Region:Global

Author(s):Geetanshi

Product Code:KRAD5981

Pages:82

Published On:December 2025

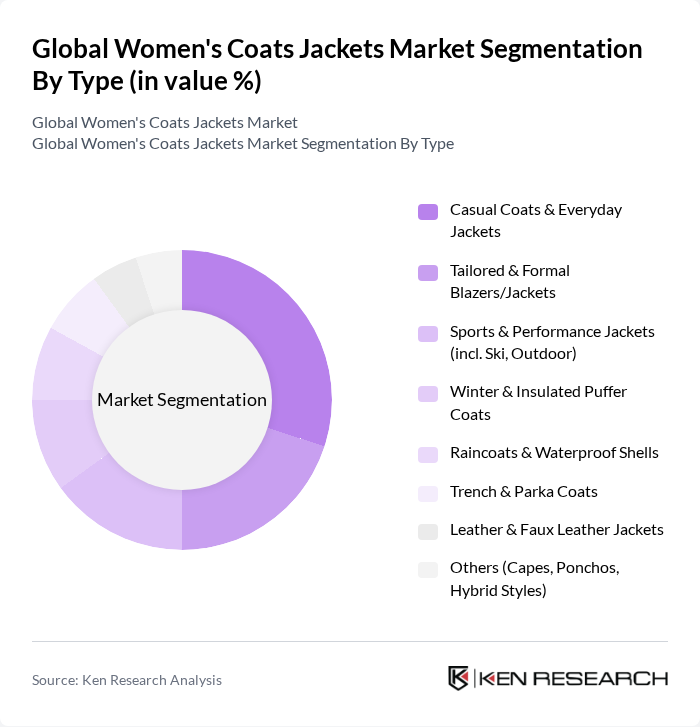

By Type:The market is segmented into various types of women's coats and jackets, each catering to different consumer preferences and occasions. The subsegments include Casual Coats & Everyday Jackets, Tailored & Formal Blazers/Jackets, Sports & Performance Jackets (including Ski and Outdoor), Winter & Insulated Puffer Coats, Raincoats & Waterproof Shells, Trench & Parka Coats, Leather & Faux Leather Jackets, and Others (Capes, Ponchos, Hybrid Styles). Among these, Casual Coats & Everyday Jackets dominate the market due to their versatility, comfort, and suitability for work?leisure hybrid dressing, appealing to a broad demographic. The trend towards casualization in fashion, growth of athleisure, and the popularity of lightweight transitional outerwear have further propelled demand for these styles, making them a staple in women's wardrobes across both mass and premium segments.

By Material:The market is also segmented by material, which includes Wool & Wool Blends, Cotton & Cotton Blends, Synthetic Fabrics (Polyester, Nylon, Acrylic), Genuine Leather & Suede, Faux Leather & Vegan Alternatives, Technical & Performance Fabrics (Waterproof, Breathable), and Others (Down, Fleece, Recycled Materials). Synthetic Fabrics dominate this segment due to their affordability, durability, wrinkle resistance, and ease of care, making them a popular choice among consumers and widely used by global brands in both fashion and performance outerwear. The increasing awareness of sustainability and animal welfare, together with advances in bio?based and recycled polymers, has led to a rise in demand for Faux Leather & Vegan Alternatives and recycled polyester, reflecting a shift in consumer preferences towards more ethical and lower?impact fashion choices.

The Global Women's Coats Jackets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zara (Industria de Diseño Textil, S.A. – Inditex), Hennes & Mauritz AB (H&M), Mango (Punto Fa, S.L.), Uniqlo (Fast Retailing Co., Ltd.), ASOS Plc, Nordstrom, Inc., Forever 21, Inc., The North Face (VF Corporation), Columbia Sportswear Company, Patagonia, Inc., Levi Strauss & Co., Eddie Bauer LLC, L.L.Bean, Inc., Ralph Lauren Corporation, Tommy Hilfiger (PVH Corp.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the women's coats and jackets market appears promising, driven by evolving consumer preferences and technological advancements. The integration of smart textiles and sustainable materials is expected to reshape product offerings, appealing to environmentally conscious consumers. Additionally, the continued growth of e-commerce will facilitate broader market access, allowing brands to reach diverse demographics. As brands adapt to these trends, they will likely enhance their competitive positioning and drive innovation in the outerwear sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual Coats & Everyday Jackets Tailored & Formal Blazers/Jackets Sports & Performance Jackets (incl. Ski, Outdoor) Winter & Insulated Puffer Coats Raincoats & Waterproof Shells Trench & Parka Coats Leather & Faux Leather Jackets Others (Capes, Ponchos, Hybrid Styles) |

| By Material | Wool & Wool Blends Cotton & Cotton Blends Synthetic Fabrics (Polyester, Nylon, Acrylic) Genuine Leather & Suede Faux Leather & Vegan Alternatives Technical & Performance Fabrics (Waterproof, Breathable) Others (Down, Fleece, Recycled Materials) |

| By Style | Long Coats & Maxi Length Short Coats & Hip-Length Jackets Oversized & Relaxed-Fit Jackets Fitted & Tailored Jackets Quilted & Puffer Styles Others (Cropped, Belted, Asymmetric) |

| By Season | Spring Transition Outerwear Summer Lightweight Jackets Fall/Autumn Midweight Coats Winter Heavyweight & Insulated Coats All-Season & Trans-Seasonal Styles |

| By Price Range | Budget/Value (Mass Market) Mid-range (High-Street) Premium (Bridge-to-Luxury) Luxury & Designer Off-price & Discount |

| By Distribution Channel | Brand-Owned Stores & Monobrand Boutiques Multi-brand Specialty Stores Department Stores & Hypermarkets Online Brand E-commerce (Direct-to-Consumer) Online Marketplaces & Pure-play E-tailers Others (Outlet Stores, Catalogs, TV/Live Commerce) |

| By Target Demographic | Teenagers & Young Adults (15–24) Working Professionals (25–44) Mature & Senior Women (45+) Plus-size & Curve Eco-conscious & Ethical Fashion Consumers Others (Maternity, Petite, Tall) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Women's Coats | 150 | Store Managers, Sales Associates |

| Consumer Preferences in Outerwear | 120 | Fashion Enthusiasts, Regular Shoppers |

| Online Shopping Trends for Women's Jackets | 120 | E-commerce Managers, Digital Marketing Specialists |

| Manufacturing Insights for Women's Coats | 80 | Production Managers, Quality Control Inspectors |

| Trends in Sustainable Fashion | 100 | Sustainability Officers, Brand Managers |

The Global Women's Coats Jackets Market is valued at approximately USD 81 billion, reflecting a significant growth driven by consumer demand for fashionable outerwear and the expansion of e-commerce platforms.