Region:Asia

Author(s):Geetanshi

Product Code:KRAA5045

Pages:92

Published On:September 2025

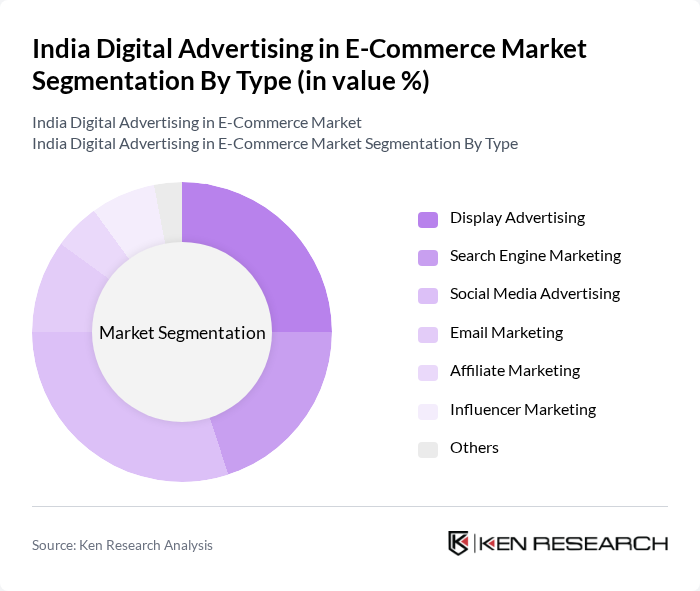

By Type:The digital advertising market in e-commerce is segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Email Marketing, Affiliate Marketing, Influencer Marketing, and Others. Each of these segments plays a crucial role in shaping the advertising strategies of e-commerce businesses. Display Advertising is particularly popular due to its visual appeal, while Search Engine Marketing is favored for its effectiveness in driving traffic. Social Media Advertising has gained traction due to the increasing time consumers spend on social platforms.

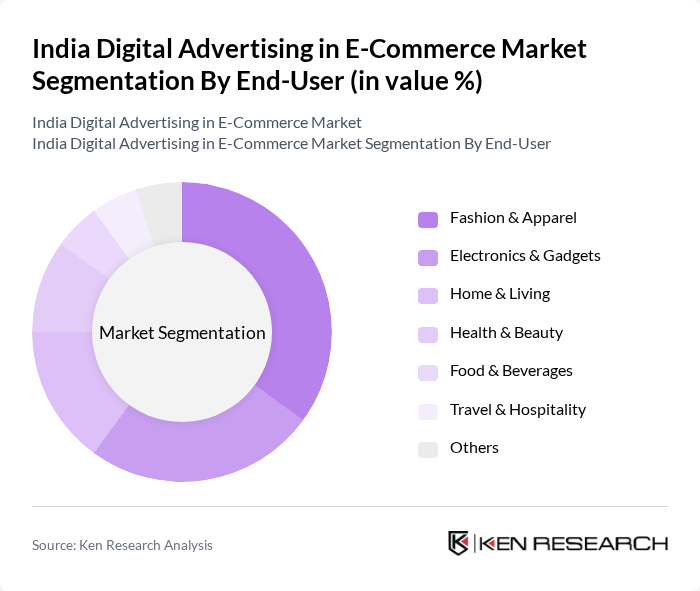

By End-User:The end-user segmentation of the digital advertising market in e-commerce includes Fashion & Apparel, Electronics & Gadgets, Home & Living, Health & Beauty, Food & Beverages, Travel & Hospitality, and Others. The Fashion & Apparel segment is particularly dominant, driven by the increasing trend of online shopping among consumers. Electronics & Gadgets also hold a significant share, as tech-savvy consumers frequently seek the latest products online.

The India Digital Advertising in E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google India Pvt. Ltd., Facebook India Pvt. Ltd., Amazon Advertising India, Flipkart Internet Pvt. Ltd., Zomato Media Pvt. Ltd., Paytm Ads, Snapdeal Pvt. Ltd., Nykaa E-Retail Pvt. Ltd., Tata CLiQ, MakeMyTrip Ltd., OYO Rooms, Swiggy, BookMyShow, Lenskart Solutions Pvt. Ltd., BigBasket contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital advertising in India's e-commerce market appears promising, driven by technological advancements and evolving consumer behaviors. As internet penetration continues to rise, brands will increasingly leverage data analytics and AI to create personalized advertising experiences. Additionally, the integration of augmented reality in ads is expected to enhance consumer engagement, while sustainability trends will shape advertising strategies, aligning with the growing consumer preference for eco-friendly brands and practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Email Marketing Affiliate Marketing Influencer Marketing Others |

| By End-User | Fashion & Apparel Electronics & Gadgets Home & Living Health & Beauty Food & Beverages Travel & Hospitality Others |

| By Sales Channel | Direct Sales Online Marketplaces Social Media Platforms Mobile Applications Others |

| By Consumer Demographics | Age Group Gender Income Level Urban vs Rural Others |

| By Advertising Format | Video Ads Banner Ads Native Ads Sponsored Content Others |

| By Device Type | Mobile Devices Desktop Computers Tablets Smart TVs Others |

| By Geographic Distribution | North India South India East India West India Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Strategies in E-commerce | 150 | Marketing Directors, Digital Strategy Managers |

| Consumer Engagement with Digital Ads | 100 | Online Shoppers, Digital Consumers |

| Advertising Agency Insights | 80 | Account Managers, Creative Directors |

| Performance Metrics of Digital Campaigns | 70 | Data Analysts, Marketing Analysts |

| Trends in E-commerce Advertising Spend | 90 | Finance Managers, Budget Analysts |

The India Digital Advertising in E-Commerce Market is valued at approximately USD 5 billion, reflecting significant growth driven by increased internet penetration, smartphone usage, and a shift towards online shopping platforms.