutions (energy harvesting, batteries) |

| By Connectivity/Communication Technology | Wi?Fi/Wi?Fi HaLow Bluetooth Low Energy (BLE) & Mesh Zigbee/Thread LoRaWAN/LPWAN Cellular IoT (LTE?M, NB?IoT, 5G) Proprietary/Industrial (WirelessHART, ISA100) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Automation Applications | 150 | Operations Managers, Automation Engineers |

| Healthcare Monitoring Systems | 100 | Healthcare IT Managers, Biomedical Engineers |

| Agricultural Sensor Networks | 80 | Agronomists, Farm Managers |

| Smart City Infrastructure | 120 | Urban Planners, City Officials |

| Environmental Monitoring Solutions | 90 | Environmental Scientists, Compliance Officers |

The Global Wireless Sensor Networks Market is valued at approximately USD 120 billion, driven by the increasing adoption of IoT technologies and advancements in wireless communication, including low-power wide-area networks and 5G.