Region:Asia

Author(s):Geetanshi

Product Code:KRAB5764

Pages:83

Published On:October 2025

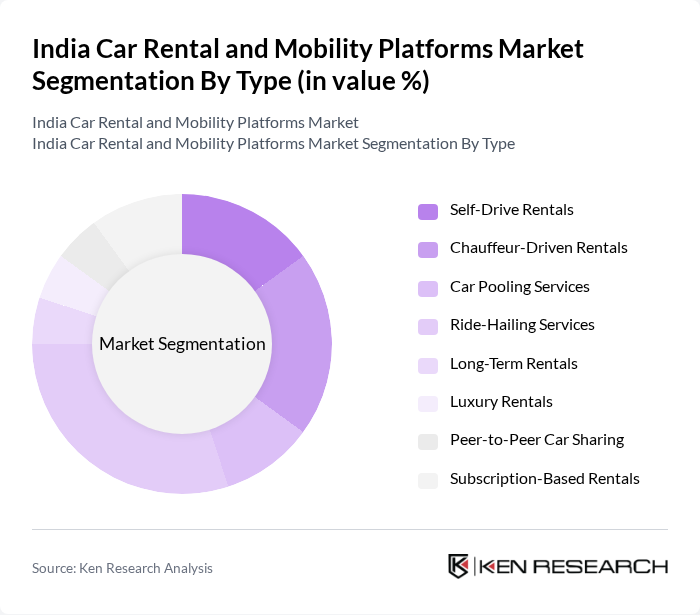

By Type:The market is segmented into various types of rental services, including self-drive rentals, chauffeur-driven rentals, car pooling services, ride-hailing services, long-term rentals, luxury rentals, peer-to-peer car sharing, and subscription-based rentals. Among these, ride-hailing services have gained significant traction due to their convenience, digital accessibility, and widespread adoption in urban areas.

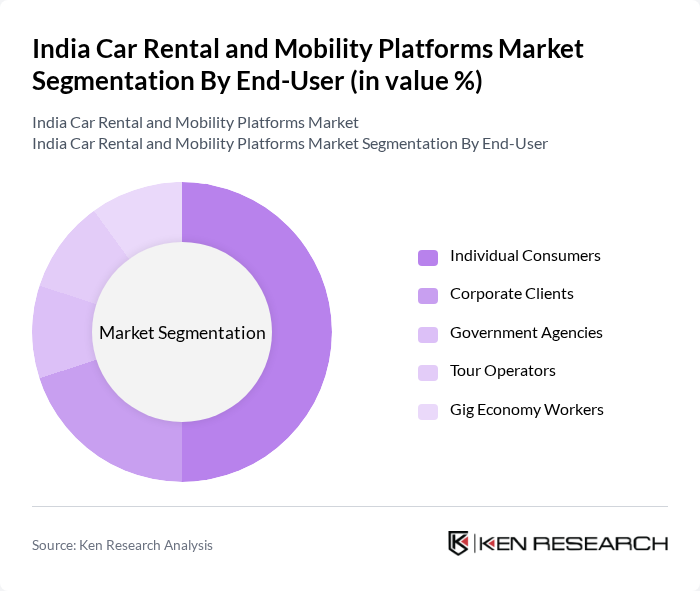

By End-User:The end-user segmentation includes individual consumers, corporate clients, government agencies, tour operators, and gig economy workers. Individual consumers represent the largest segment, driven by the increasing preference for flexible, on-demand transportation options and the rise of the sharing economy.

The India Car Rental and Mobility Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoomcar, Revv, Ola Cabs, Uber India, Carzonrent India Pvt. Ltd., Savaari Car Rentals, Myles Cars, Drivezy, Avis India, Hertz India, Eco Rent A Car, Meru Cabs, Quick Ride, BlaBlaCar India, and IndusGo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the car rental and mobility platforms market in India appears promising, driven by technological advancements and changing consumer preferences. The integration of electric vehicles and smart technologies is expected to reshape the industry landscape. Additionally, as urbanization continues, the demand for flexible mobility solutions will likely increase, encouraging companies to innovate and adapt. The focus on sustainability and eco-friendly practices will also play a crucial role in shaping market dynamics in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Self-Drive Rentals Chauffeur-Driven Rentals Car Pooling Services Ride-Hailing Services Long-Term Rentals Luxury Rentals Peer-to-Peer Car Sharing Subscription-Based Rentals |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators Gig Economy Workers |

| By Region | North India South India East India West India Top States (Maharashtra, Tamil Nadu, Karnataka, Gujarat, Uttar Pradesh, West Bengal, Rajasthan, Telangana, Andhra Pradesh, Madhya Pradesh) |

| By Vehicle Type | Economy Cars SUVs Luxury Cars Vans and Minivans Electric Vehicles (EVs) |

| By Duration of Rental | Hourly Rentals Daily Rentals Weekly Rentals Monthly Rentals Long-Term/Subscription Rentals |

| By Booking Channel | Online Platforms Mobile Applications Offline Agencies Airport/Off-Airport Counters |

| By Payment Model | Pay-Per-Use Subscription-Based Pre-Paid Post-Paid Dynamic Pricing/Surge Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Car Rental Services | 100 | Fleet Managers, Operations Directors |

| Tourism-Driven Mobility Solutions | 80 | Travel Agency Owners, Tour Operators |

| Corporate Car Leasing | 60 | Corporate Travel Managers, Procurement Officers |

| Ride-Sharing Platforms | 90 | Product Managers, Marketing Directors |

| Electric Vehicle Rental Services | 40 | Sustainability Officers, Fleet Operators |

The India Car Rental and Mobility Platforms Market is valued at approximately USD 2.75 billion, driven by factors such as urbanization, rising disposable incomes, and the growth of the tourism sector, which has increased demand for flexible transportation options.