Region:Asia

Author(s):Geetanshi

Product Code:KRAA1243

Pages:86

Published On:August 2025

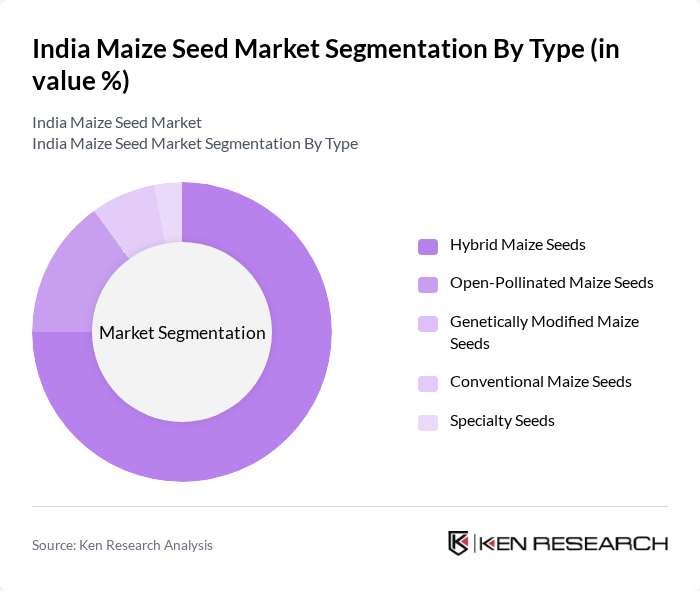

By Type:The maize seed market is segmented into Hybrid Maize Seeds, Open-Pollinated Maize Seeds, and Conventional Maize Seeds. Hybrid Maize Seeds dominate the market due to their higher yield potential, adaptability to diverse agro-climatic zones, and resistance to pests and diseases. Open-pollinated varieties are traditionally grown in specific regions and are preferred for their adaptability to local conditions, though they offer lower yields compared to hybrids. Genetically modified maize seeds are not commercially cultivated in India due to regulatory restrictions, while specialty seeds represent a niche segment focused on specific end-use traits .

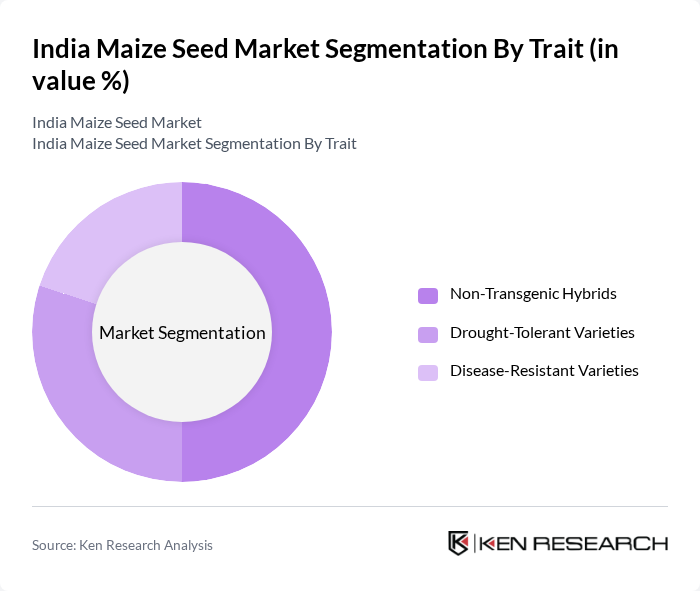

By Trait:The maize seed market is also segmented by trait, including Non-Transgenic Hybrids, Drought-Tolerant Varieties, and Disease-Resistant Varieties. Non-transgenic hybrids are the most widely adopted, driven by regulatory policies and consumer preference. Drought-tolerant and disease-resistant varieties are gaining traction as climate resilience becomes increasingly important for Indian farmers facing erratic weather patterns and pest pressures .

The India Maize Seed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer Crop Science Ltd., Syngenta India Ltd., Corteva Agriscience (formerly DuPont Pioneer), Mahyco (Maharashtra Hybrid Seeds Company Ltd.), Kaveri Seed Company Ltd., Rasi Seeds Pvt. Ltd., Nuziveedu Seeds Ltd., Advanta Seeds (UPL Group), Monsanto India Ltd. (now part of Bayer), SeedWorks International Pvt. Ltd., Indo-American Hybrid Seeds (India) Pvt. Ltd., Prabhat Agri Biotech Ltd., UPL Limited, Bioseed Research India Pvt. Ltd. (DSCL Group), and JK Agri Genetics Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the India maize seed market appears promising, driven by technological advancements and supportive government policies. The increasing focus on sustainable farming practices and the adoption of precision agriculture techniques are expected to enhance productivity. Additionally, the market is likely to benefit from rising investments in agricultural research and development, fostering innovation in seed varieties. As farmers adapt to changing climatic conditions, the demand for resilient maize seeds will continue to grow, shaping the market landscape positively.

| Segment | Sub-Segments |

|---|---|

| By Type | Hybrid Maize Seeds Open-Pollinated Maize Seeds Genetically Modified Maize Seeds Conventional Maize Seeds Specialty Seeds |

| By Trait | Non-Transgenic Hybrids Drought-Tolerant Varieties Disease-Resistant Varieties |

| By End-Use Application | Food and Beverages Animal Feed Biofuel Production Others |

| By End-User | Farmers Agricultural Cooperatives Seed Distributors |

| By Region | North India South India East India West India Central India |

| By Application | Food Production Animal Feed Industrial Uses |

| By Sales Channel | Direct Sales Retail Outlets Online Sales |

| By Distribution Mode | Wholesale Distribution Retail Distribution Direct-to-Farmer Distribution |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Maize Seed Retailers | 100 | Retail Managers, Seed Store Owners |

| Farmers in Major Maize-Producing States | 150 | Smallholder Farmers, Large-scale Farmers |

| Agricultural Extension Officers | 60 | Field Officers, Agricultural Advisors |

| Seed Company Executives | 40 | Product Managers, Sales Directors |

| Research Agronomists | 40 | Crop Scientists, Research Fellows |

The India Maize Seed Market is valued at approximately USD 360 million, driven by increasing demand for maize in food, animal feed, and industrial applications such as ethanol production.