Region:Asia

Author(s):Geetanshi

Product Code:KRAA1254

Pages:88

Published On:August 2025

By Type:The manufacturing sector in India can be segmented into various types, including automotive manufacturing, electronics & semiconductor manufacturing, textile & apparel manufacturing, food & beverage processing, chemical & petrochemical manufacturing, machinery & equipment manufacturing, pharmaceutical manufacturing, renewable energy equipment manufacturing, and others. Each of these segments plays a crucial role in the overall market dynamics, driven by consumer demand, policy support, and technological advancements .

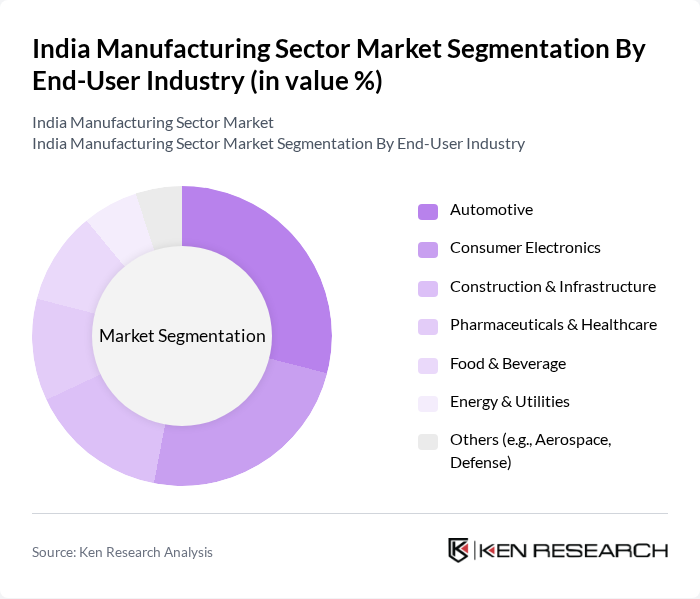

By End-User Industry:The end-user industries for the manufacturing sector in India include automotive, consumer electronics, construction & infrastructure, pharmaceuticals & healthcare, food & beverage, energy & utilities, and others. Each of these industries has unique requirements and growth trajectories, influencing the demand for manufactured products .

The India Manufacturing Sector Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Steel Limited, Mahindra & Mahindra Limited, Larsen & Toubro Limited, Bharat Forge Limited, Hindustan Aeronautics Limited, Ashok Leyland Limited, Godrej & Boyce Manufacturing Company Limited, Bosch Limited, Siemens Limited, ABB India Limited, JSW Steel Limited, Adani Enterprises Limited, Bharat Electronics Limited, Motherson Sumi Systems Limited, Hindalco Industries Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indian manufacturing sector appears promising, driven by ongoing government support and technological advancements. In future, the sector is expected to witness a significant shift towards automation and digital transformation, enhancing productivity and efficiency. Additionally, the focus on sustainability will likely lead to the adoption of eco-friendly practices, aligning with global trends. As manufacturers adapt to these changes, the sector is poised for robust growth, contributing substantially to the economy and job creation.

| Segment | Sub-Segments |

|---|---|

| By Type | Automotive Manufacturing Electronics & Semiconductor Manufacturing Textile & Apparel Manufacturing Food & Beverage Processing Chemical & Petrochemical Manufacturing Machinery & Equipment Manufacturing Pharmaceutical Manufacturing Renewable Energy Equipment Manufacturing Others (e.g., Metal Fabrication, Plastics) |

| By End-User Industry | Automotive Consumer Electronics Construction & Infrastructure Pharmaceuticals & Healthcare Food & Beverage Energy & Utilities Others (e.g., Aerospace, Defense) |

| By Region | North India South India East India West India |

| By Application | Industrial Equipment Consumer Goods Construction Materials Automotive Parts Electronics Components Renewable Energy Components Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Research and Development Grants Regulatory Support |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Manufacturing | 100 | Production Managers, Quality Control Heads |

| Automotive Manufacturing | 70 | Supply Chain Managers, Engineering Managers |

| Electronics Manufacturing | 60 | Operations Managers, Product Development Leads |

| Pharmaceutical Manufacturing | 50 | Regulatory Affairs Managers, Production Supervisors |

| Food Processing | 40 | Quality Assurance Managers, Plant Operations Managers |

The India Manufacturing Sector Market is valued at approximately USD 1.6 trillion, driven by rapid industrialization, government initiatives like "Make in India," and increasing foreign direct investment across various manufacturing verticals.