Region:Asia

Author(s):Geetanshi

Product Code:KRAA4546

Pages:100

Published On:September 2025

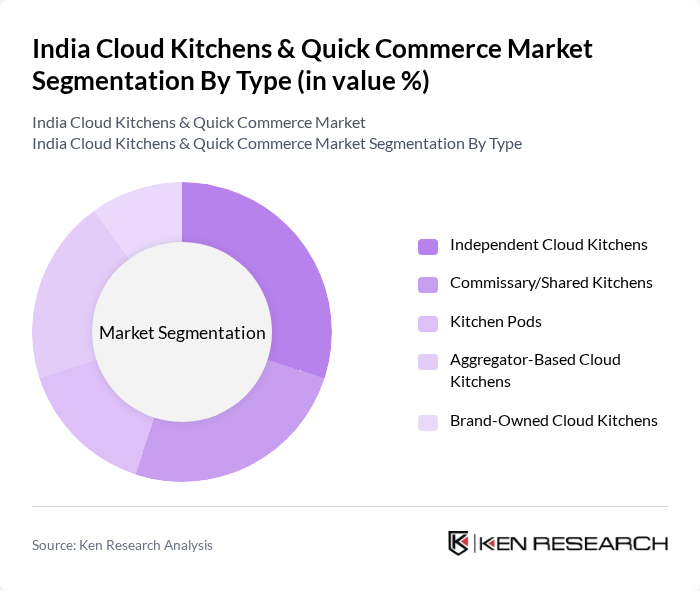

By Type:The market is segmented into Independent Cloud Kitchens, Commissary/Shared Kitchens, Kitchen Pods, Aggregator-Based Cloud Kitchens, and Brand-Owned Cloud Kitchens. Each type serves different operational needs and consumer preferences. Independent Cloud Kitchens are gaining traction due to their flexible operational model, lower setup costs, and ability to quickly adapt to changing customer demands without dine-in overheads .

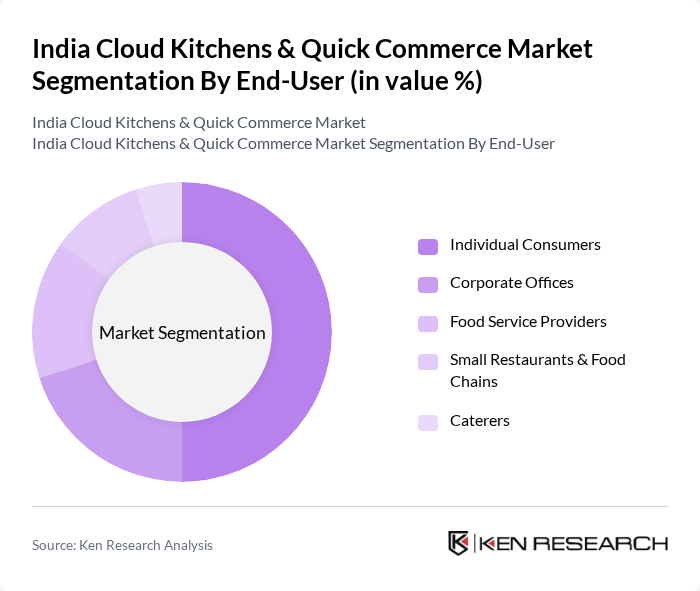

By End-User:The end-user segmentation includes Individual Consumers, Corporate Offices, Food Service Providers, Small Restaurants & Food Chains, and Caterers. Individual Consumers dominate the market due to the increasing trend of online food ordering, driven by convenience and a wide variety of options available through digital platforms .

The India Cloud Kitchens & Quick Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zomato, Swiggy, Blinkit, Instamart (Swiggy Instamart), Zepto, Dunzo, Rebel Foods, Faasos, Box8, EatFit, Wow! Momo, FreshMenu, Biryani By Kilo, EatSure, The Good Bowl contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India cloud kitchens and quick commerce market appears promising, driven by technological advancements and evolving consumer preferences. As urbanization continues, cloud kitchens are likely to expand their reach into Tier 2 and Tier 3 cities, tapping into new customer bases. Additionally, the integration of AI and data analytics will enhance operational efficiency, enabling businesses to better understand consumer behavior and optimize their offerings, thus fostering sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Independent Cloud Kitchens Commissary/Shared Kitchens Kitchen Pods Aggregator-Based Cloud Kitchens Brand-Owned Cloud Kitchens |

| By End-User | Individual Consumers Corporate Offices Food Service Providers Small Restaurants & Food Chains Caterers |

| By Region | North India West and Central India South India East India |

| By Application | Online Food Delivery Quick Commerce (Grocery & Essentials) Meal Kits Catering Services |

| By Sales Channel | Direct-to-Consumer (D2C) Third-Party Delivery Platforms Restaurant Aggregators Quick Commerce Apps |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value Pricing |

| By Customer Segment | Millennials Families Health-Conscious Consumers Working Professionals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 90 | Founders, Operations Managers |

| Quick Commerce Delivery Services | 70 | Logistics Managers, Delivery Supervisors |

| Consumer Preferences in Food Delivery | 140 | Regular Users, Occasional Users |

| Market Trends in Urban Areas | 110 | Urban Consumers, Food Enthusiasts |

| Investment Insights in Cloud Kitchens | 50 | Investors, Financial Analysts |

The India Cloud Kitchens & Quick Commerce Market is valued at approximately USD 1.1 billion, driven by the increasing demand for food delivery services and the rapid adoption of digital ordering platforms.