Region:Global

Author(s):Shubham

Product Code:KRAB0810

Pages:98

Published On:August 2025

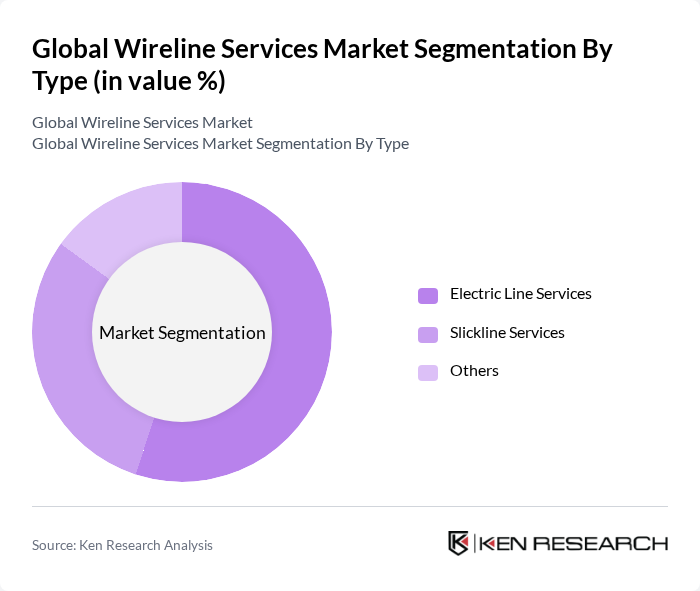

By Type:The wireline services market is segmented into Electric Line Services, Slickline Services, and Others.Electric Line Servicesare primarily utilized for well logging, perforation, and data acquisition, providing real-time downhole measurements.Slickline Servicesare favored for mechanical well intervention, such as setting plugs, valves, and gauges. TheOtherscategory includes specialized services like pipe recovery, reservoir monitoring, and production logging, which address unique operational requirements in complex wells .

By End-User:The primary end-user segment for wireline services is theOil & Gas Industry, which accounts for the majority of market demand due to the critical role of wireline operations in exploration, drilling, completion, and production. Other end-users includegeothermal energyandminingsectors, where wireline services are applied for subsurface evaluation, well intervention, and resource monitoring .

The Global Wireline Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, Expro Group Holdings N.V., Archer Limited, Superior Energy Services, Inc., Nabors Industries Ltd., Pioneer Energy Services Corp., Tetra Technologies, Inc., Altus Intervention AS, OilSERV, China Oilfield Services Limited (COSL), Basic Energy Services, Inc., and Hunting PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wireline services market appears promising, driven by ongoing technological advancements and a shift towards sustainable practices. As companies increasingly adopt digital transformation strategies, the integration of AI and automation will enhance operational efficiency. Furthermore, the growing emphasis on renewable energy sources will create new opportunities for wireline services, particularly in hybrid energy projects. This evolving landscape will likely foster innovation and collaboration among industry players, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Line Services Slickline Services Others |

| By End-User | Oil & Gas Industry Others |

| By Application | Well Completion Well Intervention Reservoir Evaluation Others |

| By Service Type | Logging Services Perforation Services Testing Services Others |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Well Type | Onshore Offshore |

| By Hole Type | Open Hole Cased Hole |

| By Distribution Channel | Direct Sales Distributors |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Wireline Services | 120 | Field Engineers, Operations Managers |

| Gas Production Wireline Services | 90 | Technical Directors, Project Managers |

| Well Intervention Services | 70 | Service Coordinators, Safety Officers |

| Data Acquisition and Analysis | 60 | Data Analysts, Geoscientists |

| Wireline Equipment Manufacturing | 50 | Product Development Managers, Sales Executives |

The Global Wireline Services Market is valued at approximately USD 12.2 billion, driven by the increasing demand for oil and gas exploration and production, particularly in North America and the Middle East.