Region:Global

Author(s):Shubham

Product Code:KRAB0772

Pages:82

Published On:August 2025

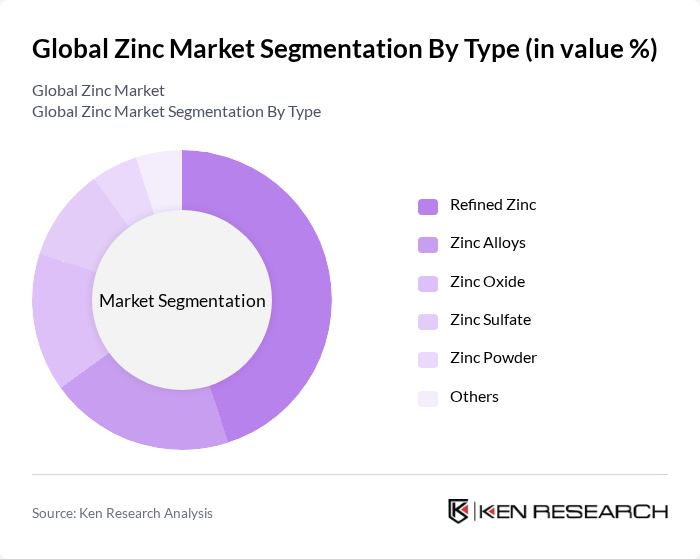

By Type:The market is segmented into Refined Zinc, Zinc Alloys, Zinc Oxide, Zinc Sulfate, Zinc Powder, and Others. Refined Zinc remains the leading sub-segment, primarily due to its use in galvanizing processes that protect steel and iron from corrosion. Demand for high-quality refined zinc is sustained by its critical role in construction, automotive, and infrastructure projects, where material durability is essential. Zinc oxide and chemical derivatives are also expanding in use, particularly in fertilizers, batteries, and specialty chemicals .

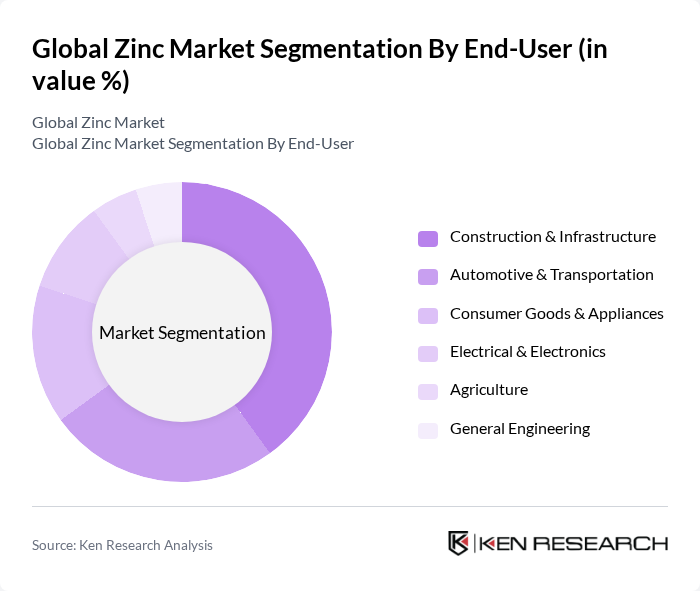

By End-User:The end-user segmentation includes Construction & Infrastructure, Automotive & Transportation, Consumer Goods & Appliances, Electrical & Electronics, Agriculture, General Engineering, and Others. Construction & Infrastructure holds the largest share, driven by the need for galvanized steel in buildings, bridges, and public works. Automotive & Transportation remains a key segment as manufacturers seek corrosion-resistant materials for vehicle longevity. Agriculture is also a growing segment, with zinc-based fertilizers gaining traction to improve crop yields .

The Global Zinc Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nyrstar NV, Teck Resources Limited, Hindustan Zinc Limited, Zinc Nacional S.A. de C.V., Korea Zinc Co., Ltd., Boliden AB, American Zinc Recycling Corp., Glencore plc, Vedanta Resources Limited, South32 Limited, Aurubis AG, Zinc Oxide LLC, China Minmetals Corporation, Shaanxi Nonferrous Metals Holding Group Co., Ltd., and Tsingshan Holding Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the zinc market appears promising, driven by increasing applications in construction, automotive, and renewable energy sectors. As sustainability becomes a priority, innovations in zinc recycling and eco-friendly production methods are expected to gain traction. Additionally, emerging markets in Asia and Africa are likely to present significant growth opportunities, as infrastructure development accelerates. The focus on health supplements and agricultural benefits of zinc will further enhance its market presence, ensuring a robust demand trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refined Zinc Zinc Alloys Zinc Oxide Zinc Sulfate Zinc Powder Others |

| By End-User | Construction & Infrastructure Automotive & Transportation Consumer Goods & Appliances Electrical & Electronics Agriculture General Engineering Others |

| By Application | Galvanizing Die Casting Zinc Compounds (Chemicals) Batteries Zinc-Based Alloys Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | Asia-Pacific North America Europe Latin America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Product Form | Solid Liquid Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Zinc Usage | 100 | Project Managers, Procurement Officers |

| Automotive Sector Zinc Applications | 80 | Manufacturing Engineers, Supply Chain Managers |

| Electronics and Electrical Equipment | 60 | Product Development Managers, Quality Assurance Managers |

| Galvanizing Process Insights | 90 | Operations Managers, Plant Supervisors |

| Zinc Recycling Initiatives | 50 | Sustainability Managers, Recycling Facility Managers |

The Global Zinc Market is valued at approximately USD 28 billion, based on a five-year historical analysis. This valuation reflects the growing demand for zinc in various industries, including construction, automotive, and renewable energy applications.