Region:Asia

Author(s):Dev

Product Code:KRAB0470

Pages:86

Published On:August 2025

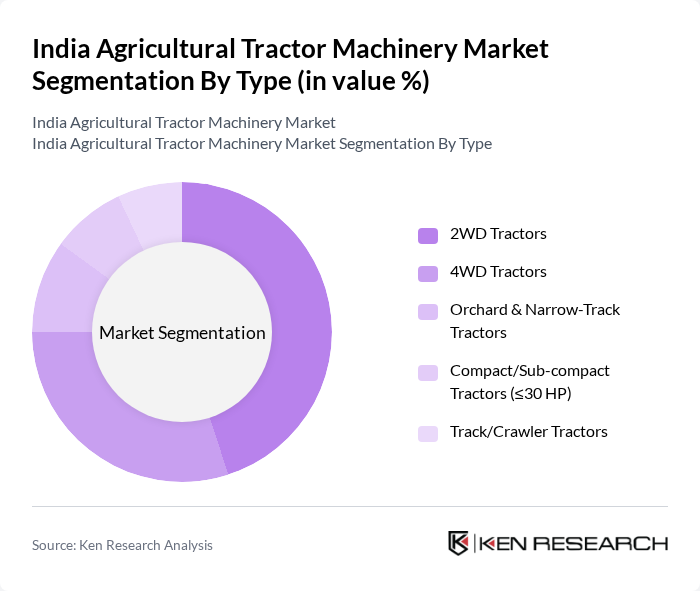

By Type:The market is segmented into various types of tractors, including 2WD Tractors, 4WD Tractors, Orchard & Narrow-Track Tractors, Compact/Sub-compact Tractors (?30 HP), and Track/Crawler Tractors. Among these, 2WD Tractors dominate the market due to their affordability and versatility, making them a preferred choice for small and marginal farmers. The increasing adoption of 4WD Tractors is also notable, particularly in larger farming operations where enhanced power and traction are required.

By End-User:The end-user segmentation includes Small & Marginal Farmers (?2 ha), Medium Farmers (2–10 ha), Large/Commercial Farms & Custom Hiring Centers, and Government & Institutional Buyers. Small & Marginal Farmers represent the largest segment, driven by the need for affordable and efficient farming solutions. The increasing trend of custom hiring services is also noteworthy, as it allows farmers to access advanced machinery without the burden of ownership costs. Growth in custom hiring has been supported by state subsidy programs and availability of rural financing options that expand access to mechanization.

The India Agricultural Tractor Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mahindra & Mahindra Ltd., TAFE (Tractors and Farm Equipment Limited), John Deere India Private Limited, Escorts Kubota Limited, New Holland Agriculture (CNH Industrial), International Tractors Limited (Sonalika), Force Motors Ltd., Kubota Agricultural Machinery India Pvt. Ltd., CNH Industrial India Pvt. Ltd., SDF Group (Same Deutz-Fahr India), Indo Farm Equipment Limited, V.S.T Tillers Tractors Ltd., Preet Tractors (Preet Tractors Pvt. Ltd.), Captain Tractors Pvt. Ltd., Standard Corporation India Ltd. (Swaraj Implements/Standard Tractors) contribute to innovation, geographic expansion, and service delivery in this space. Recent industry data highlight sustained unit sales momentum supported by favorable monsoons and kharif sowing, alongside rising preference for higher horsepower and 4WD configurations in certain regions.

The future of the India agricultural tractor machinery market appears promising, driven by technological advancements and increasing mechanization. As farmers increasingly adopt precision agriculture and smart farming technologies, the demand for advanced tractors equipped with GPS and IoT capabilities is expected to rise. Additionally, the government's continued support for agricultural mechanization and sustainability initiatives will likely foster innovation and growth in the sector, positioning it for significant development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | WD Tractors WD Tractors Orchard & Narrow-Track Tractors Compact/Sub-compact Tractors (?30 HP) Track/Crawler Tractors |

| By End-User | Small & Marginal Farmers (?2 ha) Medium Farmers (2–10 ha) Large/Commercial Farms & Custom Hiring Centers Government & Institutional Buyers |

| By Region | North India South India East India West India |

| By Application | Land Preparation & Tillage Sowing/Planting & Interculture Harvesting & Haulage Spraying & Precision Operations |

| By Sales Channel | Direct/OEM Sales Authorized Dealers & Distributors Digital/Online Platforms |

| By Price Range | Entry (Budget) Segment Mid-Price Segment Premium Segment |

| By Financing Options | Cash Purchases Bank/NBFC Loans Leasing & Rental (Custom Hiring) Government Subsidies (Central/State Schemes) |

| By Engine Power (HP) | ?30 HP –50 HP –80 HP >80 HP |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Manufacturers | 60 | Product Managers, Sales Directors |

| Farmers and End-users | 120 | Smallholder Farmers, Large-scale Farmers |

| Distributors and Dealers | 80 | Regional Managers, Sales Representatives |

| Agricultural Consultants | 50 | Agronomy Experts, Market Analysts |

| Government Officials | 40 | Policy Makers, Agricultural Development Officers |

The India Agricultural Tractor Machinery Market is valued at approximately USD 8.7 billion, reflecting a robust demand driven by factors such as increasing farm mechanization, strong replacement demand, and government support for equipment subsidies.