Region:Asia

Author(s):Geetanshi

Product Code:KRAA3277

Pages:90

Published On:September 2025

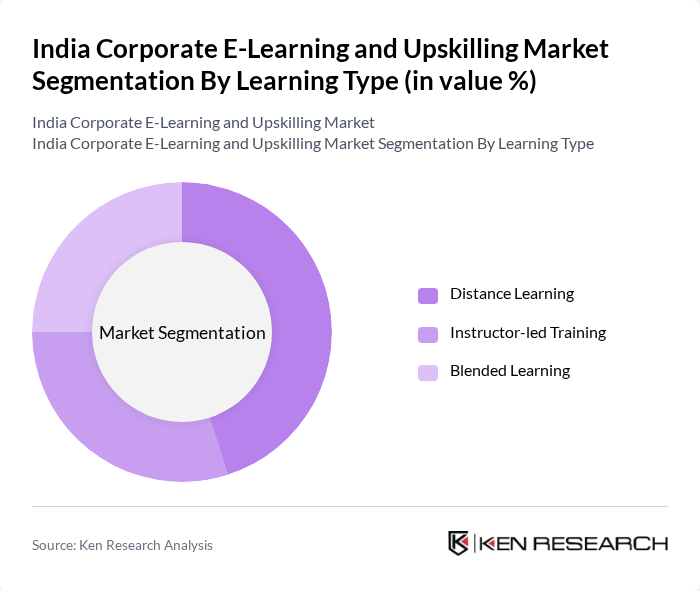

By Learning Type:The learning type segmentation includes Distance Learning, Instructor-led Training, and Blended Learning.Distance Learninghas gained significant traction due to its flexibility and accessibility, allowing employees to learn at their own pace.Instructor-led Trainingremains popular for its interactive nature and is the largest revenue-generating segment, whileBlended Learningcombines the best of both worlds, catering to diverse learning preferences.

By Organization Size:The organization size segmentation includes Large Enterprises and Small and Medium Enterprises (SMEs).Large Enterprisesdominate the market due to substantial training budgets and the need for comprehensive upskilling programs.SMEsare increasingly adopting e-learning solutions to remain competitive and enhance employee skills without incurring high costs.

The India Corporate E-Learning and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as BYJU'S, UpGrad, Coursera, edX, Simplilearn, TalentSprint, LinkedIn Learning, Skillsoft, Pluralsight, NIIT, Mindler, Great Learning, Eduonix, Harappa Education, Edureka contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India corporate e-learning market appears promising, driven by technological advancements and changing workforce dynamics. As organizations increasingly adopt blended learning approaches, the integration of AI and machine learning will enhance personalized learning experiences. Furthermore, the growing emphasis on continuous learning will likely lead to the development of innovative training solutions, ensuring that employees remain competitive in a rapidly evolving job market. The market is poised for significant transformation as companies embrace digital learning strategies.

| Segment | Sub-Segments |

|---|---|

| By Learning Type | Distance Learning Instructor-led Training Blended Learning |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Industry Vertical | IT and Software Manufacturing Healthcare BFSI (Banking, Financial Services, and Insurance) Retail Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning |

| By Duration | Short Courses (Less than 1 Month) Medium Courses (1-3 Months) Long Courses (More than 3 Months) |

| By Certification Type | Professional Certifications Academic Certifications Skill Development Certifications |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Sector E-Learning Adoption | 120 | HR Managers, Training Coordinators |

| Manufacturing Upskilling Programs | 90 | Operations Managers, Skill Development Officers |

| Healthcare Training Initiatives | 60 | Clinical Educators, HR Directors |

| Retail Sector Learning Platforms | 50 | Store Managers, L&D Specialists |

| Corporate Training Effectiveness | 70 | Employee Engagement Managers, Training Analysts |

The India Corporate E-Learning and Upskilling Market is valued at approximately USD 9.4 billion, driven by the increasing demand for skill enhancement and the adoption of digital learning solutions across various industries.