Region:Asia

Author(s):Shubham

Product Code:KRAD0632

Pages:86

Published On:August 2025

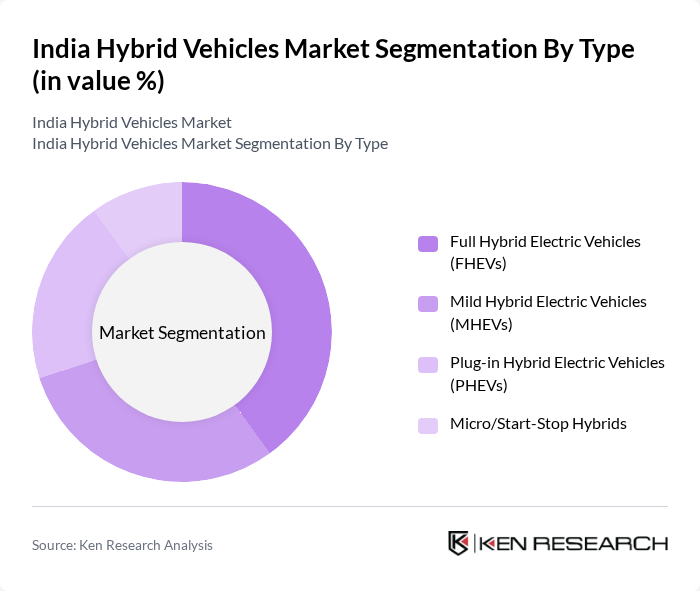

By Type:The hybrid vehicles market can be segmented into various types, including Full Hybrid Electric Vehicles (FHEVs), Mild Hybrid Electric Vehicles (MHEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Micro/Start-Stop Hybrids. Each of these sub-segments caters to different consumer needs and preferences, with varying levels of hybridization and electric assistance.

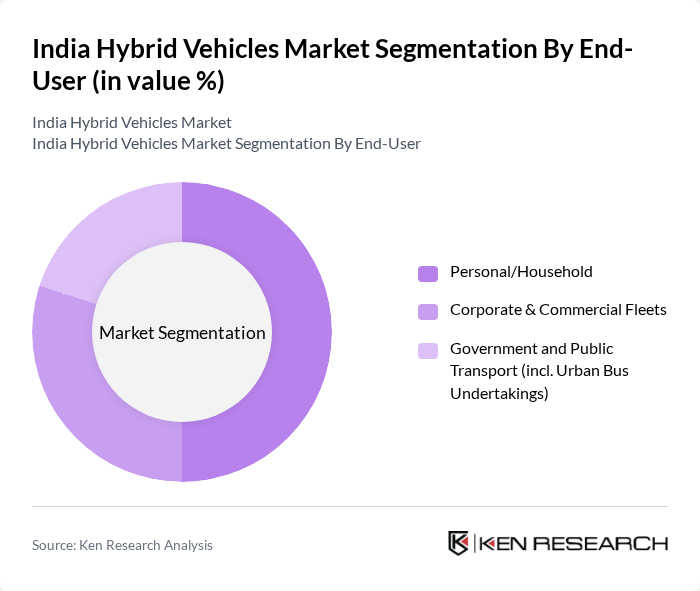

By End-User:The end-user segmentation includes Personal/Household, Corporate & Commercial Fleets, and Government and Public Transport (including Urban Bus Undertakings). Each segment reflects different usage patterns and purchasing motivations, with personal users often prioritizing fuel efficiency and environmental impact, while corporate fleets focus on cost savings and sustainability.

The India Hybrid Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Kirloskar Motor Pvt. Ltd., Maruti Suzuki India Ltd., Honda Cars India Ltd., Hyundai Motor India Ltd., Kia India Pvt. Ltd., Tata Motors Ltd., Mahindra & Mahindra Ltd., MG Motor India Pvt. Ltd., BYD India Pvt. Ltd., Nissan Motor India Pvt. Ltd., Volkswagen India Pvt. Ltd., Skoda Auto Volkswagen India Pvt. Ltd., BMW India Pvt. Ltd., Mercedes-Benz India Pvt. Ltd., Audi India Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hybrid vehicle market in India appears promising, driven by increasing environmental awareness and supportive government policies. As urbanization accelerates, the demand for sustainable transportation solutions will likely rise. Additionally, advancements in battery technology and the expansion of charging infrastructure are expected to enhance the viability of hybrid vehicles. With ongoing collaborations between automakers and technology firms, the market is poised for significant growth, aligning with global sustainability goals and consumer preferences for greener options.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Hybrid Electric Vehicles (FHEVs) Mild Hybrid Electric Vehicles (MHEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Micro/Start-Stop Hybrids |

| By End-User | Personal/Household Corporate & Commercial Fleets Government and Public Transport (incl. Urban Bus Undertakings) |

| By Region | North India South India East India West India |

| By Vehicle Size | Hatchbacks & Compact Cars Sedans SUVs & MPVs Buses and Light Commercial Vehicles |

| By Fuel Type | Petrol Hybrid Diesel Hybrid CNG Hybrid |

| By Sales Channel | Franchised Dealerships Company-Owned Showrooms Online/Digital Retail |

| By Price Range | Entry (INR 8–15 lakh) Mid (INR 15–30 lakh) Premium (INR 30–60 lakh) Luxury (Above INR 60 lakh) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness of Hybrid Vehicles | 150 | Car Owners, Potential Buyers |

| Dealership Insights on Hybrid Sales | 100 | Sales Managers, Dealership Owners |

| Government Policy Impact Assessment | 80 | Policy Makers, Regulatory Officials |

| Expert Opinions on Hybrid Technology | 60 | Automotive Engineers, Industry Analysts |

| Market Trends and Consumer Preferences | 120 | Market Researchers, Automotive Consultants |

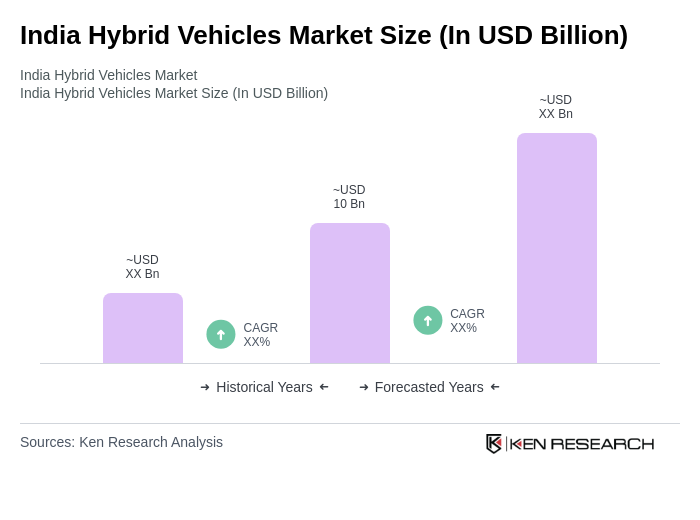

The India Hybrid Vehicles Market is valued at approximately USD 10 billion, reflecting strong adoption of hybrid models, particularly strong-hybrids, driven by rising fuel prices and stricter emissions norms.