Region:Asia

Author(s):Geetanshi

Product Code:KRAC0002

Pages:97

Published On:August 2025

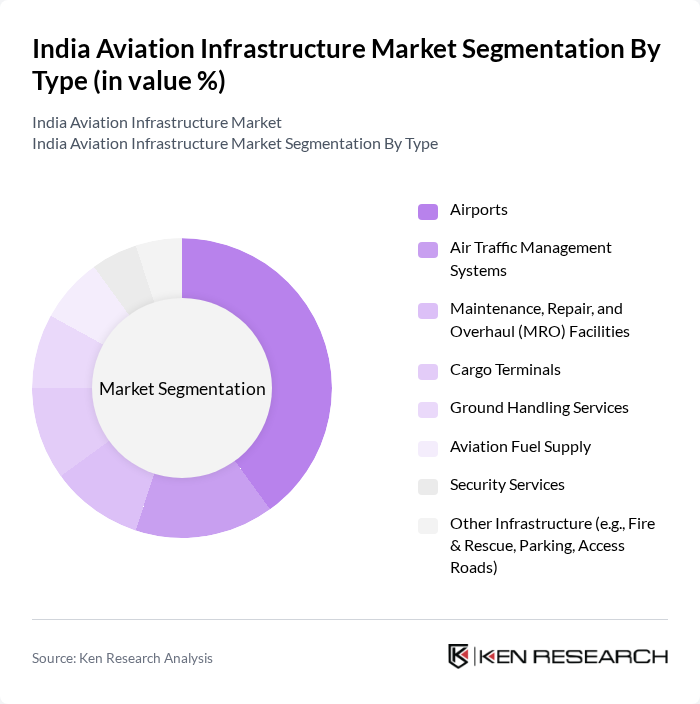

By Type:The market can be segmented into various types, includingAirports, Air Traffic Management Systems, Maintenance, Repair, and Overhaul (MRO) Facilities, Cargo Terminals, Ground Handling Services, Aviation Fuel Supply, Security Services, and Other Infrastructure(e.g., Fire & Rescue, Parking, Access Roads). Among these,Airportsare the most significant segment, driven by the increasing demand for air travel and the need for modern facilities to accommodate growing passenger numbers. The sector is witnessing rapid adoption of digital technologies, automation, and sustainable infrastructure solutions to enhance operational efficiency and passenger experience.

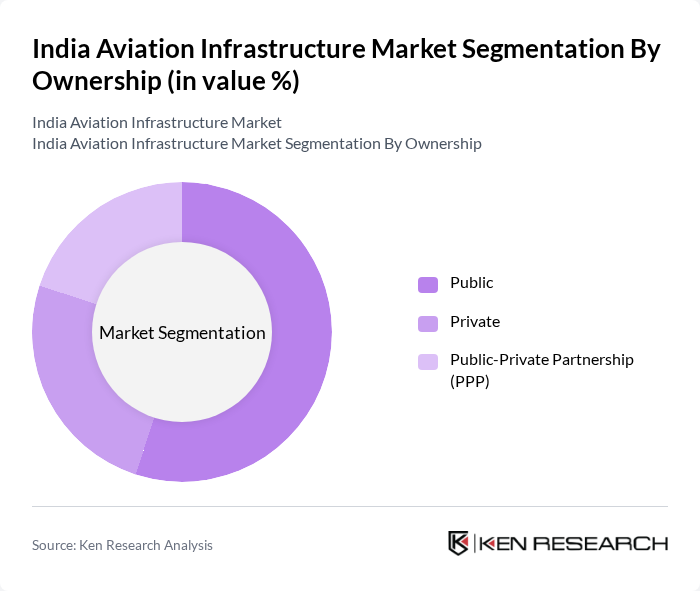

By Ownership:The market is also segmented by ownership intoPublic, Private, and Public-Private Partnership (PPP). ThePublicsegment dominates the market due to the significant number of government-owned airports and facilities, which are crucial for national connectivity and infrastructure development. However, thePrivateandPPPsegments are gaining traction as more private players enter the market, driven by government initiatives to enhance operational efficiency, service quality, and investment in airport modernization.

The India Aviation Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airports Authority of India, GMR Airports Infrastructure Limited, Adani Airports Holdings Limited, Bangalore International Airport Limited, Delhi International Airport Limited, Mumbai International Airport Limited, Larsen & Toubro (L&T) Construction, IndiGo (InterGlobe Aviation Ltd.), Air India Limited, Vistara (Tata SIA Airlines Limited), Go First (Go Airlines (India) Ltd.), AirAsia India (now AIX Connect), Blue Dart Aviation Limited, Pawan Hans Limited, Bird Group (Bird Worldwide Flight Services India Pvt. Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indian aviation infrastructure market appears promising, driven by increasing air traffic and government initiatives aimed at enhancing connectivity. In future, the focus will likely shift towards sustainable practices and technological advancements, including the integration of smart technologies in airport operations. Additionally, the expansion of regional airports will play a crucial role in improving accessibility and supporting economic growth in various regions, ensuring a balanced development across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Airports Air Traffic Management Systems Maintenance, Repair, and Overhaul (MRO) Facilities Cargo Terminals Ground Handling Services Aviation Fuel Supply Security Services Other Infrastructure (e.g., Fire & Rescue, Parking, Access Roads) |

| By Ownership | Public Private Public-Private Partnership (PPP) |

| By Airport Construction Type | Greenfield Airports Brownfield Airports |

| By Airport Type | Commercial Airports Military Airports General Aviation Airports |

| By Region | North India South India East India West India Others |

| By Technology | Advanced Air Traffic Management Systems Automated Check-in Systems Baggage Handling Systems Security Screening Technologies Smart Airport Solutions (IoT, Biometrics, etc.) Others |

| By Application | Passenger Transport Cargo Transport Emergency Services Charter Services Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Major International Airports | 60 | Airport Directors, Operations Managers |

| Regional Airport Development | 50 | Infrastructure Planners, Local Government Officials |

| Airline Infrastructure Needs | 55 | Airline Executives, Fleet Managers |

| Aviation Regulatory Framework | 40 | Policy Makers, Aviation Consultants |

| Airport Technology Integration | 45 | IT Managers, Technology Officers |

The India Aviation Infrastructure Market is valued at approximately USD 99 billion, reflecting significant growth driven by increasing air passenger traffic, government initiatives, and the expansion of low-cost carriers.