Region:Asia

Author(s):Rebecca

Product Code:KRAA2105

Pages:91

Published On:August 2025

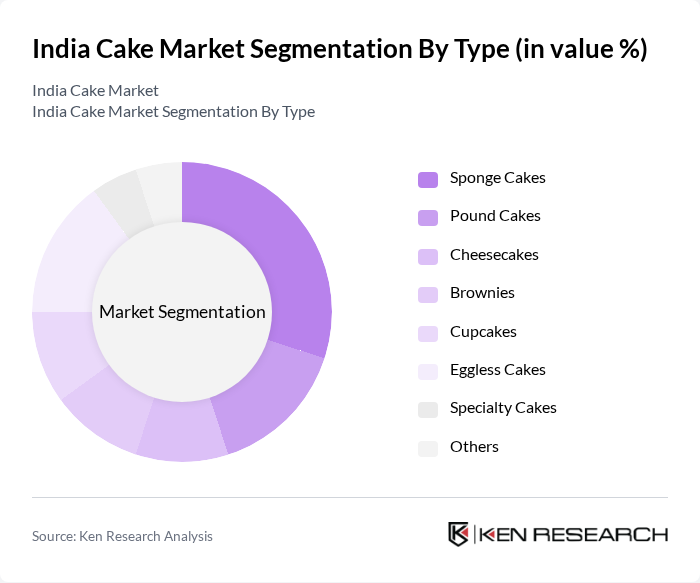

By Type:The cake market can be segmented into various types, including Sponge Cakes, Pound Cakes, Cheesecakes, Brownies, Cupcakes, Eggless Cakes, Specialty Cakes, and Others. Among these, Sponge Cakes are particularly popular due to their light texture and versatility, making them suitable for various occasions. The demand for Eggless Cakes has also surged, driven by the growing vegetarian population, health-conscious consumers, and religious preferences. Specialty cakes, including vegan, gluten-free, and low-sugar options, are gaining traction among urban consumers seeking healthier alternatives .

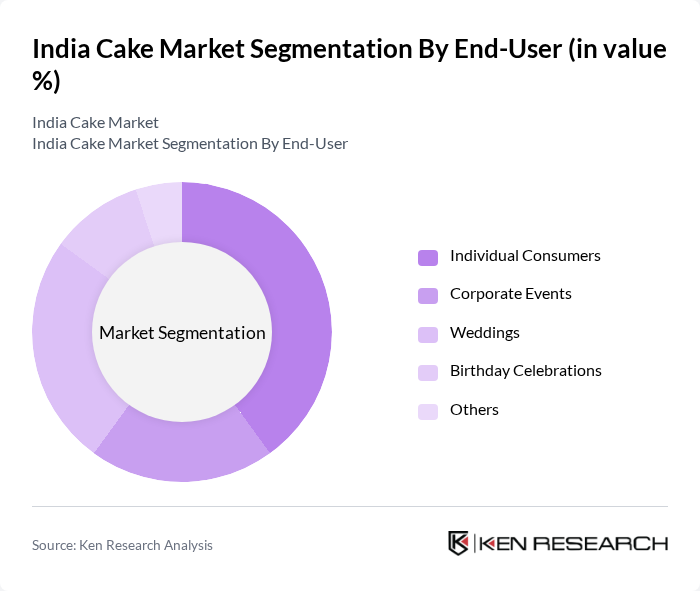

By End-User:The cake market is segmented based on end-users, including Individual Consumers, Corporate Events, Weddings, Birthday Celebrations, and Others. Individual Consumers represent the largest segment, driven by the increasing trend of celebrating personal milestones, the growing popularity of online cake delivery services, and the influence of Western-style celebrations. Corporate events and weddings also contribute significantly to the market, as cakes are integral to a wide range of celebrations and gatherings .

The India Cake Market is characterized by a dynamic mix of regional and international players. Leading participants such as Britannia Industries Limited, ITC Limited, Nestlé India Limited, Bisk Farm (SAJ Food Products Pvt. Ltd.), Monginis Foods Pvt. Ltd., Theobroma Foods Pvt. Ltd., Just Bake (Bakers Circle India Pvt. Ltd.), WarmOven (Mukunda Foods Pvt. Ltd.), CakeZone (Cloudnine Technologies Pvt. Ltd.), Sweet Chariot, 5th Avenue Bakers, The Cake Shop, Smoor Chocolates and Cakes, Bakers Lounge, and French Loaf (Spencer’s Retail Ltd.) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the India cake market appears promising, driven by evolving consumer preferences and technological advancements. The increasing inclination towards health-conscious options and the rise of e-commerce platforms are expected to shape market dynamics. Additionally, the trend of customization will likely continue to grow, as consumers seek unique and personalized cake experiences. As urbanization progresses, the market is poised for expansion, particularly in tier 2 and tier 3 cities, where disposable incomes are rising.

| Segment | Sub-Segments |

|---|---|

| By Type | Sponge Cakes Pound Cakes Cheesecakes Brownies Cupcakes Eggless Cakes Specialty Cakes Others |

| By End-User | Individual Consumers Corporate Events Weddings Birthday Celebrations Others |

| By Region | North India South India East India West India |

| By Sales Channel | Offline Retail Online Retail Supermarkets/Hypermarkets Specialty Bakeries Direct Sales Others |

| By Price Range | Premium Cakes Mid-Range Cakes Budget Cakes Others |

| By Occasion | Birthdays Weddings Festivals Anniversaries Graduations Others |

| By Flavor | Chocolate Vanilla Fruit Flavors Cheese Red Velvet Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cake Shops | 80 | Shop Owners, Managers |

| Online Cake Delivery Services | 60 | eCommerce Managers, Marketing Heads |

| Event Planners and Caterers | 40 | Event Coordinators, Catering Managers |

| Consumer Preferences Survey | 120 | General Consumers, Cake Enthusiasts |

| Bakery Ingredient Suppliers | 50 | Sales Representatives, Product Managers |

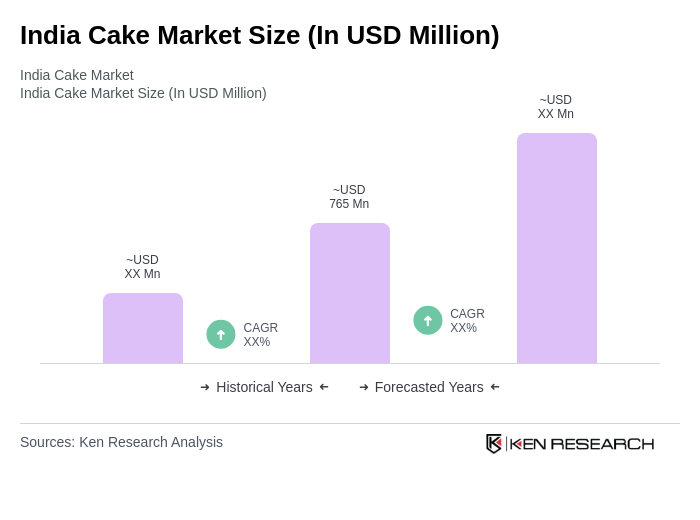

The India Cake Market is valued at approximately USD 765 million, reflecting significant growth driven by rising disposable incomes, urbanization, and a trend towards celebrating occasions with cakes.