Region:Asia

Author(s):Dev

Product Code:KRAC0503

Pages:99

Published On:August 2025

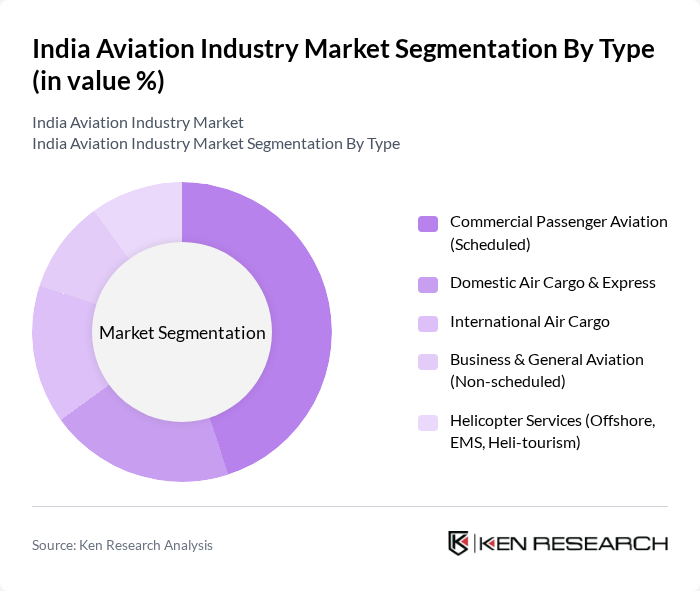

By Type:The aviation market can be segmented into various types, including Commercial Passenger Aviation (Scheduled), Domestic Air Cargo & Express, International Air Cargo, Business & General Aviation (Non-scheduled), and Helicopter Services (Offshore, EMS, Heli-tourism). Each of these segments plays a crucial role in catering to different consumer needs and operational requirements.

The Commercial Passenger Aviation (Scheduled) segment dominates the market, driven by the increasing demand for air travel among both leisure and business travelers. The rise of low-cost carriers has made air travel more accessible, leading to a significant increase in passenger numbers. Additionally, the expansion of airport infrastructure and improved connectivity have further fueled growth in this segment, making it the backbone of the aviation industry.

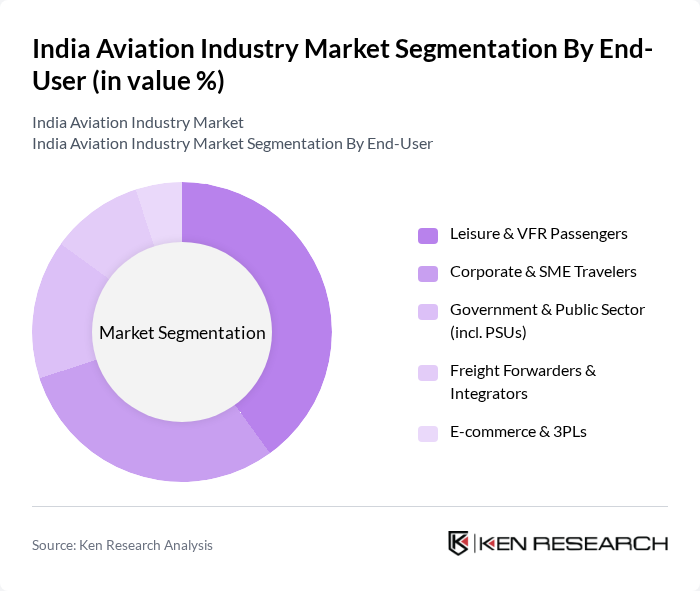

By End-User:The aviation market can also be segmented by end-user categories, including Leisure & VFR Passengers, Corporate & SME Travelers, Government & Public Sector (including PSUs), Freight Forwarders & Integrators, and E-commerce & 3PLs. Each of these categories reflects different consumer behaviors and operational needs within the aviation sector.

The Leisure & VFR Passengers segment is the largest, driven by the growing trend of domestic tourism and increased disposable incomes. The rise in travel for leisure purposes, coupled with the popularity of visiting friends and relatives (VFR), has significantly boosted demand in this segment. Additionally, the expansion of low-cost airlines has made air travel more affordable, further contributing to its dominance.

The India Aviation Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as IndiGo (InterGlobe Aviation Ltd.), Air India (Tata Group), Air India Express, Vistara (Tata SIA Airlines Ltd.), Akasa Air (SNV Aviation), SpiceJet, Alliance Air, Blue Dart Aviation, Quikjet Airlines, Star Air (Ghodawat Enterprises), Fly91 (Just Udo Aviation Pvt. Ltd.), IndiaOne Air, Pawan Hans, TAAL SASE (Taneja Aerospace & Aviation Ltd. – charter/MRO), Zoom Air (Zexus Air Services) – currently non-operational contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indian aviation industry appears promising, driven by increasing air travel demand and government support for infrastructure development. As the sector adapts to challenges such as high operational costs and infrastructure limitations, innovations in technology and customer service will play a crucial role. The focus on sustainability and regional connectivity will likely shape the industry's trajectory, ensuring that it remains resilient and competitive in the global aviation landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Commercial Passenger Aviation (Scheduled) Domestic Air Cargo & Express International Air Cargo Business & General Aviation (Non-scheduled) Helicopter Services (Offshore, EMS, Heli-tourism) |

| By End-User | Leisure & VFR Passengers Corporate & SME Travelers Government & Public Sector (incl. PSUs) Freight Forwarders & Integrators E-commerce & 3PLs |

| By Region | North India South India East & Northeast India West India Central India |

| By Aircraft Category | Narrow-Body Jets Wide-Body Jets Regional Jets & Turboprops Freighters (Dedicated Cargo Aircraft) |

| By Service Type | Scheduled Services Non-Scheduled/Charter Services Regional Connectivity (UDAN/RCS) |

| By Distribution Channel | Direct (Airline Websites/Apps) Travel Agencies & OTAs GDS/Corporate Travel Management |

| By Pricing Model | Dynamic/Yield-Based Pricing Ancillary Revenue Bundles (Seats, Bags, Meals) Subscription & Corporate Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Airlines Operations | 150 | Airline Executives, Operations Managers |

| Airport Management and Operations | 100 | Airport Authorities, Facility Managers |

| Cargo and Freight Services | 80 | Cargo Managers, Logistics Coordinators |

| Aviation Regulatory Bodies | 60 | Regulatory Officials, Policymakers |

| Aviation Support Services | 70 | Ground Handling Managers, Maintenance Supervisors |

The India Aviation Industry Market is valued at approximately USD 15 billion, reflecting significant growth driven by increasing passenger traffic, rising disposable incomes, and the expansion of low-cost carriers, particularly following the recovery from the pandemic.