India Classifieds and Used Goods Market Overview

- The India Classifieds and Used Goods Market is valued at USD 18 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet and smartphones, a rising focus on sustainability, and cost-effectiveness among consumers. The proliferation of e-commerce platforms and social media has significantly facilitated the buying and selling of used goods, further accelerating market expansion. Urban consumers, especially millennials and Gen Z, are increasingly adopting circular consumption models, and online peer-to-peer platforms are streamlining trust, logistics, and payment processes, making secondhand transactions more mainstream .

- Key cities dominating this market include Mumbai, Delhi, Bangalore, and Chennai. These urban centers have a high population density, a tech-savvy demographic, and robust digital infrastructure supporting online transactions. The concentration of small businesses and individual sellers in these cities further enhances the market's vibrancy, making them pivotal hubs for classifieds and used goods .

- The Digital India initiative, implemented by the Ministry of Electronics and Information Technology under the Government of India, aims to promote digital literacy and strengthen online marketplaces. The program includes measures to support small businesses and individual sellers in leveraging digital platforms for their transactions, thereby boosting the classifieds and used goods market. The initiative encompasses the Digital India Programme (Ministry of Electronics and IT, 2015), which mandates the development of digital infrastructure, delivery of government services digitally, and universal digital literacy .

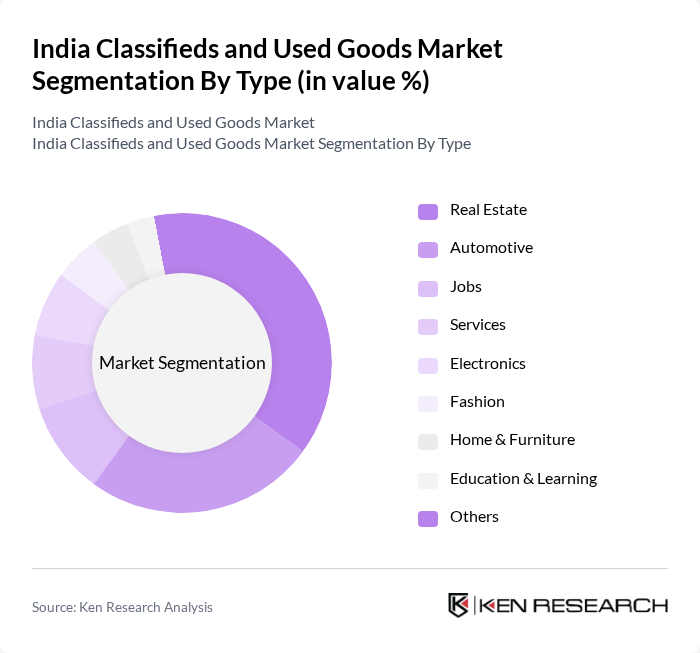

India Classifieds and Used Goods Market Segmentation

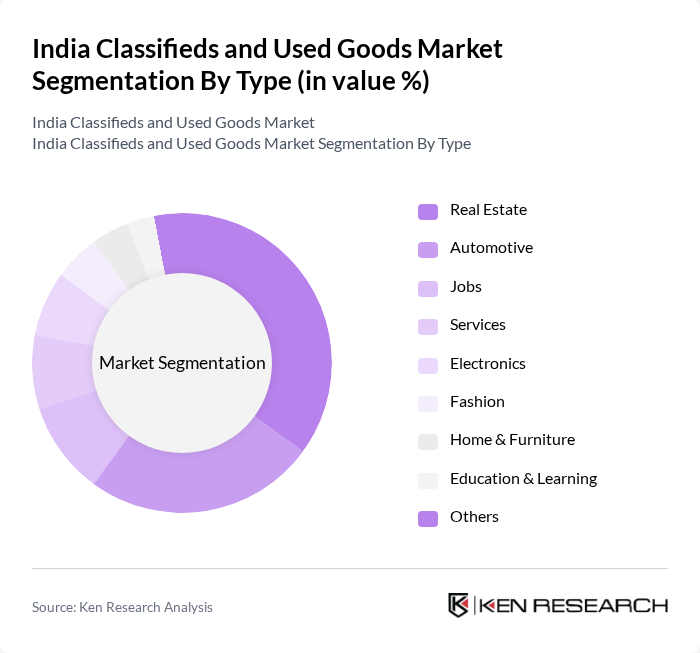

By Type:The market is segmented into various types, including Real Estate, Automotive, Jobs, Services, Electronics, Fashion, Home & Furniture, Education & Learning, and Others. Among these, the Real Estate segment is currently the most dominant, supported by the ongoing demand for residential and commercial properties in urban areas and the increased listing activity driven by remote work trends. The Automotive segment follows closely, with rising consumer interest in second-hand vehicles due to affordability, improved online verification processes, and the growing acceptance of pre-owned cars and two-wheelers. Electronics and fashion are also fast-growing categories, as consumers seek value and sustainability in their purchases .

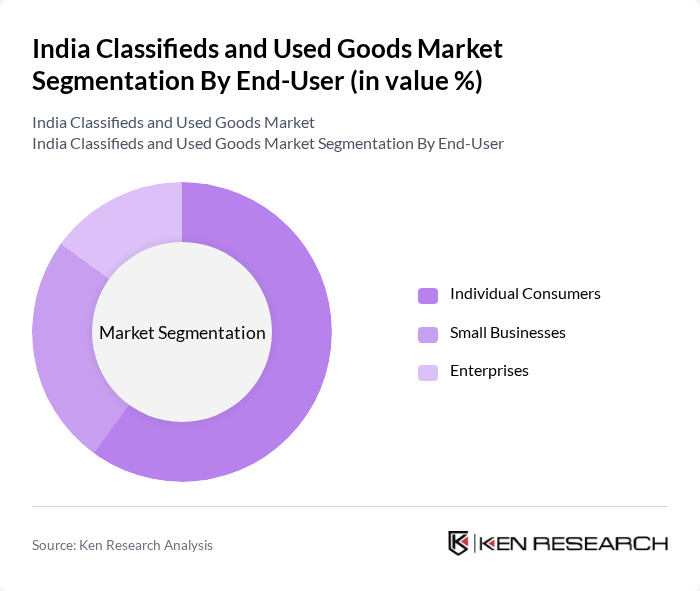

By End-User:The market is segmented by end-users into Individual Consumers, Small Businesses, and Enterprises. Individual Consumers dominate the market, reflecting the surge in online shopping and the demand for affordable, sustainable options. The rise of peer-to-peer selling platforms has enabled individuals to participate actively in the used goods economy. Small Businesses also play a significant role, leveraging classifieds to expand reach and reduce marketing costs, while Enterprises are increasingly utilizing these platforms for asset liquidation and procurement of refurbished equipment .

India Classifieds and Used Goods Market Competitive Landscape

The India Classifieds and Used Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX India, Quikr, Facebook Marketplace, Sulekha, Amazon India, eBay India, CarDekho, MagicBricks, 99acres, NoBroker, Housing.com, Justdial, CredR, Cashify, Locanto India contribute to innovation, geographic expansion, and service delivery in this space.

India Classifieds and Used Goods Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, India boasts over 850 million internet users, a significant increase from 600 million in the past. This surge in connectivity has facilitated access to online classifieds and used goods platforms, enabling consumers to engage in buying and selling activities. The rapid growth of mobile internet, with 4G and 5G technologies expanding, is expected to further enhance user engagement, driving market growth. Enhanced digital literacy among users also contributes to this trend, fostering a more active online marketplace.

- Rise of E-commerce Platforms:The Indian e-commerce sector is projected to reach $112 billion in future, up from $84 billion in the past. This growth is largely driven by the increasing popularity of online shopping, which has led to a rise in classifieds and used goods platforms. Major players like OLX and Quikr are capitalizing on this trend, offering user-friendly interfaces and extensive product listings. The integration of payment gateways and logistics solutions further enhances the shopping experience, making it easier for consumers to buy and sell second-hand goods.

- Growing Urbanization:By future, urbanization in India is expected to reach 36%, with over 500 million people living in urban areas. This demographic shift is driving demand for affordable goods, leading to increased interest in second-hand products. Urban consumers are more likely to utilize online platforms for purchasing used items, as they seek cost-effective solutions. The rise of urban middle-class households, which are projected to reach over 300 million in future, further fuels this trend, creating a robust market for classifieds and used goods.

Market Challenges

- Trust and Safety Concerns:Trust issues remain a significant barrier in the classifieds market, with 60% of users expressing concerns about fraud and scams. The lack of verification processes for sellers and buyers can deter potential users from engaging in transactions. As the market grows, addressing these safety concerns through enhanced verification methods and secure payment options will be crucial for building consumer confidence and encouraging participation in the online classifieds ecosystem.

- Regulatory Compliance Issues:The evolving regulatory landscape poses challenges for classifieds platforms, particularly regarding data privacy and consumer protection. The implementation of the Consumer Protection Act in the past has introduced stringent guidelines that platforms must adhere to, increasing operational complexities. Non-compliance can lead to hefty fines, impacting profitability. As regulations continue to evolve, platforms must invest in compliance measures to mitigate risks and ensure sustainable operations in the market.

India Classifieds and Used Goods Market Future Outlook

The future of the India classifieds and used goods market appears promising, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence and machine learning is expected to enhance user experiences, making transactions more efficient and personalized. Additionally, the increasing focus on sustainability will likely encourage more consumers to opt for second-hand goods, further expanding the market. As platforms innovate and adapt to these trends, they will be well-positioned to capture a larger share of the growing online marketplace.

Market Opportunities

- Expansion of Mobile Platforms:With over 750 million smartphone users in India by future, mobile platforms present a significant opportunity for classifieds. Enhanced mobile applications can facilitate seamless transactions, attracting more users. This shift towards mobile commerce is expected to drive engagement and increase sales, as consumers prefer the convenience of shopping on their devices.

- Increasing Demand for Second-Hand Goods:The second-hand goods market is projected to grow significantly, with an estimated value of $20 billion by future. This demand is driven by cost-conscious consumers and a growing awareness of sustainability. Platforms that effectively market the benefits of purchasing used items can capitalize on this trend, attracting environmentally conscious buyers and expanding their customer base.