Vietnam Medical Devices Market Outlook to 2022

By Equipments (Consumables, Diagnostic Imaging, Dental Products, Orthopedics and Prosthetics, Patient Aids and Other Medical Devices)

Region:Asia

Product Code:KR594

February 2018

54

About the Report

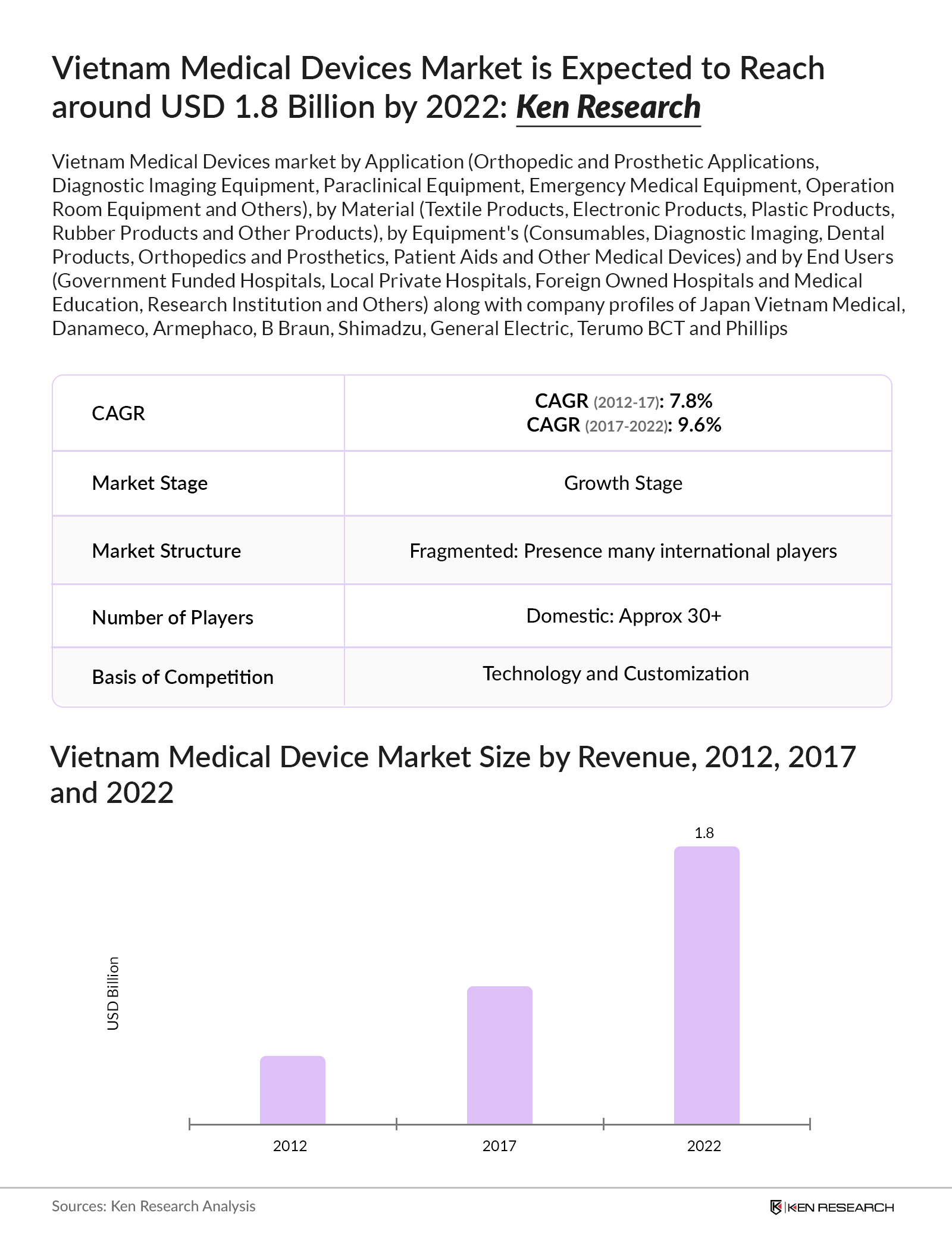

The report titled "Vietnam Medical Devices Market Outlook to 2022 - By Equipments (Consumables, Diagnostic Imaging, Dental Products, Orthopedics and Prosthetics, Patient Aids and Other Medical Devices)" provides a comprehensive analysis of Vietnam Medical Devices Market Overview and Size, growth drivers and restraints. The report also provides data points on Vietnam Medical Devices market by Application (Orthopedic and Prosthetic Applications, Diagnostic Imaging Equipment, Paraclinical Equipment, Emergency Medical Equipment, Operation Room Equipment and Others), by Material (Textile Products, Electronic Products, Plastic Products, Rubber Products and Other Products), by Equipments (Consumables, Diagnostic Imaging, Dental Products, Orthopaedics and Prosthetics, Patient Aids and Other Medical Devices) and by End Users (Government Funded Hospitals, Local Private Hospitals, Foreign Owned Hospitals and Medical Education, Research Institution and Others) along with company profiles of Japan Vietnam Medical, Danameco, Armephaco, B Braun, Shimadzu, General Electric, Terumo BCT and Phillips. The report also covers SWOT Analysis, Roadmap for Tender Application for Medical Device Company in Vietnam, Regulatory Process, import by value and destination, Vietnam Medical devices competitive landscape, Analyst Recommendations and future outlook.

Vietnam Medical Devices Market Size and Overview: Vietnam medical devices market recorded growth at a CAGR of ~% during 2012-2017, driven by liberal import policies, and surge in Orthopedic and Prosthetic medical equipments. Increase in investments in public healthcare facilities and tax exemption for newly established private healthcare providers increased the demand for medical devices. With a need to improve healthcare services in Vietnam, healthcare providers are focusing on using advanced technological medical equipments which will help in early detection of diseases and increase pace in diagnosis and recovery timelines.

Market Segmentation

By Application (Orthopedic and Prosthetic Applications, Diagnostic Imaging Equipment, Paraclinical Equipment, Emergency Medical Equipment, Operation Room Equipment and Others): Orthopedic and Prosthetic Applications dominated the type of applications in medical devices market in Vietnam in 2017 generating revenue share of ~%. Diagnostic imaging equipment generated second highest revenue with a share of ~% due to increase in the number of units. Paraclinic equipment generated third highest revenue share of ~% due to rise in chronic diseases in Vietnam owing to changing lifestyles and aging population. Emergency Medical equipment followed Paraclinic equipment with ~% revenue share. The product with least share was medical supplies, hygiene disposables and therapeutic equipment as the product quality of these products are not very critical to research, diagnosis and treatment quality and there is already an abundance of such products in the market from local players and end users prefer cheaper options. Others include Medical furniture, medical utensils, Clothing medical and accessories.

By Material (Textile Products, Electronic Products, Plastic Products, Rubber Products and Other Products): Textile products dominated the market structure of Vietnam medical devices by materials generating revenue with ~% share in 2017 due to major expansion in fields such as wound healing and controlled release, bandaging and pressure garments, implantable devices and extracorporeal devices. Electronics products generated second highest revenue with a share of ~%. Technological advancement in semiconductor and nanotechnology has aided in large-scale integration and reduced power consumption in medical devices which helped in building better portable medical devices for users in home healthcare services, telemedicine facilities and specialty hospitals. Plastic products generated third highest revenue share of ~% followed by the rubber products generating ~% revenue share. Other products include the products made of steel, iron, brass or combination of two or more.

By Equipments (Consumables, Diagnostic Imaging, Dental Products, Orthopaedics and Prosthetics, Patient Aids and Other Medical Devices): The consumables dominated the equipments in medical devices market in Vietnam in 2017 generating ~% revenue share as syringes, needles and catheters have been the most popular and fastest growing sub-categories of imported goods over the last five years. Diagnostic imaging equipment generated second highest revenue with a share of ~% due to the growing awareness among people about early disease diagnosis, improving healthcare expenditure and a high number of ongoing research activities across the country. Orthopaedics and Prosthetics generated third highest revenue share of ~% followed by Patient Aids with ~% revenue share. Other Medical Devices generated revenue with ~% of share in equipments in medical devices market in Vietnam in 2017.

By End Users (Government Funded Hospitals, Local Private Hospitals, Foreign Owned Hospitals and Medical Education, Research Institution and Others): Government funded hospitals dominated the end users of the medical device market with ~% share amounting to USD ~ million. Local Private Hospitals were the second largest end user segment and accounted for ~% of the medical device market amounting to USD ~ million. Foreign Owned Hospitals contributed third highest revenue share of ~% in the medical device market as this segment tends to purchase devices from their sponsoring country. Research institutions generated least revenue share of ~% in the end user segments of the medical devices market as this segment is open to experimentation with new and innovative techniques.

Future Outlook to Vietnam Medical Devices Market: The Vietnam medical devices market will record growth at a CAGR of ~% during 2017-2022, driven by growing investment in public and private health care sector and emphasis on local production. Future growth will be attributed to growing demand from expanding/upgrading healthcare resources (both in public as well as in private healthcare) opens up a valuable opportunity for market players. Vietnam may turn into a regional manufacturing hub for medical device manufacturers which are looking forward to expand their footprint in other south east nations. Other future growth drivers for the medical devices market in Vietnam will include increase in domestic production and technological tie-ups.

Key Topics Covered in the Report

- Vietnam Medical Devices Market Overview and Size

- Vietnam Medical Devices Market Growth drivers

- Vietnam Medical Devices Market Restraints

- Vietnam Medical Devices Market by Application (Orthopedic and Prosthetic Applications, Diagnostic Imaging Equipment, Paraclinical Equipment, Emergency Medical Equipment, Operation Room Equipment and Others)

- Vietnam Medical Devices Medical Devices Market by Material (Textile Products, Electronic Products, Plastic Products, Rubber Products and Other Products)

- Vietnam Medical Devices Medical Devices Market by Equipments (Consumables, Diagnostic Imaging, Dental Products, Orthopaedics and Prosthetics, Patient Aids and Other Medical Devices)

- Vietnam Medical Devices Medical Devices Market by End Users (Government Funded Hospitals, Local Private Hospitals, Foreign Owned Hospitals and Medical Education, Research Institution and Others)

- SWOT Analysis for Vietnam Medical Devices Market

- Roadmap for Tender Application for Medical Device Company in Vietnam

- Regulatory Process

- Import by value and destination

- Vietnam Medical devices competitive landscape

- Analyst Recommendations for Vietnam Medical Devices Market

- Future outlook for Vietnam Medical Devices Market

Products

Companies

Japan Vietnam Medical,

Danameco,

Armephaco,

B Braun,

Shimadzu,

General Electric,

Terumo BCT and Phillips

Table of Contents

1. Research Methodology

1.1: Market Definitions

1.2: Abbreviations

1.3: Consolidated Research Approach

1.4: Market Sizing and Limitations

1.5: Products and Test Covered

1.6: Variables (Dependent and Independent)

1.7: Correlation Matrix

1.8: Regression Matrix

2. Healthcare Scenario

2.1: Healthcare Ecosystem

2.2: How are Healthcare Organizations Positioned

2.3: Vietnam Healthcare Metrics

2.4: Health Statistics

2.5: Vietnam Universal Health Coverage

3. Vietnam Healthcare Market

3.1: Vietnam Healthcare Market Size by Revenues

3.2: Vietnam Healthcare Market Segmentation by Healthcare Sectors, 2012 & 2017

3.3: Vietnam Healthcare Market Future Outlook and Projections, 2018-2022

4. Vietnam Medical Devices Market

4.1: Executive Summary

4.2: Vietnam Medical Devices Market Overview

4.3: Vietnam Medical Devices Market Size by Revenues, 2012-2017

4.4: Growth Drivers in Vietnam Medical Devices Market

4.5: Restraints in Vietnam Medical Devices Market

4.6: Market Segmentation for Vietnam Medical Devices Market by Applications, 2017

Orthopedic and Prosthetic Applications

Diagnostic Imaging Equipment

Paraclinical Equipment

Emergency Medical Equipment

Operation Room Equipment

Others (Medical furniture, medical utensils, Clothing medical and accessories)

4.7: Market Segmentation for Vietnam Medical Devices Market by Material Used, 2017

Textile Products

Electronic Products

Plastic Products

Rubber Products

Other Products (made of steel, iron, brass or combination of two or more)

4.8: Market Segmentation for Vietnam Medical Devices Market by Equipments, 2017

Consumables

Diagnostic Imaging

Dental Products

Orthopedic and Prosthetics Devices

Patient Aids

Other Medical Devices

4.9: Market Segmentation for Vietnam Medical Devices Market by End User Segment, 2017 Public Hospitals

Local Private Hospitals

Foreign Owned Hospitals

Medical Research Institutions and Others

4.10: SWOT Analysis for Vietnam Medical Devices Market

4.11: Tender Application Process for Medical Device Company

4.12: Regulatory Process for Medical Device in Vietnam

4.13: Market Segmentation for Vietnam Medical Devices Market by Imports and Domestic Production, 2012-2017

4.14: Trade Scenario of Medical Devices Market in Vietnam (Imports), 2012-2017

4.15: Competitive Landscape for Medical Device Market in Vietnam

4.16: Vietnam Medical Devices Market Future Outlook and Projections, 2018-2022

4.17: Analyst Recommendations

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.