Region:Asia

Author(s):Dev

Product Code:KRAD0432

Pages:100

Published On:August 2025

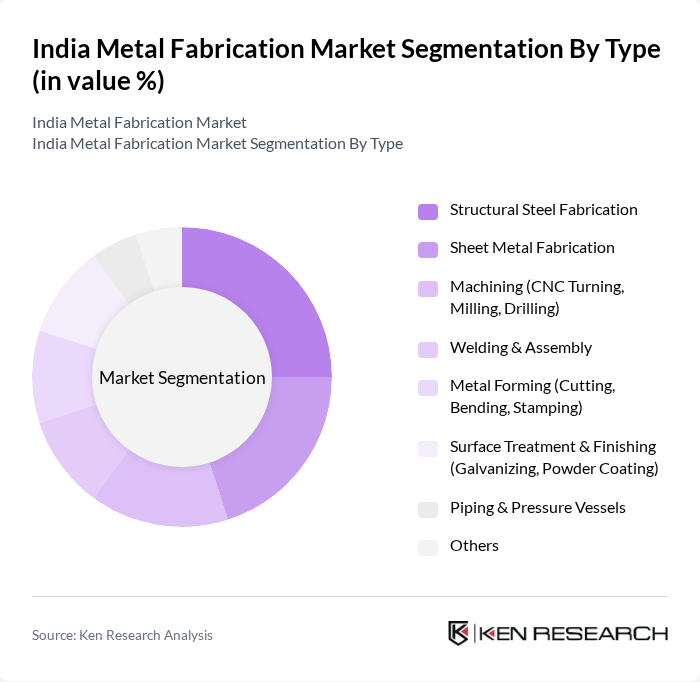

By Type:The metal fabrication market can be segmented into various types, including structural steel fabrication, sheet metal fabrication, machining (CNC turning, milling, drilling), welding & assembly, metal forming (cutting, bending, stamping), surface treatment & finishing (galvanizing, powder coating), piping & pressure vessels, and others. Each of these sub-segments plays a crucial role in meeting the diverse needs of various industries .

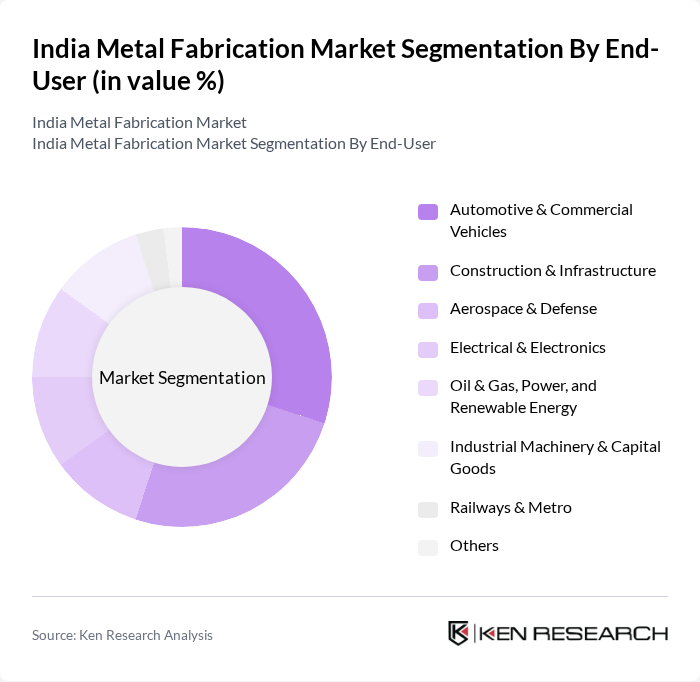

By End-User:The end-user segmentation of the metal fabrication market includes automotive & commercial vehicles, construction & infrastructure, aerospace & defense, electrical & electronics, oil & gas, power, and renewable energy, industrial machinery & capital goods, railways & metro, and others. Each end-user segment has unique requirements that drive the demand for specific fabrication services. Fabricators increasingly serve auto/EV platforms, renewable equipment (wind towers, solar mounting structures), power T&D (lattice towers), rail/metro rolling stock, and data center structures, supported by localization and industrial policy tailwinds .

The India Metal Fabrication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Larsen & Toubro Limited (L&T) – Heavy Engineering & L&T Construction, Godrej & Boyce Mfg. Co. Ltd. – Process Equipment & Precision Fabrication, Tata Steel Limited – Tata Steel Downstream Products Limited (TSDPL), JSW Steel Coated Products Ltd. (JSW Steel), Jindal Steel & Power Limited (JSPL), Steel Authority of India Limited (SAIL) – Fabrication & Engineering Units, Welspun Corp Limited (Plate/Spiral Pipes & Fabrication), APL Apollo Tubes Limited (Structural Steel Tubes & PEB), Pennar Industries Limited (PEB, Railway & Industrial Fabrication), Jindal Stainless Limited, ISGEC Heavy Engineering Ltd., Bharat Heavy Electricals Limited (BHEL) – Fabrication Shops, Thermax Limited – Boilers & Fabricated Process Equipment, KEC International Limited – Lattice Towers & Structural Fabrication, Kalpataru Projects International Ltd. (Transmission Structures), Tega Industries Limited (Mining Wear Parts & Fabrication), Taneja Aerospace & Aviation Ltd. (TAAL) – Aerospace Fabrication, Hindalco Industries Limited – Extrusions & Fabricated Products, Ramkrishna Forgings Limited – Fabricated Assemblies, Ratnamani Metals & Tubes Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The India metal fabrication market is poised for significant transformation, driven by technological advancements and increasing demand from key sectors. As the automotive and infrastructure industries expand, the need for innovative fabrication solutions will intensify. Additionally, the push towards sustainable practices and automation will reshape operational strategies. Companies that invest in advanced technologies and workforce training will likely gain a competitive edge, positioning themselves favorably in this evolving landscape, while also addressing challenges related to raw material costs and labor shortages.

| Segment | Sub-Segments |

|---|---|

| By Type | Structural Steel Fabrication Sheet Metal Fabrication Machining (CNC Turning, Milling, Drilling) Welding & Assembly Metal Forming (Cutting, Bending, Stamping) Surface Treatment & Finishing (Galvanizing, Powder Coating) Piping & Pressure Vessels Others |

| By End-User | Automotive & Commercial Vehicles Construction & Infrastructure Aerospace & Defense Electrical & Electronics Oil & Gas, Power, and Renewable Energy Industrial Machinery & Capital Goods Railways & Metro Others |

| By Region | North India South India East India West India |

| By Application | Automotive Components & Body-in-White Industrial Equipment & Enclosures Construction Structures (Beams, Girders, PEB) Consumer Appliances & Furniture Renewable Structures (Solar Mounting, Wind Towers) Process Equipment (Tanks, Vessels, Skids) Logistics & Storage (Racks, Containers) Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Production-Linked Incentives (PLI) Tax Incentives & Duty Drawbacks Regulatory Support (BIS Standards, EoDB) Others |

| By Distribution Channel | Direct Contracts/OEM Supply Distributors/Stockists Online/Platform-Based Procurement Retail/Trade Counters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Metal Fabrication | 100 | Production Managers, Quality Control Engineers |

| Construction Metal Works | 80 | Project Managers, Site Engineers |

| Aerospace Component Manufacturing | 60 | Design Engineers, Compliance Officers |

| Heavy Machinery Fabrication | 70 | Operations Supervisors, Supply Chain Managers |

| Metal Recycling and Reprocessing | 50 | Sustainability Managers, Recycling Plant Operators |

The India Metal Fabrication Market is valued at approximately USD 3.4 billion, reflecting a comprehensive analysis of historical data and market benchmarks. This valuation is driven by significant demand from sectors like construction and automotive manufacturing.