Region:Asia

Author(s):Rebecca

Product Code:KRAA1418

Pages:88

Published On:August 2025

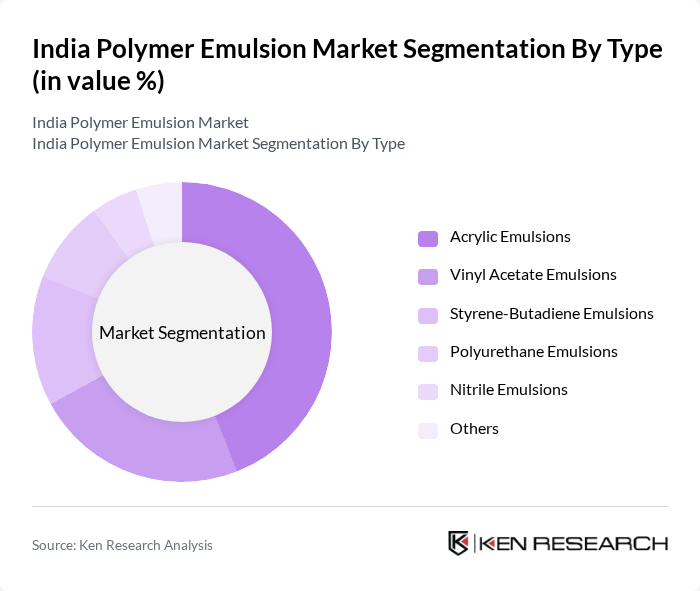

By Type:The market is segmented into various types of polymer emulsions, including Acrylic Emulsions, Vinyl Acetate Emulsions, Styrene-Butadiene Emulsions, Polyurethane Emulsions, Nitrile Emulsions, and Others. Among these, Acrylic Emulsions are the most widely used due to their excellent adhesion, flexibility, and durability, making them suitable for applications such as paints, coatings, and adhesives. Demand for Acrylic Emulsions is driven by the expanding construction industry and the increasing preference for water-based, low-VOC products .

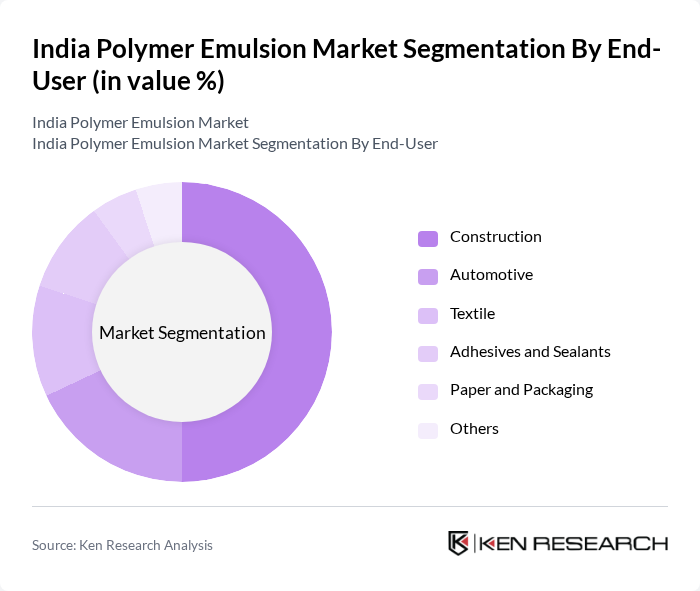

By End-User:The end-user segments include Construction, Automotive, Textile, Adhesives and Sealants, Paper and Packaging, and Others. The Construction sector is the leading end-user, driven by the increasing demand for high-performance coatings and adhesives in residential and commercial projects. Growth in infrastructure development and urbanization in India has further propelled the consumption of polymer emulsions in this sector. The paints and coatings segment accounts for the majority of demand, followed by adhesives, textiles, and packaging .

The India Polymer Emulsion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Asian Paints Ltd., BASF India Ltd., Pidilite Industries Ltd., Akzo Nobel India Ltd., Berger Paints India Ltd., Nippon Paint India Pvt. Ltd., Dow Chemical International Pvt. Ltd., Huntsman International (India) Pvt. Ltd., Sika India Pvt. Ltd., Wacker Chemie India Pvt. Ltd., Solvay Specialities India Pvt. Ltd., Clariant Chemicals (India) Ltd., 3M India Ltd., Covestro (India) Pvt. Ltd., Jotun India Pvt. Ltd., Arkema Chemicals India Pvt. Ltd., DIC India Ltd., Apcotex Industries Ltd., Visen Industries Ltd., Mallak Specialties Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India polymer emulsion market appears promising, driven by increasing demand from various sectors, particularly construction and automotive. Innovations in water-based emulsions and sustainable practices are expected to shape the market landscape. Additionally, the government's focus on infrastructure development and green manufacturing will likely create a conducive environment for growth. As manufacturers adapt to regulatory changes and consumer preferences, the market is poised for significant advancements in technology and product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Acrylic Emulsions Vinyl Acetate Emulsions Styrene-Butadiene Emulsions Polyurethane Emulsions Nitrile Emulsions Others |

| By End-User | Construction Automotive Textile Adhesives and Sealants Paper and Packaging Others |

| By Region | North India South India East India West India |

| By Application | Paints and Coatings Adhesives Textiles Construction Materials Paper and Packaging Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Research and Development Grants Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 100 | Project Managers, Procurement Officers |

| Textile Coating and Finishing | 60 | Production Managers, Quality Control Specialists |

| Adhesives and Sealants Market | 50 | Product Development Managers, R&D Managers |

| Automotive Interior Applications | 40 | Design Engineers, Supply Chain Managers |

| Consumer Goods Packaging | 45 | Marketing Managers, Packaging Engineers |

The India Polymer Emulsion Market is valued at approximately USD 31.8 billion, reflecting a significant growth trend driven by the demand for eco-friendly and sustainable products across various industries, including construction, automotive, and textiles.