Region:Asia

Author(s):Rebecca

Product Code:KRAA3832

Pages:90

Published On:September 2025

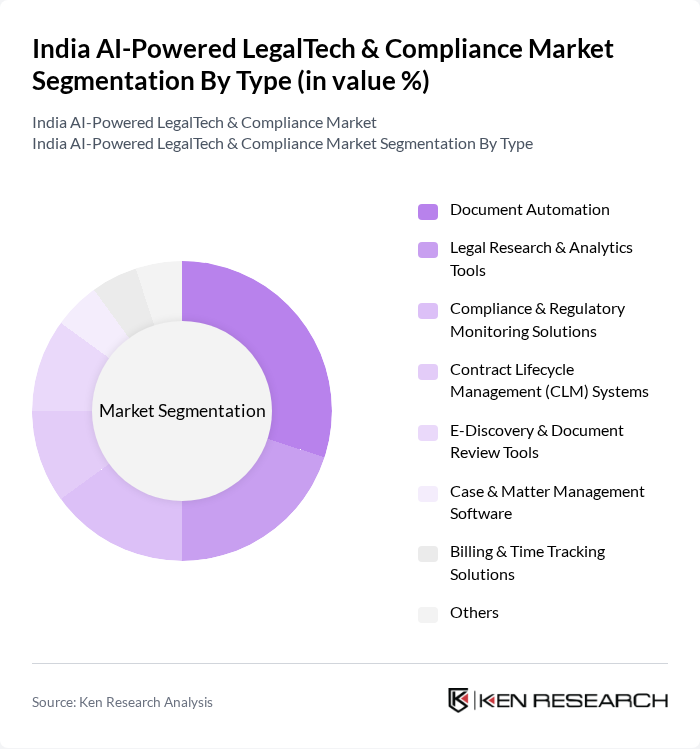

By Type:The market is segmented into various types, including Document Automation, Legal Research & Analytics Tools, Compliance & Regulatory Monitoring Solutions, Contract Lifecycle Management (CLM) Systems, E-Discovery & Document Review Tools, Case & Matter Management Software, Billing & Time Tracking Solutions, and Others. Among these, Document Automation is gaining traction due to its ability to streamline document creation and management processes, significantly reducing time and costs for legal professionals. The adoption of AI-powered contract analysis and e-discovery platforms is also increasing, driven by the need for rapid, accurate data handling and compliance .

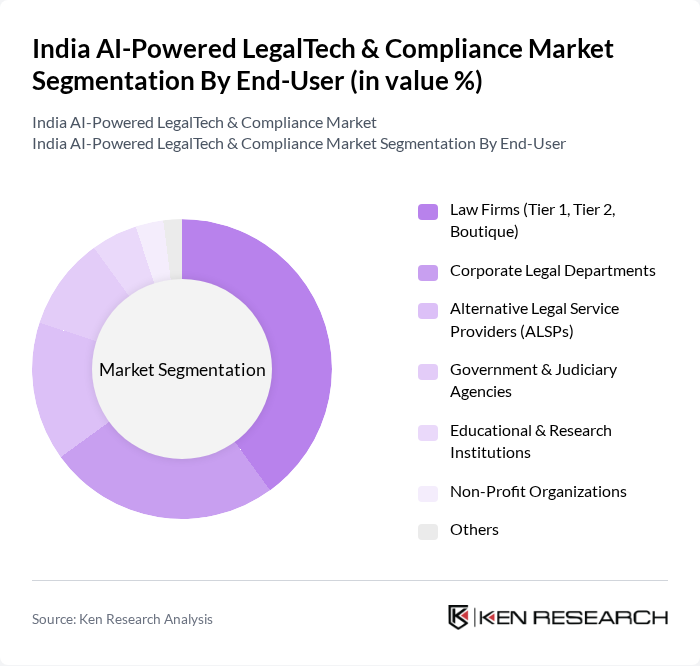

By End-User:The end-user segmentation includes Law Firms (Tier 1, Tier 2, Boutique), Corporate Legal Departments, Alternative Legal Service Providers (ALSPs), Government & Judiciary Agencies, Educational & Research Institutions, Non-Profit Organizations, and Others. Law Firms, particularly Tier 1 and Tier 2, are the leading users of AI-powered LegalTech solutions, driven by their need for efficiency, digital transformation, and competitive advantage in a rapidly evolving legal landscape. Corporate legal departments are increasingly adopting AI for contract management and compliance automation, while ALSPs leverage technology for scalable service delivery .

The India AI-Powered LegalTech & Compliance Market is characterized by a dynamic mix of regional and international players. Leading participants such as MikeLegal, SpotDraft, NearLaw, Presolv360, LegalMind, PracticeLeague, LegitQuest, CaseMine, Vakilsearch, LawRato, LegalKart, Jupitice Justice Technologies, Manupatra, Leegality, Simpliance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI-powered LegalTech and compliance market in India appears promising, driven by technological advancements and increasing digitalization. As firms increasingly adopt AI solutions, the focus will shift towards enhancing user experience and integrating advanced analytics. Additionally, the collaboration between legalTech companies and educational institutions is expected to foster innovation, leading to the development of tailored solutions that address specific legal challenges, ultimately transforming the legal landscape in India.

| Segment | Sub-Segments |

|---|---|

| By Type | Document Automation Legal Research & Analytics Tools Compliance & Regulatory Monitoring Solutions Contract Lifecycle Management (CLM) Systems E-Discovery & Document Review Tools Case & Matter Management Software Billing & Time Tracking Solutions Others |

| By End-User | Law Firms (Tier 1, Tier 2, Boutique) Corporate Legal Departments Alternative Legal Service Providers (ALSPs) Government & Judiciary Agencies Educational & Research Institutions Non-Profit Organizations Others |

| By Application | Litigation Support & Predictive Analytics Regulatory Compliance Automation Risk & Fraud Management Intellectual Property (IP) Management Contract Review & Management Knowledge Management Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | North India South India East India West India Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Legal Tech Startups | 60 | Founders, CEOs, Product Managers |

| Corporate Compliance Departments | 50 | Compliance Officers, Risk Managers |

| Law Firms Utilizing AI | 40 | Partners, IT Directors, Legal Researchers |

| Regulatory Bodies | 40 | Policy Makers, Legal Advisors |

| End-users of LegalTech Solutions | 50 | Legal Practitioners, In-house Counsel |

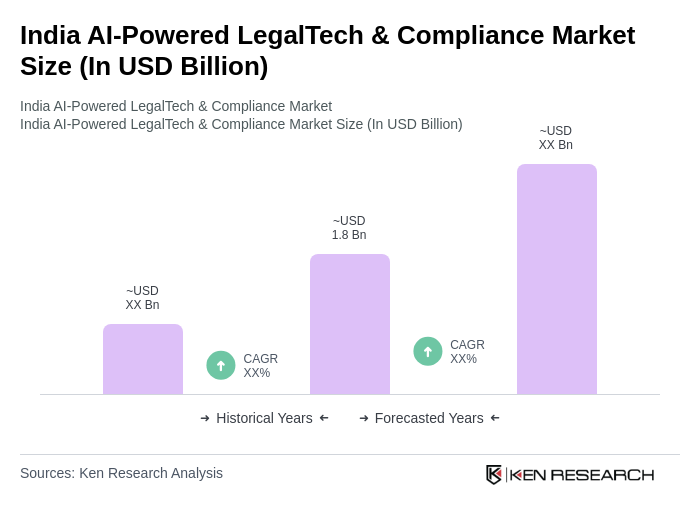

The India AI-Powered LegalTech & Compliance Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by the adoption of AI technologies in legal processes, enhancing efficiency and accuracy in various legal services.