Region:Asia

Author(s):Geetanshi

Product Code:KRAB0100

Pages:98

Published On:August 2025

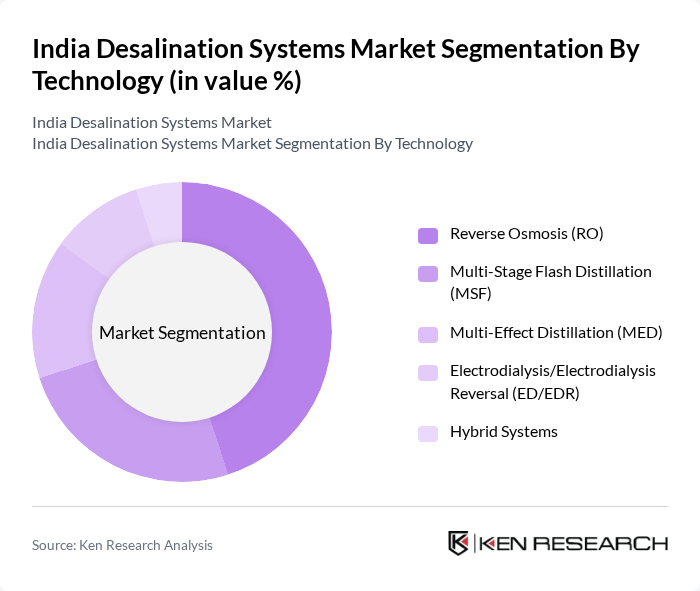

By Technology:The technology segment of the desalination systems market includes various methods such asReverse Osmosis (RO), Multi-Stage Flash Distillation (MSF), Multi-Effect Distillation (MED), Electrodialysis/Electrodialysis Reversal (ED/EDR), and Hybrid Systems. Among these,Reverse Osmosis (RO)is the most widely adopted technology due to its high energy efficiency, lower operational cost, and scalability. The increasing demand for freshwater in urban areas and industries has led to a significant rise in the installation of RO systems, making it the dominant technology in the market. Recent trends also highlight the growing adoption of hybrid and renewable energy-powered desalination systems to improve sustainability .

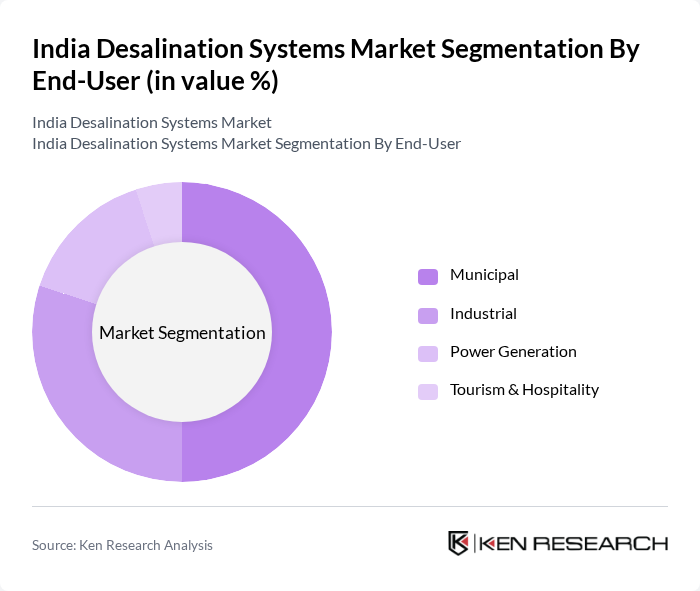

By End-User:The end-user segment encompassesMunicipal, Industrial, Power Generation, and Tourism & Hospitalitysectors. TheMunicipalsegment is the largest consumer of desalination systems, driven by the urgent need for potable water in urban areas. As cities expand and face water shortages, municipal authorities are increasingly investing in desalination plants to ensure a sustainable water supply for their populations. The industrial segment is also witnessing robust growth, particularly in coastal industrial corridors where process water demand is high. The adoption of desalination in power generation and tourism is rising, but these remain smaller segments compared to municipal and industrial users .

The India Desalination Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as VA Tech Wabag Limited, Tata Projects Limited, L&T Construction (Larsen & Toubro), SUEZ Water Technologies & Solutions, IDE Technologies, Aquatech International LLC, Ion Exchange (India) Ltd., Thermax Limited, Veolia Water Technologies, Xylem Inc., Acciona Agua, Pentair plc, Aqualia, GE Water & Process Technologies (now SUEZ WTS), and Doosan Heavy Industries & Construction contribute to innovation, geographic expansion, and service delivery in this space. These companies are actively involved in large-scale municipal and industrial desalination projects, leveraging advanced technologies and public-private partnerships to expand their footprint in India .

The future of the India desalination systems market appears promising, driven by increasing water scarcity and supportive government policies. As urbanization accelerates, the demand for reliable water sources will intensify, prompting further investments in desalination technologies. Additionally, the integration of renewable energy sources and smart water management systems will enhance operational efficiency. The focus on sustainability will likely lead to innovative solutions that address environmental concerns while meeting the growing water needs of the population and industries.

| Segment | Sub-Segments |

|---|---|

| By Technology | Reverse Osmosis (RO) Multi-Stage Flash Distillation (MSF) Multi-Effect Distillation (MED) Electrodialysis/Electrodialysis Reversal (ED/EDR) Hybrid Systems |

| By End-User | Municipal Industrial Power Generation Tourism & Hospitality |

| By Region | Gujarat Maharashtra Tamil Nadu Andhra Pradesh Other States |

| By Capacity | Small-scale Plants (<10 MLD) Medium-scale Plants (10–50 MLD) Large-scale Plants (>50 MLD) |

| By Application | Drinking Water Supply Industrial Processes Agricultural Irrigation Desalination for Power Generation |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnership (PPP) Government Schemes |

| By Energy Source | Conventional (Grid/Electricity) Solar-Powered Desalination Wind-Powered Desalination Hybrid Energy Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Authorities | 100 | Water Resource Managers, Policy Makers |

| Desalination Technology Providers | 60 | Product Development Engineers, Sales Directors |

| Private Sector Water Management Firms | 50 | Operations Managers, Business Development Executives |

| Environmental NGOs | 40 | Sustainability Advocates, Research Analysts |

| Academic Researchers in Water Technology | 45 | Professors, Research Fellows |

The India Desalination Systems Market is valued at approximately USD 955 million, driven by increasing water scarcity, rapid urbanization, and the need for sustainable water management solutions, particularly in coastal regions with limited freshwater resources.