India Online Loan Aggregators Market Overview

- The India Online Loan Aggregators Market is valued at approximately USD 5.4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for quick and accessible financial solutions, the proliferation of digital platforms enabling seamless loan applications and approvals, and the adoption of advanced technologies such as artificial intelligence and automation to streamline lending processes. The market has experienced a notable increase in participation from both consumers and lenders, reflecting a broader shift toward digital financial services and a mobile-first approach among Millennials and Gen Z .

- Key cities such as Mumbai, Delhi, and Bengaluru dominate the market due to their robust financial ecosystems, high population density, and a rapidly growing base of tech-savvy consumers. These urban centers are home to a significant concentration of fintech startups and established financial institutions, fostering a competitive landscape that encourages continual innovation and enhanced customer engagement .

- In 2023, the Reserve Bank of India (RBI) implemented the “Guidelines on Digital Lending, 2023” issued by the Reserve Bank of India, requiring all digital loan providers to disclose the total cost of the loan upfront, including interest rates and all additional fees. These guidelines mandate clear communication of terms, direct loan disbursal into borrowers’ bank accounts, and explicit consent for data sharing, thereby enhancing transparency and consumer protection in the online loan aggregation sector .

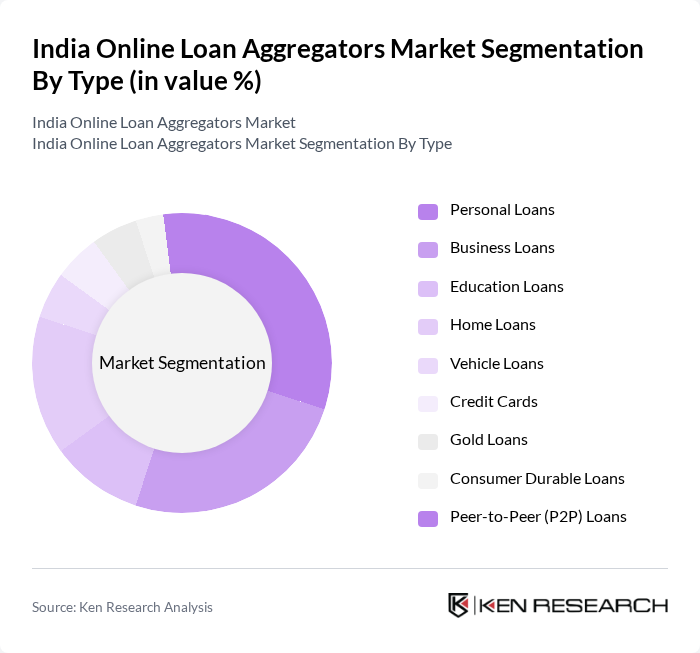

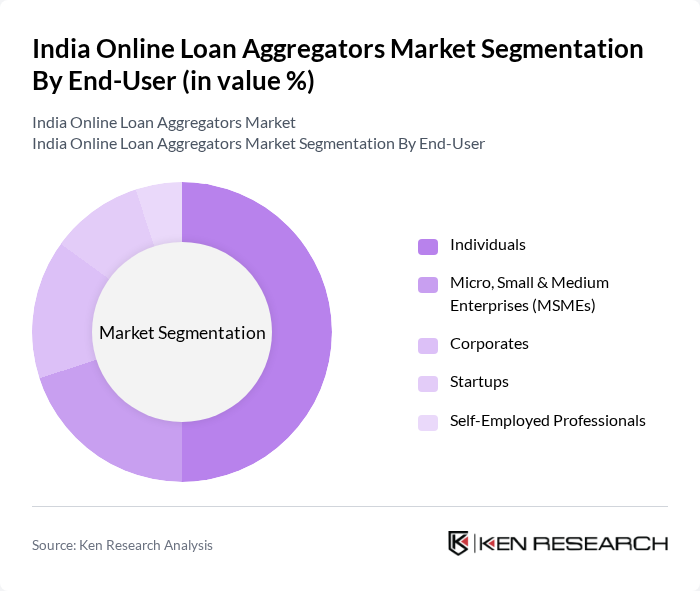

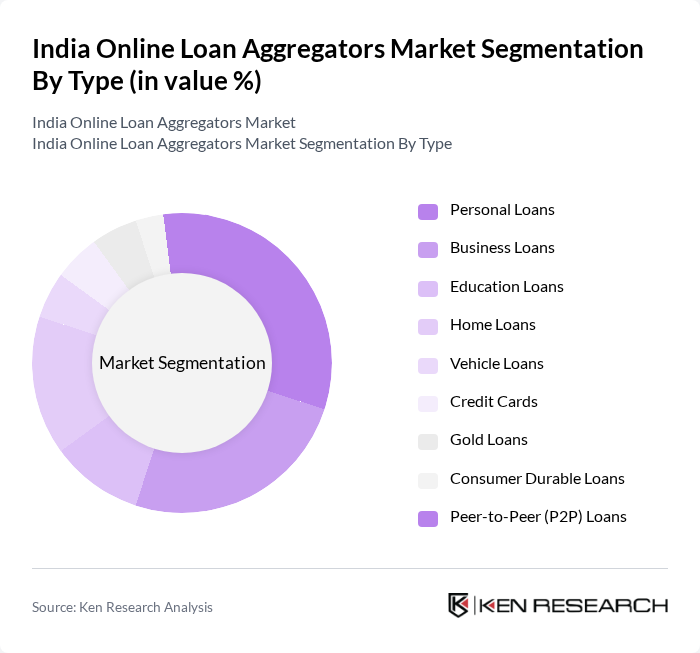

India Online Loan Aggregators Market Segmentation

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Education Loans, Home Loans, Vehicle Loans, Credit Cards, Gold Loans, Consumer Durable Loans, and Peer-to-Peer (P2P) Loans. Each type addresses distinct consumer needs, reflecting the diverse financial requirements and borrowing patterns of the Indian population. Personal loans and business loans account for the majority share, driven by the demand for unsecured credit and working capital among individuals and MSMEs. P2P loans are gaining traction, particularly among underserved segments seeking alternative financing options .

By End-User:The end-user segmentation includes Individuals, Micro, Small & Medium Enterprises (MSMEs), Corporates, Startups, and Self-Employed Professionals. Each segment has unique financial needs and risk profiles, influencing the types of loans they seek and the terms they prefer. Individuals and MSMEs are the primary drivers of demand, leveraging online aggregators for quick access to personal and working capital loans .

India Online Loan Aggregators Market Competitive Landscape

The India Online Loan Aggregators Market is characterized by a dynamic mix of regional and international players. Leading participants such as BankBazaar, Paisabazaar, Lendingkart, PaySense (now PayLater by LazyPay), RupeeRedee, CASHe, Indiabulls Dhani, EarlySalary (now Fibe), KreditBee, FlexiLoans, LoanTap, Nira, ZestMoney, Fibe, MoneyTap, Faircent, IndiaLends, and Buddy Loan contribute to innovation, geographic expansion, and service delivery in this space .

India Online Loan Aggregators Market Industry Analysis

Growth Drivers

- Increasing Digital Penetration:The digital landscape in India is rapidly evolving, with internet penetration reaching approximately759 million usersin future, according to the Telecom Regulatory Authority of India (TRAI). This surge in connectivity facilitates access to online loan aggregators, enabling consumers to compare and apply for loans conveniently. The rise of smartphones, with over750 million users, further supports this trend, as mobile applications become the primary channel for financial services, driving growth in the online loan aggregation sector.

- Rising Demand for Quick Loans:The demand for quick loans in India is escalating, with the microfinance sector alone disbursing aroundINR 3.5 trillion (approximately USD 42 billion)in loans in future. This trend is fueled by the need for immediate financial solutions among consumers, particularly in urban areas where access to traditional banking is limited. The convenience of online platforms allows borrowers to secure funds within hours, making online loan aggregators an attractive option for those seeking rapid financial assistance.

- Expansion of Financial Inclusion Initiatives:Government initiatives aimed at enhancing financial inclusion have led to a significant increase in the number of bank accounts, with over520 million new accountsopened under the Pradhan Mantri Jan Dhan Yojana in future. This expansion provides a larger customer base for online loan aggregators, as more individuals gain access to banking services. Additionally, the push for digital literacy ensures that potential borrowers are better equipped to utilize online platforms for their financial needs.

Market Challenges

- Regulatory Compliance Issues:The online loan aggregation market faces significant regulatory challenges, particularly with the Reserve Bank of India (RBI) implementing stringent guidelines.Compliance costs for aggregators are projected to increase by 20%, impacting profitability. These regulations aim to protect consumers but can also hinder the operational flexibility of aggregators, making it difficult for them to innovate and respond to market demands effectively.

- Consumer Trust and Security Concerns:Trust remains a critical issue in the online loan aggregation market, with approximately60% of potential borrowers expressing concerns over data security and fraud. The rise in cybercrime incidents, with reported cases increasing by30% in future, exacerbates these fears. As a result, aggregators must invest significantly in cybersecurity measures to build consumer confidence and ensure the safety of personal and financial information.

India Online Loan Aggregators Market Future Outlook

The future of the India online loan aggregators market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more individuals are likely to embrace online lending platforms. Additionally, the integration of artificial intelligence and machine learning will enhance customer experience and risk assessment, allowing for more personalized loan offerings. The market is expected to adapt to regulatory changes while focusing on building consumer trust through transparency and security measures.

Market Opportunities

- Growth of Peer-to-Peer Lending:The peer-to-peer lending segment is gaining traction, with an estimatedINR 100 billion (approximately USD 1.2 billion)in transactions expected in future. This model allows individuals to lend directly to borrowers, bypassing traditional financial institutions, thus creating a unique opportunity for online aggregators to facilitate these connections and expand their service offerings.

- Expansion into Rural Markets:With over65% of India's populationresiding in rural areas, there is a significant opportunity for online loan aggregators to penetrate these markets. The government’s focus on rural development and digital infrastructure is expected to increase access to financial services, potentially unlocking a market worthINR 1 trillion (approximately USD 12 billion) in rural lending in future, providing a lucrative avenue for growth.