Region:Global

Author(s):Rebecca

Product Code:KRAD0327

Pages:83

Published On:August 2025

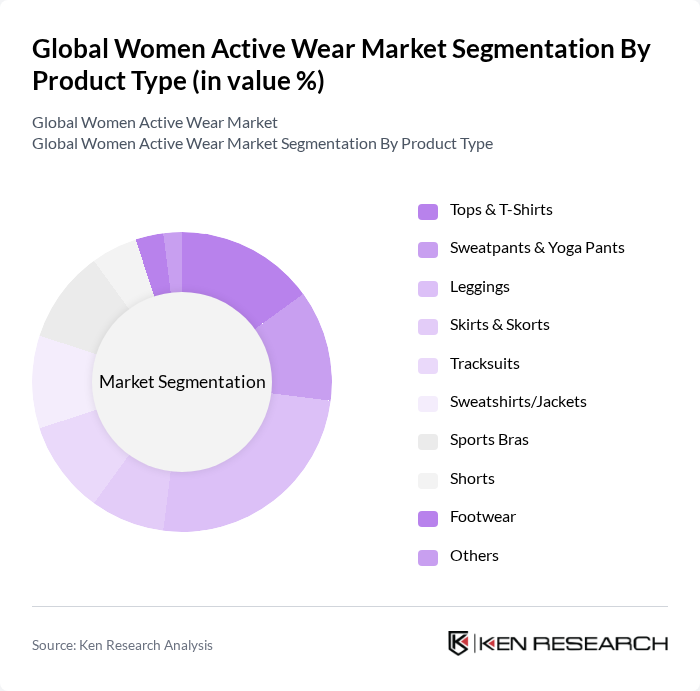

By Product Type:The product type segmentation includes various categories such as Tops & T-Shirts, Sweatpants & Yoga Pants, Leggings, Skirts & Skorts, Tracksuits, Sweatshirts/Jackets, Sports Bras, Shorts, Footwear, and Others. Among these,Leggingshave emerged as the leading sub-segment due to their versatility and comfort, making them a preferred choice for both workouts and casual wear. The trend towards athleisure has further propelled the demand for leggings, as consumers seek stylish yet functional options.

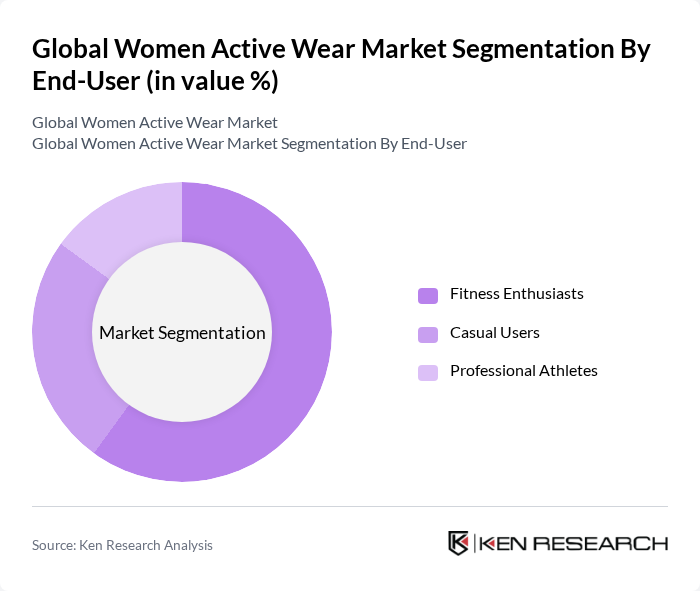

By End-User:This segmentation includes Fitness Enthusiasts, Casual Users, and Professional Athletes. TheFitness Enthusiastssegment is the most significant, driven by the increasing number of women participating in fitness activities and the growing popularity of fitness classes and gyms. This demographic is particularly inclined towards high-performance activewear that enhances their workout experience, leading to a surge in demand for specialized products.

The Global Women Active Wear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Lululemon Athletica Inc., Puma SE, Reebok International Ltd., Athleta (Gap Inc.), Fabletics, Sweaty Betty, Gymshark, New Balance Athletics, Inc., ASICS Corporation, Champion (Hanesbrands Inc.), Outdoor Voices, Alo Yoga, Columbia Sportswear Company, Decathlon S.A., VF Corporation (The North Face, Vans), Patagonia, Inc., Lorna Jane contribute to innovation, geographic expansion, and service delivery in this space.

The future of the women active wear market appears promising, driven by evolving consumer preferences and technological advancements. As athleisure continues to gain traction, brands are expected to innovate with smart fabrics and sustainable materials. Additionally, the rise of social media influencers will likely shape marketing strategies, enhancing brand visibility. Companies that adapt to these trends while maintaining a focus on inclusivity and body positivity will be well-positioned to capture market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Tops & T-Shirts Sweatpants & Yoga Pants Leggings Skirts & Skorts Tracksuits Sweatshirts/Jackets Sports Bras Shorts Footwear Others |

| By End-User | Fitness Enthusiasts Casual Users Professional Athletes |

| By Distribution Channel | Online Retail Stores Supermarkets/Hypermarkets Specialty Stores Department Stores Direct Sales Other Distribution Channels |

| By Price Range | Budget Mid-range Premium |

| By Fabric Type | Cotton Polyester Nylon Spandex Others |

| By Occasion | Gym Workouts Outdoor Activities Everyday Wear |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers Trend-driven Customers |

| By Geography | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, Japan, India, Australia, Rest of Asia-Pacific) South America (Brazil, Argentina, Rest of South America) Middle East & Africa (South Africa, Saudi Arabia, Rest of Middle East & Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Activewear Sales | 150 | Store Managers, Sales Associates |

| Consumer Preferences in Activewear | 150 | Female Consumers, Fitness Enthusiasts |

| Brand Perception Studies | 100 | Marketing Managers, Brand Strategists |

| Fitness Industry Insights | 80 | Gym Owners, Personal Trainers |

| Online Shopping Behavior | 120 | E-commerce Managers, Digital Marketing Specialists |

The Global Women Active Wear Market is valued at approximately USD 202 billion, reflecting a significant growth trend driven by increasing health consciousness, fitness activities, and the popularity of athleisure wear among women.