Region:Asia

Author(s):Shubham

Product Code:KRAA1924

Pages:100

Published On:August 2025

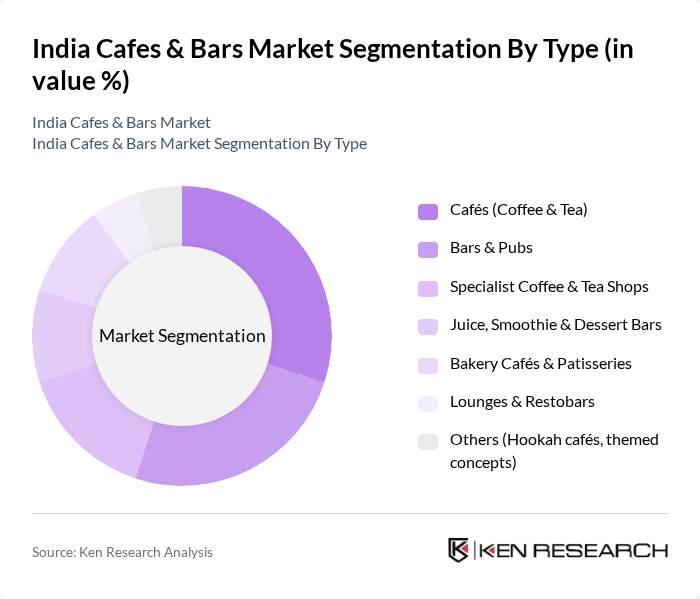

By Type:The market is segmented into various types, including Cafés (Coffee & Tea), Bars & Pubs, Specialist Coffee & Tea Shops, Juice, Smoothie & Dessert Bars, Bakery Cafés & Patisseries, Lounges & Restobars, and Others (Hookah cafés, themed concepts). Each of these segments caters to different consumer preferences and occasions, contributing to the overall market dynamics.

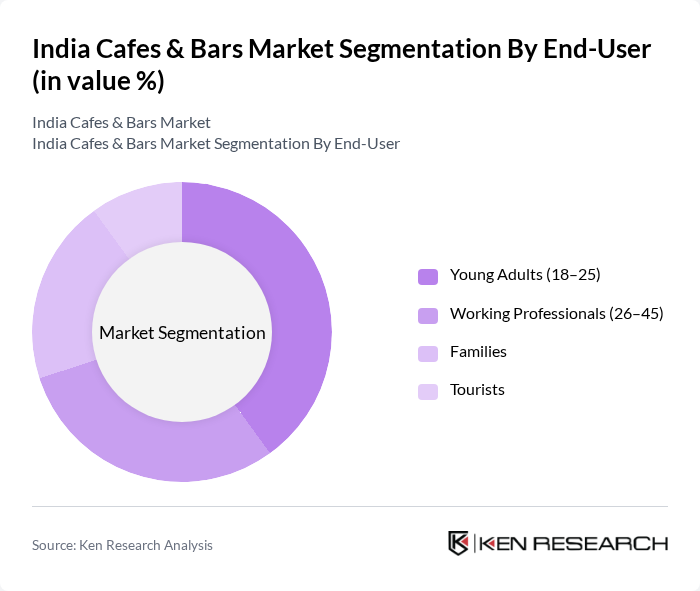

By End-User:The end-user segmentation includes Young Adults (18–25), Working Professionals (26–45), Families, and Tourists. Each group has distinct preferences and spending habits, influencing the types of cafes and bars that thrive in the market.

The India Cafes & Bars Market is characterized by a dynamic mix of regional and international players. Leading participants such as Café Coffee Day (Coffee Day Global Ltd.), Tata Starbucks Private Ltd. (Starbucks India), Barista Coffee Company Ltd., Dunkin’ (Jubilant FoodWorks Ltd.), The Beer Café, SOCIAL (Impresa Hospitality Pvt. Ltd.), Hoppipola (Speciality Restaurants Ltd.), The Coffee Bean & Tea Leaf (India), Costa Coffee (Devyani International Ltd.), Theobroma Patisserie India Pvt. Ltd., Chaayos (Sunshine Teahouse Pvt. Ltd.), Chai Point (Mountain Trail Foods Pvt. Ltd.), Blue Tokai Coffee Roasters, Third Wave Coffee Roasters, Pret A Manger India (Reliance Brands Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India cafes and bars market appears promising, driven by evolving consumer preferences and technological advancements. As digital ordering platforms gain traction, businesses are likely to enhance their online presence, catering to the growing demand for convenience. Furthermore, sustainability practices are becoming increasingly important, with consumers favoring establishments that prioritize eco-friendly operations. This trend will likely shape the market landscape, encouraging innovation and adaptation among industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Cafés (Coffee & Tea) Bars & Pubs Specialist Coffee & Tea Shops Juice, Smoothie & Dessert Bars Bakery Cafés & Patisseries Lounges & Restobars Others (Hookah cafés, themed concepts) |

| By End-User | Young Adults (18–25) Working Professionals (26–45) Families Tourists |

| By Region | North India South India East India West India |

| By Service Type | Dine-In Takeaway Delivery |

| By Price Range | Budget Mid-Range Premium |

| By Occasion | Casual Outings Celebrations Business Meetings |

| By Customer Loyalty Programs | Membership Discounts Reward Points Referral Bonuses |

| By Outlet Format | Standalone In-Mall/Retail Travel (Airports, Rail, Highways) Lodging (Hotels/Resorts) Chained Outlets Independent Outlets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cafe Consumer Preferences | 140 | Regular Cafe Patrons, Young Professionals |

| Bar Experience Insights | 100 | Frequent Bar Goers, College Students |

| Market Trends in Urban Areas | 120 | Urban Residents, Trend Analysts |

| Impact of Social Media on Cafe Choices | 80 | Social Media Influencers, Digital Marketers |

| Health Trends in Beverage Choices | 90 | Health-Conscious Consumers, Nutritionists |

The India Cafes & Bars Market is valued at approximately INR 1,500 billion, reflecting a consolidation of estimates based on historical analysis and recent market valuations specific to the cafes and bars sector in India.