India Non Whey Mass Gainer Market Outlook to 2023

By Product (Granules and Tablets & Others), By Metro & Non Metro Cities, By Online & Offline Sales Channels and By Flavors (Chocolate, Banana, Vanilla & Others)

Region:Asia

Product Code:KR624

May 2018

70

About the Report

The report is useful for non whey/ whey mass gain producers, potential investors, potential entrants, nutraceutical companies, companies, major fitness center owners, government authorities and other stakeholders to align their market centric strategies according to ongoing and expected trends in the future.

India Non Whey Mass Gain Market Size and Overview

Market Segmentation

By Products: Granules constituted for higher sales in the market in comparison to tablets. This has been primarily attributed to the fact that it contains much higher amount of nutrients in comparison to pills, it facilitates more consumption of water/fluids and come in a variety of flavors.

By Metro & Non Metro Sales: Major metro cities including Mumbai, Chennai, Delhi, Kolkata, Hyderabad, Bangalore, Pune, and Ahmedabad have generated highest demand for non whey mass gainer products. Key influencers in metro cities are fitness trainers, friends & relatives and nutritionists. Major growth factor in this region includes higher presence of direct consumers including more number of working class population and people engaged in fitness & body maintaining activities such as yoga, jogging and others coupled with having much higher per capita disposable income. Non metro cities' demand is gradually increasing with increase in product awareness. Domestic brands have shown considerable improvement in terms of growth in non metro cities by tapping demand arising from population engaged in pehlwani, joining army & naval forces and due to non availability of imported products.

Online & Offline Sales Channel: Online sales are done through 3 models namely, Market Place Model, Inventory- Led Model and Omni Channel Mode. Neulife, GNC, Supermarkets, pharmacies, chemists, retail shops have been the major retail channels in offline distribution.

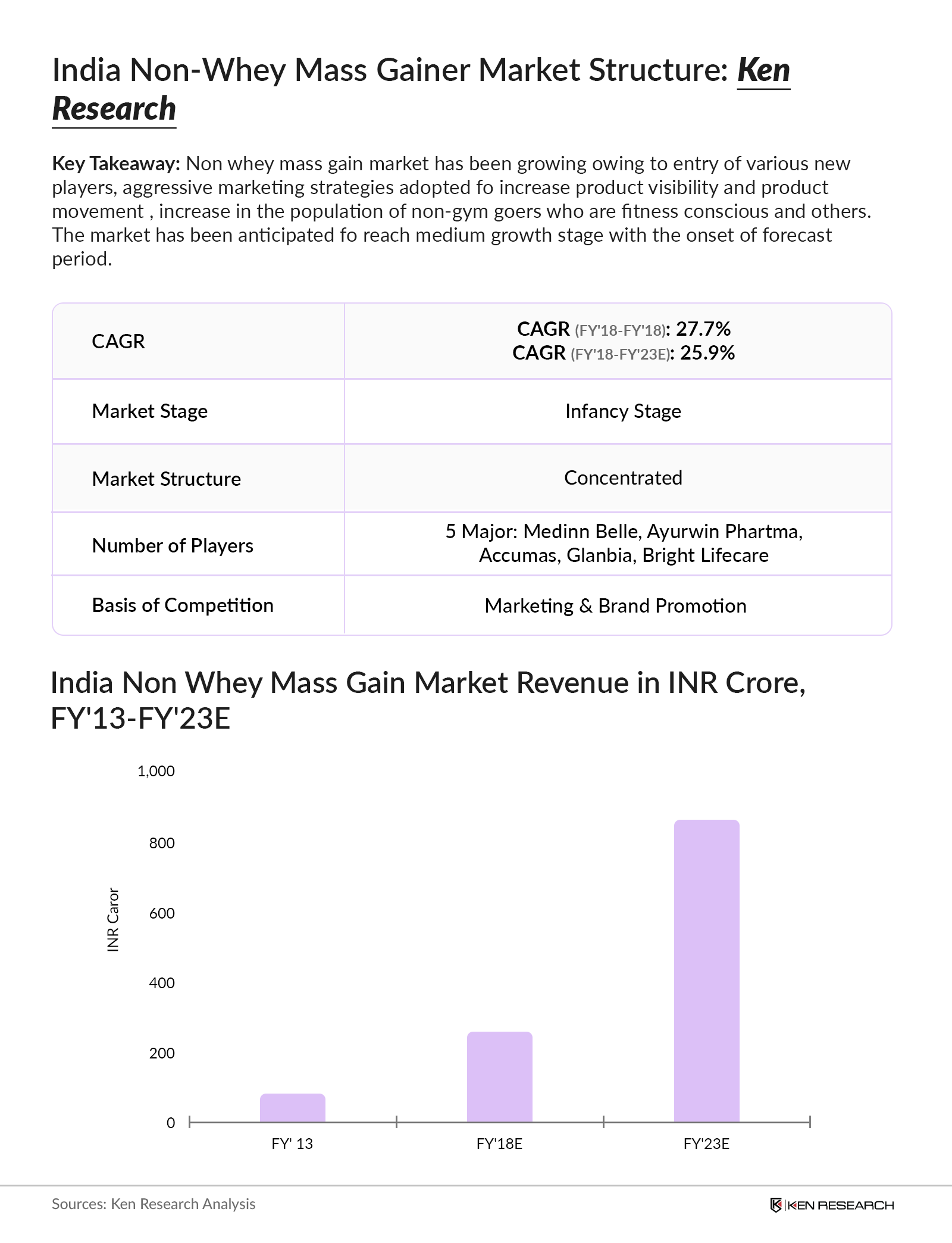

Competitive Landscape: Competition in the non whey mass gain market has been concentrated among top 5 companies. Market has been unregulated in terms of nutrient, trust and quality standards to be maintained by manufacturer. Major competition is being driven through new product launches and marketing initiatives. Products are being manufactured domestically as well as imported.

Future Outlook and Tailwind: Market has been anticipated to showcase a substantial growth at a CAGR during the forecast period (FY'18-FY'23E). Increase in the number of new entrants in the market, larger product acceptance, expanding distribution channels of existing players and higher marketing expenditure done by the companies are expected to be tailwind for future growth.

Key Topics Covered in the Report

- India Non Whey Mass Gain Market Genesis & Timeline

- India Non Whey Mass Gain Market Ecosystem

- India Non Whey Mass Gain Market Value Chain Analysis

- India Non Whey Mass Gain Market Size

- India Non Whey Mass Gain Market Segmentation by Product (Granules and Tablets & Others), By Metro & Non Metro Cities, By Online & Offline Sales Channels and By Flavors (Chocolate, Banana, Vanilla & Others)

- India Non Whey Mass Gain Market Success Case Studies for New Entrants

- India Non Whey Mass Gain Market SWOT analysis

- India Non Whey Mass Gain Market Competition Scenario

- India Non Whey Mass Gain Market Share of Major Companies

- Company Profiles of Major manufacturers & Importers

- India Non Whey Mass Gain Market Future & Segmentation

- India Sports Nutrition Industry Snapshot

- India Non Whey Mass Gain Market Analyst Recommendations

Products

Companies

Medinn Belle Herbal Pvt. Ltd (Endura Supplements),

Ayurwin Pharma,

Accumass,

Glanbia (Optimum Nutrition),

Bright Lifecare and Medisys Biotech Pvt. Ltd

Table of Contents

1. Executive Summary

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Consolidated Research Approach

2.4. Market Sizing and Limitations

2.5. Variables (Dependent and Independent)

3. India Non Whey Mass Gain Market: Supply Side Ecosystem

4. India Non Whey Mass Gain Market: Timeline & Genesis

5. India Non Whey Mass Gain Market: Overview & Market Nature

6. Value Chain Analysis in India Non Whey Mass Gain Market

6.1. Value Chain Analysis Flow Chart 1: Importing Brands

6.2. Value Chain Analysis Flow Chart 2: Domestic Brands

6.3. Entity Analysis

7. India Non Whey Market Size by Revenues

8. India Non Whey Mass Gain Market Growth Drivers

9. India Non Whey Mass Gain Market Restraints

10. India Non Whey Mass Gain Market Segmentation

10.1. India Non Whey Mass Gain Market Segmentation by Flavor

10.2. India Non Whey Mass Gain Market Segmentation by Product

10.3. India Non Whey Mass Gain Market Segmentation by Metro & Non Metro Cities

10.4. India Non Whey Mass Gain Market Segmentation by Online & Offline Sales

10.5. India Non Whey Mass Gain Market Segmentation: Online operating models

10.6. India Non Whey Mass Gain Market Segmentation: Online Players Overview

11. Success Case Studies

11.1. Market Entrant Success Case Study 1: Endura Supplements

11.2. Market Entrant Success Case Study 2: Ayurwin Pharma Pvt. Ltd

12. SWOT Analysis for India Non Whey Mass Gain Market

13. Non Whey Mass Gain Market: Competition Scenario FY'18

Non Whey Mass Gain Market: Market Share of Major Players

14. Company Profiles

14.1. Endura Supplements

14.2. Ayurwin Pharma

14.3. Accumass

14.4. Glanbia (Optimum Nutrition)

14.5. Bright Lifecare

14.6. Medisys Biotech

15. Snapshot on India Sports Nutrition Market

15.1. Snapshot on India Sports Nutrition Market: Market Size & Overview

15.2. Snapshot on India Sports Nutrition Market: Distribution Channel

15.3. Snapshot on India Sports Nutrition Market: Competition Landscape

15.4. Market Potential

16. Future Market Size Non Whey Mass Gain Market by Revenue

16.1. India Non Whey Mass Gain Market-Future Segmentation by Metro & Non Metro Cities and Online & Offline Sales Channel, FY'23E

17. Analyst Recommendations

17.1. Value Chain Focus Points

17.2. Analyst Recommendations: Product Innovations

17.3. Analyst Recommendations - Marketing is the Key

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.