Region:Global

Author(s):Rebecca

Product Code:KRAC0293

Pages:84

Published On:August 2025

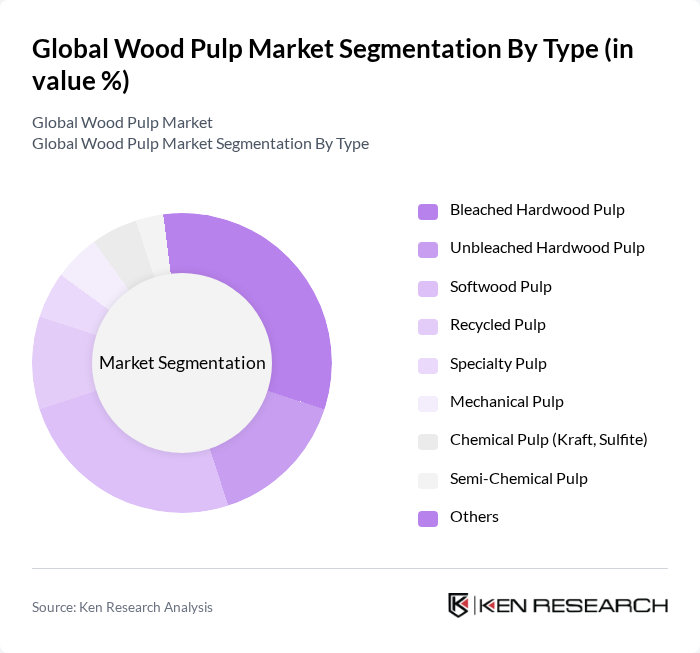

By Type:The wood pulp market is segmented into various types, including Bleached Hardwood Pulp, Unbleached Hardwood Pulp, Softwood Pulp, Recycled Pulp, Specialty Pulp, Mechanical Pulp, Chemical Pulp (Kraft, Sulfite), Semi-Chemical Pulp, and Others. Among these, Bleached Hardwood Pulp and Softwood Pulp are the most dominant due to their extensive use in high-quality paper production and packaging materials. The demand for Recycled Pulp is also on the rise as sustainability becomes a priority for consumers and manufacturers alike .

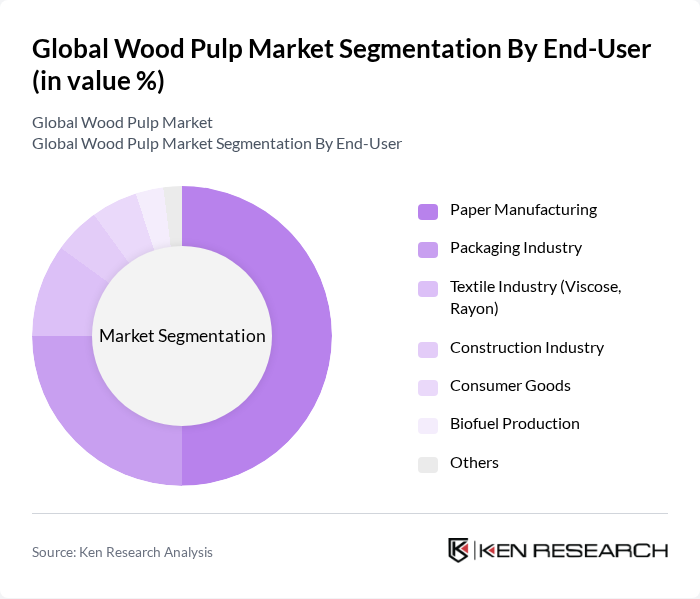

By End-User:The end-user segmentation includes Paper Manufacturing, Packaging Industry, Textile Industry (Viscose, Rayon), Construction Industry, Consumer Goods, Biofuel Production, and Others. The Paper Manufacturing sector is the largest consumer of wood pulp, driven by the continuous demand for various paper products. The Packaging Industry is also growing rapidly, fueled by the rise in e-commerce and the need for sustainable packaging solutions .

The Global Wood Pulp Market is characterized by a dynamic mix of regional and international players. Leading participants such as International Paper Company, WestRock Company, Stora Enso Oyj, UPM-Kymmene Corporation, Sappi Limited, Domtar Corporation, Suzano S.A., Resolute Forest Products Inc., Rayonier Advanced Materials Inc., Oji Holdings Corporation, Norske Skog ASA, Mondi Group, Smurfit Kappa Group, Canfor Corporation, Tembec Inc., Celulosa Arauco y Constitución S.A., Södra, Empresas CMPC S.A., Asia Pacific Resources International Limited (APRIL), Metsä Group, Georgia-Pacific LLC, Nippon Paper Industries Co., Ltd., Nine Dragons Paper Holdings Ltd., Shanying International Holding Co., Ltd., Sinar Mas Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the wood pulp market appears promising, driven by increasing consumer demand for sustainable products and innovations in processing technologies. As companies invest in eco-friendly practices, the market is likely to see a rise in the use of recycled pulp and bioproducts. Additionally, the expansion into emerging markets will provide new growth avenues, allowing producers to capitalize on the rising demand for paper and packaging solutions in these regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Bleached Hardwood Pulp Unbleached Hardwood Pulp Softwood Pulp Recycled Pulp Specialty Pulp Mechanical Pulp Chemical Pulp (Kraft, Sulfite) Semi-Chemical Pulp Others |

| By End-User | Paper Manufacturing Packaging Industry Textile Industry (Viscose, Rayon) Construction Industry Consumer Goods Biofuel Production Others |

| By Application | Printing Paper Writing Paper Newsprint Tissue Paper Paperboard & Carton Specialty Papers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Quality Grade | Premium Grade Standard Grade Industrial Grade |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Cost-Plus Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Paper Manufacturing Sector | 120 | Production Managers, Supply Chain Analysts |

| Textile Industry Pulp Usage | 90 | Procurement Managers, Product Development Leads |

| Packaging Solutions Providers | 70 | Operations Directors, Sustainability Coordinators |

| Wood Pulp Export Markets | 50 | Export Managers, Trade Compliance Officers |

| Environmental Impact Assessments | 40 | Environmental Scientists, Policy Advisors |

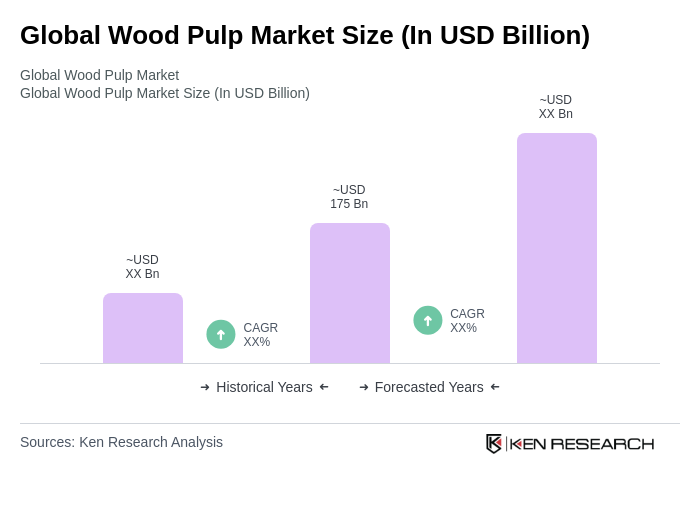

The Global Wood Pulp Market is valued at approximately USD 175 billion, driven by increasing demand for paper products, packaging materials, and sustainable practices in the industry. This valuation is based on a five-year historical analysis.