Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KRAD0274

Pages:91

Published On:August 2025

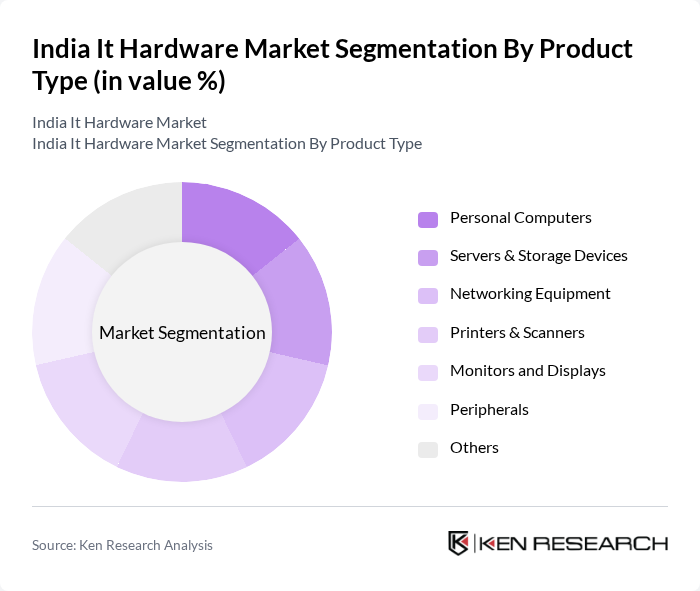

By Product Type:The product type segmentation includes various categories such as Personal Computers, Servers & Storage Devices, Networking Equipment, Printers & Scanners, Monitors and Displays, Peripherals, and Others. Among these, Personal Computers have emerged as the leading sub-segment due to the increasing adoption of laptops and desktops for both personal and professional use. The surge in remote work and online learning has significantly boosted the demand for PCs, making them a staple in households and businesses alike. Recent trends also indicate growing demand for AI-enabled PCs and product diversification, with companies introducing advanced models and targeting multiple market segments .

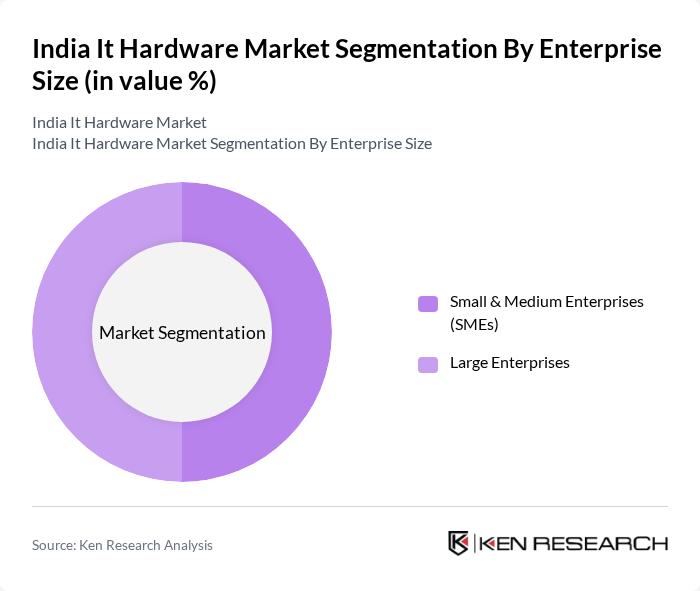

By Enterprise Size:The enterprise size segmentation is categorized into Small & Medium Enterprises (SMEs) and Large Enterprises. SMEs are currently dominating the market, driven by the increasing number of startups and small businesses in India. These enterprises are rapidly adopting IT hardware solutions to enhance productivity and streamline operations, making them a significant contributor to the overall market growth. The adoption of IT hardware among SMEs is further propelled by government digital initiatives and the need for scalable, secure infrastructure .

The India IT Hardware Market is characterized by a dynamic mix of regional and international players. Leading participants such as HP Inc., Dell Technologies, Lenovo Group Ltd., Acer Inc., AsusTek Computer Inc., Cisco Systems, Inc., HCL Infosystems Ltd., Wipro Limited, Tata Consultancy Services, Infosys Limited, Samsung Electronics, Microsoft Corporation, IBM Corporation, Oracle Corporation, Tech Mahindra, NetApp, Inc., Panasonic India Pvt. Ltd., Hitachi Systems Micro Clinic Pvt. Ltd., Arista Networks, Juniper Networks, Ciena India Pvt. Ltd., Flex India Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Indian IT hardware market appears promising, driven by ongoing digital transformation and increased investments in technology. As enterprises continue to adopt advanced technologies, including AI and machine learning, the demand for high-performance hardware will rise. Additionally, the expansion of 5G infrastructure is expected to enhance connectivity, further stimulating the market. Companies that adapt to these trends and invest in innovative solutions will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Personal Computers Servers & Storage Devices Networking Equipment Printers & Scanners Monitors and Displays Peripherals Others |

| By Enterprise Size | Small & Medium Enterprises (SMEs) Large Enterprises |

| By End-User Industry | BFSI (Banking, Financial Services & Insurance) Retail IT & Telecom Government Education Healthcare Other Industries |

| By Region | North India South India East India West & Central India |

| By Sales Channel | Direct Sales Online Retail Distributors Retail Stores Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retail | 100 | Store Managers, Sales Executives |

| Corporate IT Procurement | 80 | IT Managers, Procurement Officers |

| Small and Medium Enterprises (SMEs) | 60 | Business Owners, IT Consultants |

| Government IT Hardware Acquisition | 50 | Procurement Officers, IT Administrators |

| Educational Institutions' IT Needs | 40 | IT Coordinators, Administrative Heads |

The India IT Hardware Market is valued at approximately USD 20 billion, driven by the increasing demand for personal computers, servers, and networking equipment, particularly due to digital transformation across various sectors.