Region:Asia

Author(s):Rebecca

Product Code:KRAB2960

Pages:92

Published On:October 2025

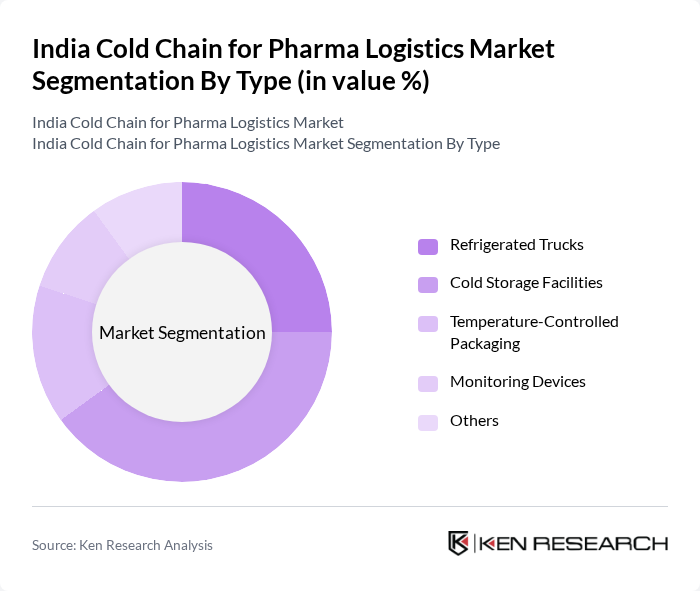

By Type:The market is segmented into various types, including Refrigerated Trucks, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Devices, and Others. Among these, Cold Storage Facilities are currently dominating the market due to the increasing need for large-scale storage solutions for temperature-sensitive pharmaceuticals. The rise in biologics and vaccines, especially during health crises, has led to a surge in demand for these facilities, which ensure the integrity and efficacy of products throughout their shelf life.

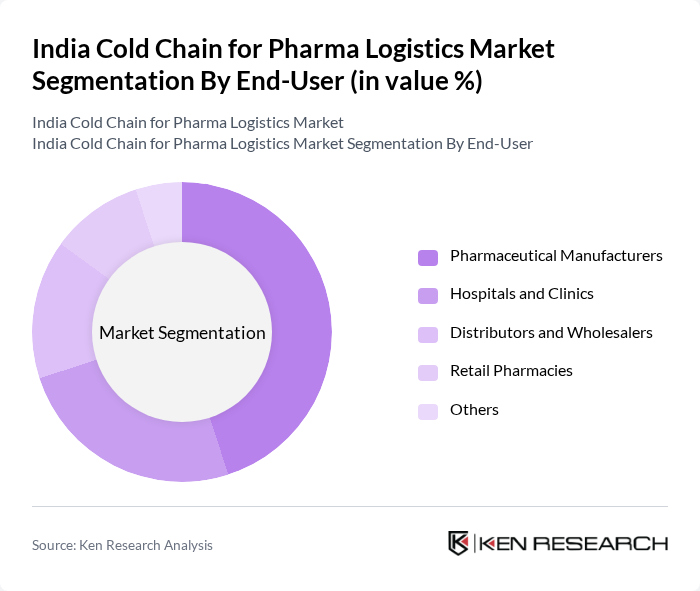

By End-User:The end-user segmentation includes Pharmaceutical Manufacturers, Hospitals and Clinics, Distributors and Wholesalers, Retail Pharmacies, and Others. Pharmaceutical Manufacturers are the leading end-users in the market, driven by the need for efficient distribution of temperature-sensitive products. The increasing production of vaccines and biologics has necessitated robust cold chain logistics solutions, making manufacturers a critical segment in ensuring product safety and compliance with regulatory standards.

The India Cold Chain for Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blue Dart Express Limited, DHL Supply Chain India, Gati Limited, ColdEX Logistics, Snowman Logistics Limited, Mahindra Logistics, TCI Cold Chain Solutions, Xpressbees Logistics, Allcargo Logistics Limited, Future Supply Chain Solutions, Aegis Logistics Limited, Sical Logistics Limited, Shree Maruti Courier Services, Om Logistics, Delhivery Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain logistics market in India appears promising, driven by technological advancements and increasing investments in infrastructure. The adoption of IoT and automation is expected to enhance operational efficiency, enabling real-time monitoring and reducing spoilage rates. Additionally, as the government continues to support healthcare initiatives, the cold chain sector will likely see significant growth, ensuring that temperature-sensitive pharmaceuticals reach patients effectively and safely across diverse regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Trucks Cold Storage Facilities Temperature-Controlled Packaging Monitoring Devices Others |

| By End-User | Pharmaceutical Manufacturers Hospitals and Clinics Distributors and Wholesalers Retail Pharmacies Others |

| By Region | North India South India East India West India |

| By Application | Vaccines Biologics Blood Products Other Pharmaceuticals |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Cold Chain Operators Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 150 | Supply Chain Managers, Quality Assurance Heads |

| Cold Chain Service Providers | 100 | Operations Directors, Logistics Coordinators |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Healthcare Institutions | 80 | Pharmacy Managers, Procurement Specialists |

| Technology Providers for Cold Chain | 70 | Product Managers, R&D Engineers |

The India Cold Chain for Pharma Logistics Market is valued at approximately USD 2.5 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals, including vaccines and biologics, and the expansion of the pharmaceutical industry in India.