Region:Asia

Author(s):Geetanshi

Product Code:KRAA8065

Pages:89

Published On:September 2025

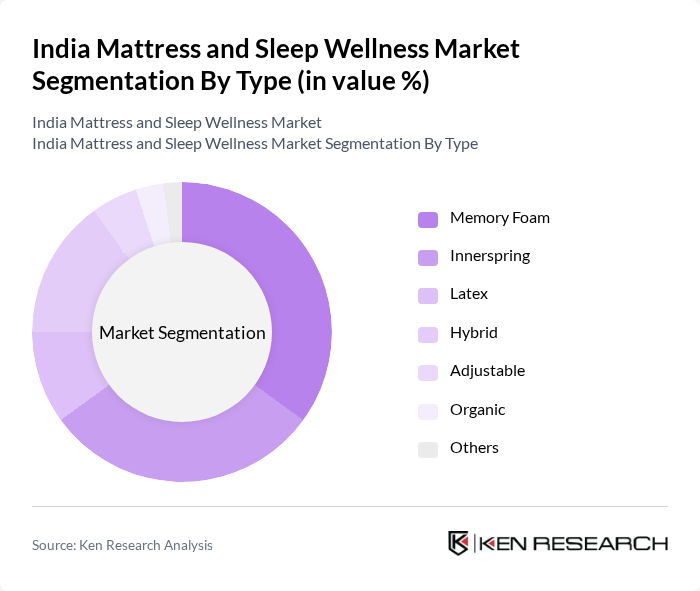

By Type:The mattress market is segmented into various types, including Memory Foam, Innerspring, Latex, Hybrid, Adjustable, Organic, and Others. Among these, Memory Foam mattresses are gaining significant traction due to their comfort and support features, appealing to consumers seeking better sleep quality. Innerspring mattresses remain popular for their traditional feel and affordability, while the demand for Organic mattresses is rising as consumers become more health-conscious.

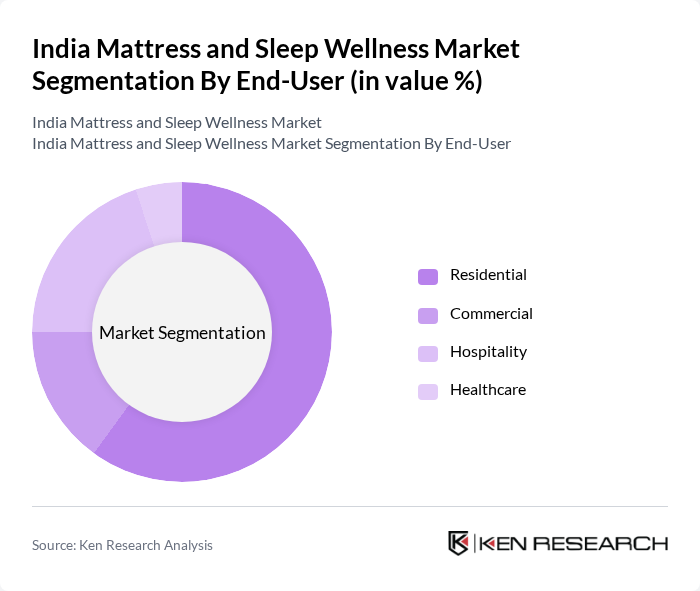

By End-User:The market is segmented into Residential, Commercial, Hospitality, and Healthcare. The Residential segment dominates the market, driven by the increasing number of households and the growing trend of home improvement. The Hospitality sector is also significant, as hotels and resorts invest in high-quality mattresses to enhance guest experiences. The Healthcare segment is emerging, with a focus on specialized mattresses for patient comfort and support.

The India Mattress and Sleep Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sleepwell, Kurlon, Duroflex, Wakefit, Sunday Mattress, Peps Mattress, Springfit, Nilkamal, Urban Ladder, SleepyCat, Zinus, Tempur-Pedic, Sealy, IKEA, Coirfit contribute to innovation, geographic expansion, and service delivery in this space.

The India mattress and sleep wellness market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As awareness of sleep health continues to rise, brands are likely to innovate with smart mattresses and sleep tracking technologies. Additionally, the increasing penetration of e-commerce will facilitate access to diverse products, enhancing consumer choice. The focus on sustainability will also shape product offerings, as eco-friendly materials gain traction among environmentally conscious consumers, creating a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Memory Foam Innerspring Latex Hybrid Adjustable Organic Others |

| By End-User | Residential Commercial Hospitality Healthcare |

| By Region | North India South India East India West India |

| By Price Range | Budget Mid-Range Premium |

| By Sales Channel | Online Retail Offline Retail Direct Sales |

| By Material | Foam Fabric Metal |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Preferences | 150 | Homeowners, Renters, Sleep Enthusiasts |

| Retail Sales Insights | 100 | Store Managers, Sales Representatives |

| Health and Wellness Impact | 80 | Healthcare Professionals, Sleep Therapists |

| Online Shopping Behavior | 120 | Frequent Online Shoppers, E-commerce Users |

| Market Trends and Innovations | 90 | Product Designers, Industry Analysts |

The India Mattress and Sleep Wellness Market is valued at approximately INR 30,000 crore, driven by increasing consumer awareness about sleep health, rising disposable incomes, and the growth of e-commerce platforms that provide access to various mattress options.