Region:Asia

Author(s):Rebecca

Product Code:KRAA4570

Pages:98

Published On:September 2025

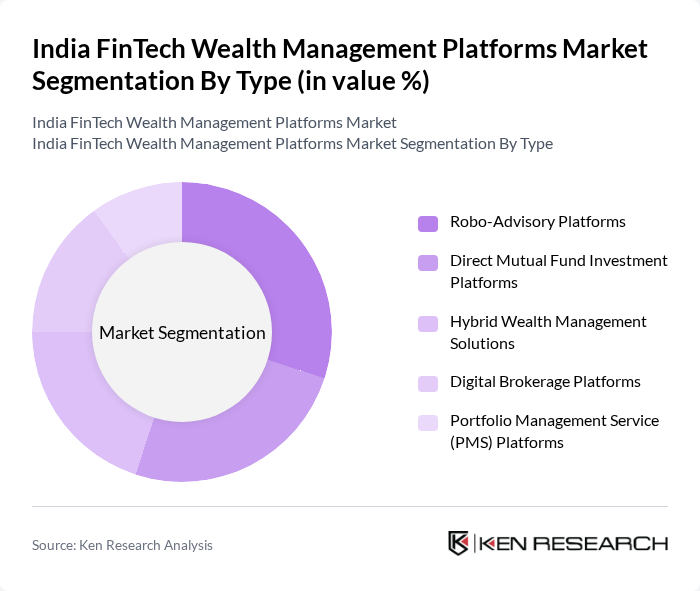

By Type:The market is segmented into various types of wealth management platforms, each catering to different investor needs and preferences. The subsegments include Robo-Advisory Platforms, Direct Mutual Fund Investment Platforms, Hybrid Wealth Management Solutions, Digital Brokerage Platforms, and Portfolio Management Service (PMS) Platforms. Among these, Robo-Advisory Platforms are gaining significant traction due to their cost-effectiveness and ease of use, appealing particularly to tech-savvy millennials and first-time investors .

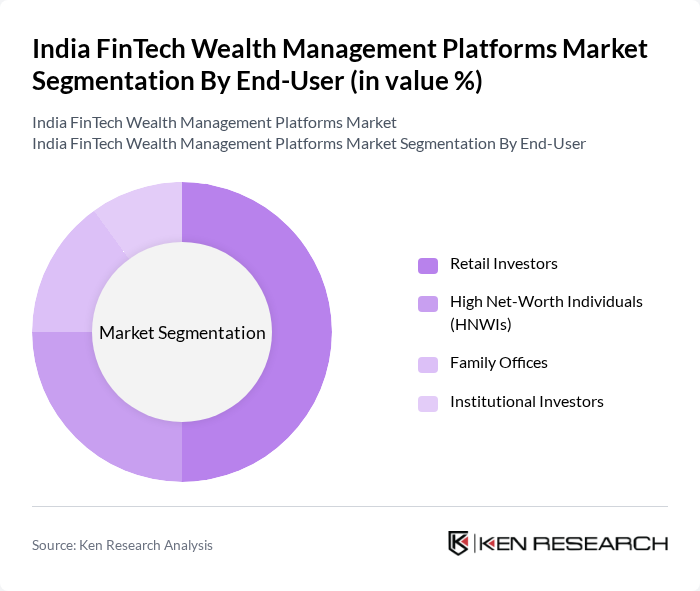

By End-User:The end-user segmentation includes Retail Investors, High Net-Worth Individuals (HNWIs), Family Offices, and Institutional Investors. Retail Investors are the largest segment, driven by the increasing number of individuals seeking to manage their investments independently through digital platforms. The rise of financial literacy and the availability of user-friendly investment tools have made wealth management more accessible to this demographic .

The India FinTech Wealth Management Platforms market is characterized by a dynamic mix of regional and international players. Leading participants such as Zerodha, Groww, Paytm Money, Upstox, ET Money, Kuvera, Scripbox, ClearTax, Fisdom, Angel One, HDFC Securities, ICICI Direct, Axis Direct, Kotak Securities, Motilal Oswal, 360 ONE WAM (formerly IIFL Wealth), NJ Wealth, WealthDesk, Smallcase, FundsIndia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India FinTech wealth management market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more individuals are expected to engage with wealth management platforms. Additionally, the integration of AI and machine learning will enhance service personalization, making investment strategies more effective. The focus on sustainable investments is also likely to grow, aligning with global trends towards responsible investing, which will further shape the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisory Platforms Direct Mutual Fund Investment Platforms Hybrid Wealth Management Solutions Digital Brokerage Platforms Portfolio Management Service (PMS) Platforms |

| By End-User | Retail Investors High Net-Worth Individuals (HNWIs) Family Offices Institutional Investors |

| By Region | North India South India East India West India |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Strategic Asset Allocation |

| By Service Model | Subscription-Based Services Commission-Based Services Fee-Only Advisory Services |

| By Client Demographics | Millennials Gen X Baby Boomers |

| By Policy Support | Tax Incentives for Investments Regulatory Support for FinTech Startups Financial Literacy Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investors Using FinTech Platforms | 100 | Individual Investors, Financial Advisors |

| High Net-Worth Individuals (HNWIs) | 60 | Wealth Managers, Private Bankers |

| Millennial Investors | 50 | Young Professionals, Tech-Savvy Investors |

| Institutional Investors | 40 | Portfolio Managers, Institutional Fund Managers |

| FinTech Platform Developers | 40 | Product Managers, Software Engineers |

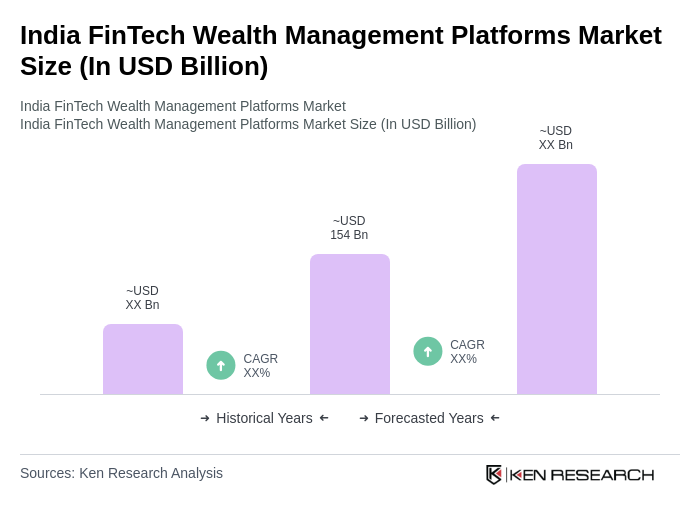

The India FinTech Wealth Management Platforms market is valued at approximately USD 154 billion, driven by the increasing adoption of digital financial services and rising disposable incomes among the Indian population.