Region:Global

Author(s):Rebecca

Product Code:KRAB0288

Pages:90

Published On:August 2025

By Type:The wood preservatives market can be segmented into various types, including water-based preservatives, oil-based preservatives, solvent-based preservatives, borate-based preservatives, copper-based preservatives, organic preservatives, micronized copper systems, chromated copper arsenate (CCA), creosote, and others. Each type serves specific applications and consumer preferences, with varying levels of effectiveness and environmental impact.

Thewater-based preservativessegment is currently dominating the market due to their eco-friendliness and low toxicity, making them a preferred choice for consumers concerned about health and environmental impacts. These preservatives are easy to apply, dry quickly, and offer good protection against fungi and insects. The increasing trend towards sustainable building practices and the growing demand for non-toxic products in residential and commercial applications further bolster the popularity of water-based preservatives.

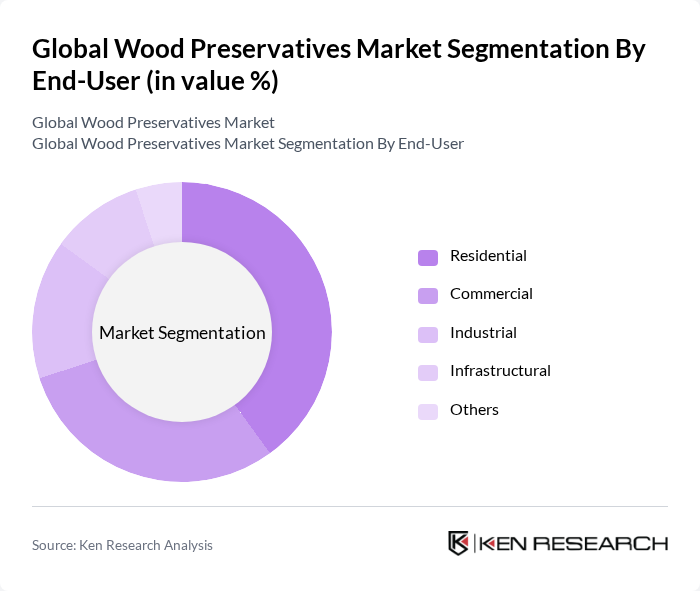

By End-User:The market can also be segmented based on end-users, which include residential, commercial, industrial, infrastructural, and others. Each segment has unique requirements and preferences for wood preservation, influenced by factors such as application type, environmental regulations, and consumer awareness.

Theresidential segmentis the largest end-user category, driven by the increasing demand for home improvement and renovation projects. Homeowners are increasingly opting for treated wood products to enhance durability and aesthetics, leading to a surge in the use of wood preservatives in residential applications. Additionally, the growing trend of DIY projects and the rise in awareness regarding the benefits of wood treatment contribute to the dominance of this segment.

The Global Wood Preservatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Lonza Group AG (now Arxada AG), Koppers Holdings Inc., Arch Wood Protection Inc. (a Lonza/Arxada company), UPM-Kymmene Corporation, The Sherwin-Williams Company, RPM International Inc., PPG Industries Inc., Rütgers Organics GmbH, Taminco Corporation (now part of Eastman Chemical Company), Wood Protection Products LLC, Osmose Utilities Services, Inc., Treatex Ltd., Tikkurila Oyj, Rotho Blaas GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wood preservatives market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in bio-based preservatives are expected to gain traction, aligning with consumer preferences for eco-friendly products. Additionally, the rise in DIY projects is likely to create new avenues for market growth, as homeowners increasingly seek effective wood preservation solutions. These trends indicate a dynamic market landscape, with opportunities for companies to adapt and thrive in a changing environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-based preservatives Oil-based preservatives Solvent-based preservatives Borate-based preservatives Copper-based preservatives Organic preservatives Micronized copper systems Chromated copper arsenate (CCA) Creosote Others |

| By End-User | Residential Commercial Industrial Infrastructural Others |

| By Application | Construction Furniture Decking Fencing Pallets Railroad ties Wood flooring Doors & windows Cabinets Others |

| By Distribution Channel | Direct sales Retail Online sales Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Brand Positioning | Premium Mid-range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Wood Treatment | 100 | Homeowners, DIY Enthusiasts |

| Commercial Construction Projects | 80 | Project Managers, Architects |

| Industrial Wood Preservation | 60 | Facility Managers, Procurement Specialists |

| Environmental Impact Assessments | 50 | Environmental Scientists, Regulatory Compliance Officers |

| Wood Preservation Technology Adoption | 40 | R&D Managers, Product Development Teams |

The Global Wood Preservatives Market is valued at approximately USD 1.3 billion, driven by increasing demand for treated wood in construction, infrastructure, and furniture manufacturing, along with a growing preference for eco-friendly and non-toxic preservatives.