Region:Global

Author(s):Rebecca

Product Code:KRAC0241

Pages:92

Published On:August 2025

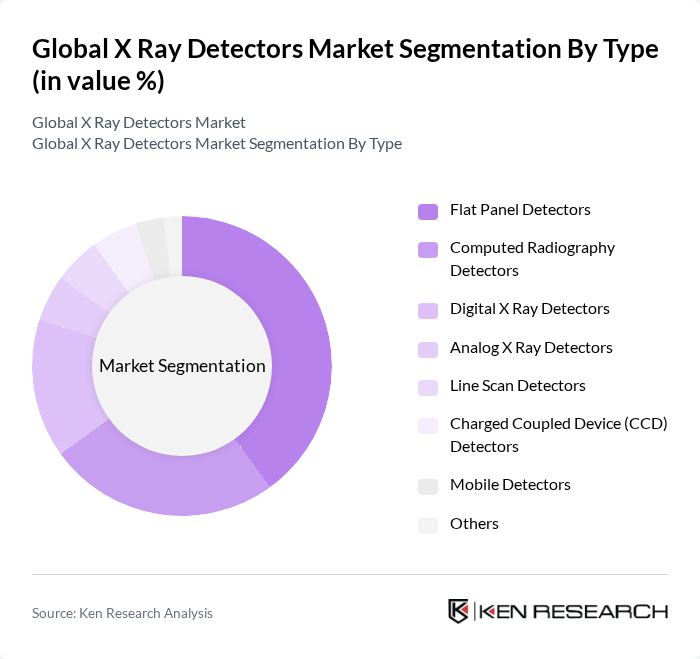

By Type:The market is segmented into various types of X-ray detectors, including Flat Panel Detectors, Computed Radiography Detectors, Digital X Ray Detectors, Analog X Ray Detectors, Line Scan Detectors, Charged Coupled Device (CCD) Detectors, Mobile Detectors, and Others. Among these, Flat Panel Detectors lead the market due to their superior image quality, compact design, rapid image acquisition, and ease of integration into digital radiography systems. The demand for these detectors is driven by the increasing need for high-resolution imaging in hospitals and diagnostic centers, as well as their growing use in mobile and point-of-care applications .

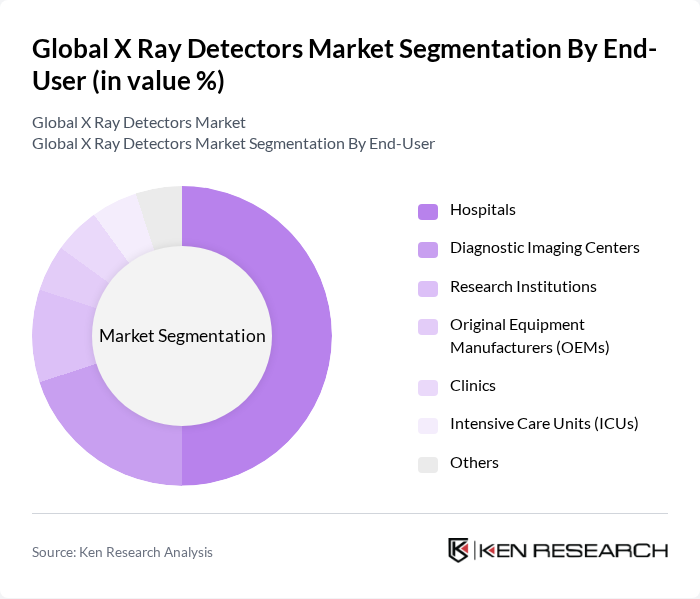

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Research Institutions, Original Equipment Manufacturers (OEMs), Clinics, Intensive Care Units (ICUs), and Others. Hospitals are the dominant end-user segment, driven by the increasing number of diagnostic imaging procedures and the need for advanced imaging technologies to improve patient care. The growing focus on early disease detection and treatment in hospitals further fuels the demand for X-ray detectors. Diagnostic imaging centers are also significant users, reflecting the decentralization of imaging services and the rise in outpatient diagnostic procedures .

The Global X Ray Detectors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems Corporation, FUJIFILM Healthcare, Agfa HealthCare, Carestream Health, Hitachi, Ltd. (Healthcare Division), Hologic, Inc., Varian Medical Systems, Mindray Medical International Limited, Shimadzu Corporation, Konica Minolta, Inc., Teledyne DALSA, PerkinElmer, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the X-ray detectors market in None is poised for significant transformation, driven by technological advancements and evolving healthcare needs. The integration of artificial intelligence in imaging systems is expected to enhance diagnostic accuracy and efficiency, while the shift towards portable X-ray solutions will cater to the growing demand for accessible healthcare. Additionally, increased investments in healthcare infrastructure will further support the expansion of advanced imaging technologies, ensuring that the market remains dynamic and responsive to emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Flat Panel Detectors Computed Radiography Detectors Digital X Ray Detectors Analog X Ray Detectors Line Scan Detectors Charged Coupled Device (CCD) Detectors Mobile Detectors Others |

| By End-User | Hospitals Diagnostic Imaging Centers Research Institutions Original Equipment Manufacturers (OEMs) Clinics Intensive Care Units (ICUs) Others |

| By Application | Medical Imaging Dental Application Security Application Veterinary Application Industrial Inspection Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Range Mid Range High Range |

| By Technology | Digital Radiography Analog Radiography Hybrid Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiology Departments | 100 | Radiologists, Imaging Technologists |

| Diagnostic Imaging Centers | 80 | Center Managers, Equipment Buyers |

| Healthcare Equipment Distributors | 60 | Sales Managers, Product Specialists |

| Research Institutions | 50 | Research Scientists, Lab Managers |

| Government Health Agencies | 40 | Policy Makers, Health Program Directors |

The Global X Ray Detectors Market is valued at approximately USD 3.5 billion, driven by advancements in digital imaging technologies and the increasing demand for early and accurate diagnosis in healthcare settings.