Global Womens Non Athletic Footwear Market Overview

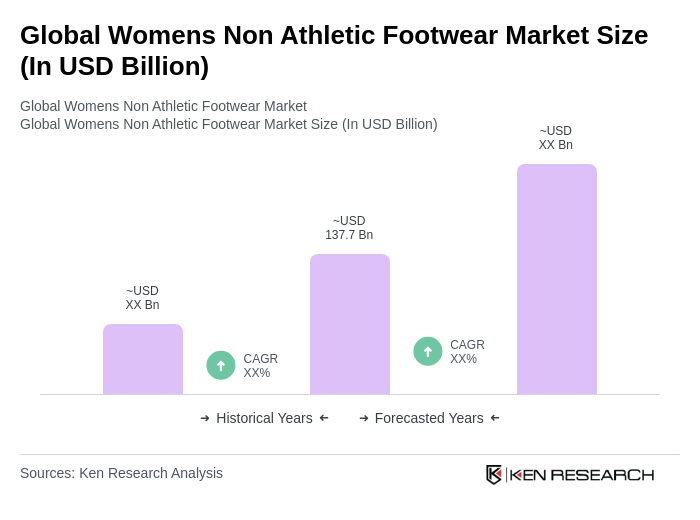

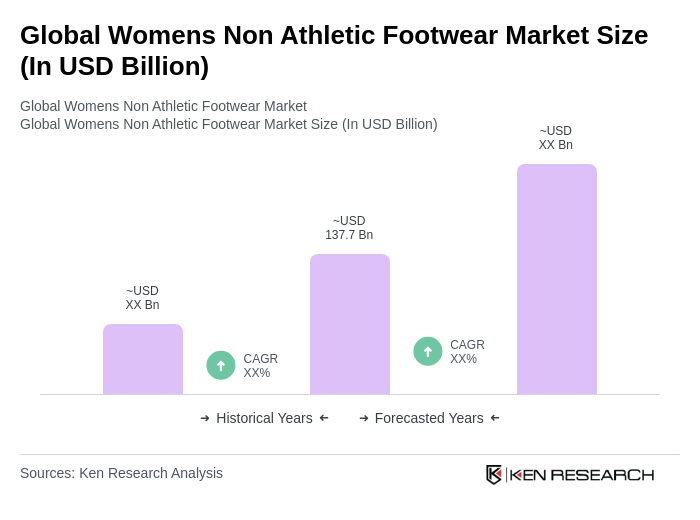

- The Global Womens Non Athletic Footwear Market is valued at USD 137.7 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for fashionable and comfortable footwear, the expansion of e-commerce, and the adoption of digital technologies such as augmented reality for virtual try-ons. The market has also seen a significant shift towards sustainable materials and ethical production practices, reflecting changing consumer preferences and heightened awareness regarding environmental issues.

- Key players in this market include the United States, China, and Germany, which dominate due to their strong retail infrastructure, high disposable incomes, and a growing focus on fashion trends. The U.S. market benefits from a diverse consumer base and a robust e-commerce sector, while China’s rapid urbanization and increasing middle-class population contribute to its market strength. Germany is recognized for its quality craftsmanship and design innovation. The Asia-Pacific region currently accounts for the largest market share globally, driven by rapid urbanization and rising consumer spending.

- In 2023, the European Union implemented regulations aimed at reducing the environmental impact of footwear production. This includes mandatory reporting on the sustainability of materials used and the lifecycle of products, encouraging brands to adopt eco-friendly practices. The regulation aims to promote transparency and accountability in the industry, aligning with the EU's broader sustainability goals.

Global Womens Non Athletic Footwear Market Segmentation

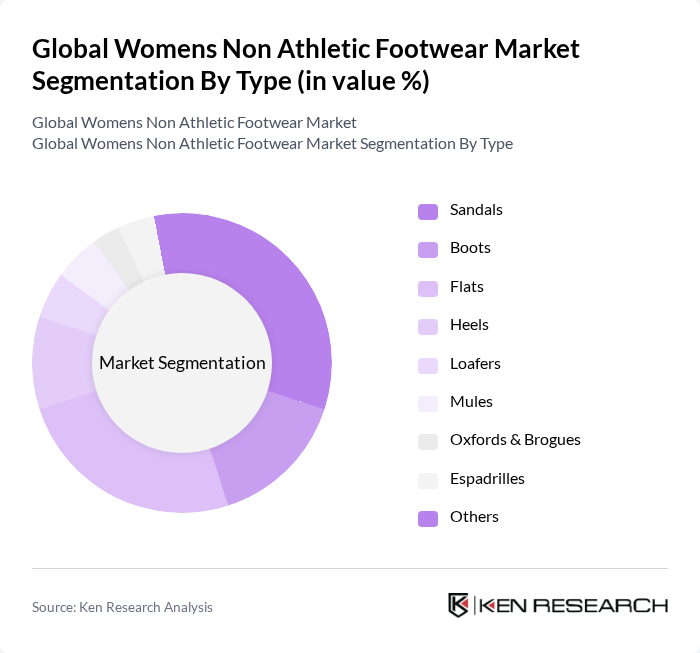

By Type:The market is segmented into various types of footwear, including sandals, boots, flats, heels, loafers, mules, oxfords & brogues, espadrilles, and others. Among these,sandalsandflatsare particularly popular due to their comfort and versatility, making them the leading subsegments. The demand for stylish yet comfortable options has driven consumer preferences towards these types, especially in warmer climates and casual settings.

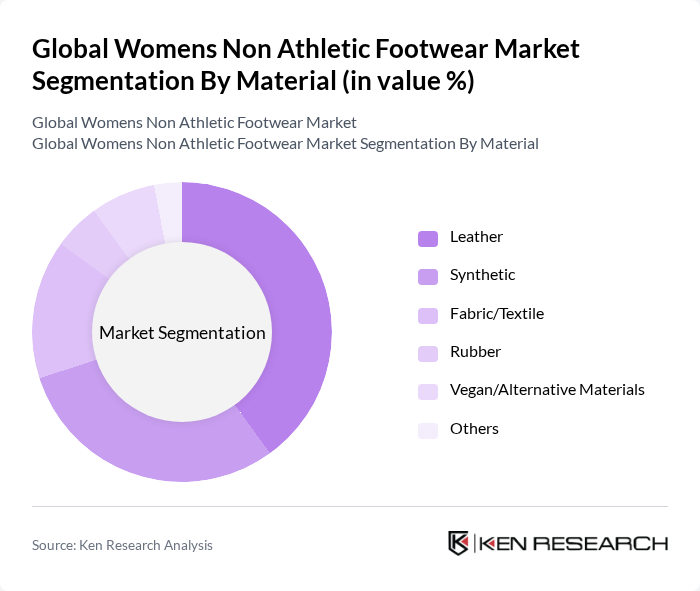

By Material:The market is also segmented by material, including leather, synthetic, fabric/textile, rubber, vegan/alternative materials, and others.Leatherremains the dominant material due to its durability and premium appeal, whilesynthetic materialsare gaining traction for their affordability and variety. The increasing demand for vegan options reflects a significant shift in consumer preferences towards sustainable and cruelty-free products.

Global Womens Non Athletic Footwear Market Competitive Landscape

The Global Womens Non Athletic Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Prada SpA, Bata Corporation, Kering SA, The ALDO Group Inc., LVMH Moët Hennessy Louis Vuitton SE, Ecco Sko A/S, Capri Holdings Limited, Steve Madden Ltd., Clarks International Ltd., Dr. Martens plc, Nine West Holdings, Inc., Sam Edelman, Naturalizer, Franco Sarto, Vionic Group LLC, TOMS Shoes, LLC, Crocs, Inc., Hush Puppies contribute to innovation, geographic expansion, and service delivery in this space.

Global Womens Non Athletic Footwear Market Industry Analysis

Growth Drivers

- Increasing Fashion Consciousness:The global women's non-athletic footwear market is significantly driven by rising fashion consciousness among consumers. In future, the global fashion industry is projected to reach $3.5 trillion, with footwear accounting for approximately $450 billion. This growth is fueled by the increasing influence of social media and celebrity endorsements, which have led to a 30% increase in online searches for trendy footwear styles, indicating a strong consumer desire for fashionable options.

- Rise in Disposable Income:The rise in disposable income, particularly in emerging markets, is a crucial growth driver for the women's non-athletic footwear sector. According to the World Bank, global GDP per capita is expected to increase by $1,500 in future, leading to higher consumer spending. In regions like Asia-Pacific, disposable income is projected to rise by 7% annually, allowing consumers to invest more in premium and luxury footwear brands, thus expanding the market.

- Expansion of E-commerce Platforms:The rapid expansion of e-commerce platforms is transforming the women's non-athletic footwear market. In future, online retail sales are expected to reach $7 trillion globally, with footwear sales contributing significantly. The convenience of online shopping, coupled with the rise of mobile commerce, has led to a 25% increase in online footwear purchases. This trend is particularly strong among younger consumers, who prefer the ease of browsing and purchasing footwear online.

Market Challenges

- Intense Competition:The women's non-athletic footwear market faces intense competition, with numerous brands vying for market share. In future, the top five brands are expected to hold only 30% of the market, indicating a fragmented landscape. This competition pressures companies to innovate continuously and invest in marketing strategies, which can strain resources and impact profitability. Additionally, new entrants are frequently disrupting the market with unique offerings, further intensifying competition.

- Fluctuating Raw Material Prices:Fluctuating raw material prices pose a significant challenge to the women's non-athletic footwear market. In future, the price of leather is projected to increase by 15% due to supply chain disruptions and rising demand. This volatility can lead to increased production costs, forcing manufacturers to either absorb the costs or pass them on to consumers, potentially affecting sales. Companies must develop strategies to mitigate these risks and maintain profitability.

Global Womens Non Athletic Footwear Market Future Outlook

The future of the women's non-athletic footwear market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are increasingly focusing on eco-friendly materials and production methods. Additionally, the integration of technology, such as augmented reality for virtual try-ons, is expected to enhance the shopping experience. These trends indicate a shift towards more personalized and responsible consumer choices, positioning the market for sustained growth in future.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present significant opportunities for growth in the women's non-athletic footwear sector. With a growing middle class and increasing urbanization, countries like India and Brazil are expected to see a 25% rise in footwear demand in future. Brands that strategically enter these markets can capitalize on the rising consumer spending and brand awareness.

- Collaborations with Influencers:Collaborations with social media influencers offer a lucrative opportunity for brands to enhance visibility and reach. In future, influencer marketing is projected to be a $20 billion industry, with footwear brands increasingly leveraging this trend. By partnering with influencers, companies can tap into their followers' trust and expand their customer base, driving sales and brand loyalty.