Region:Asia

Author(s):Rebecca

Product Code:KRAB0291

Pages:93

Published On:August 2025

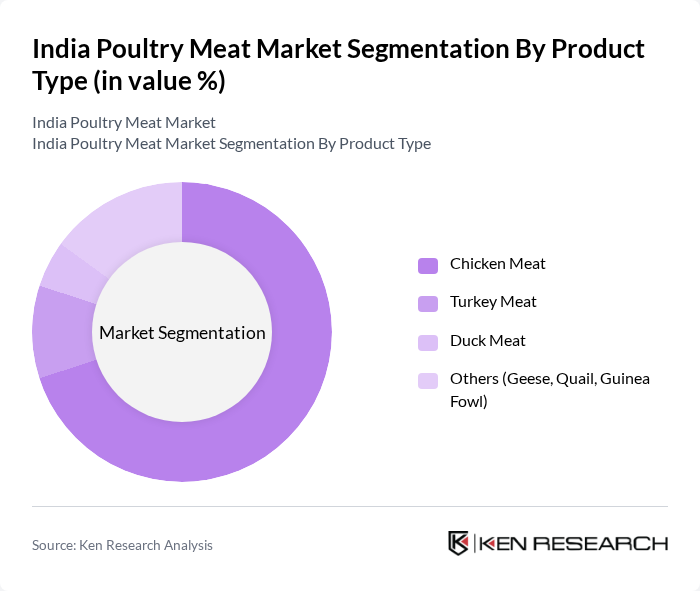

By Product Type:The product type segmentation includes Chicken Meat, Turkey Meat, Duck Meat, and Others (Geese, Quail, Guinea Fowl). Chicken meat is the most consumed and preferred type due to its versatility, affordability, and health benefits. Turkey and duck meat are niche categories, with limited but growing demand in urban centers, while other poultry types cater to specific regional and gourmet preferences.

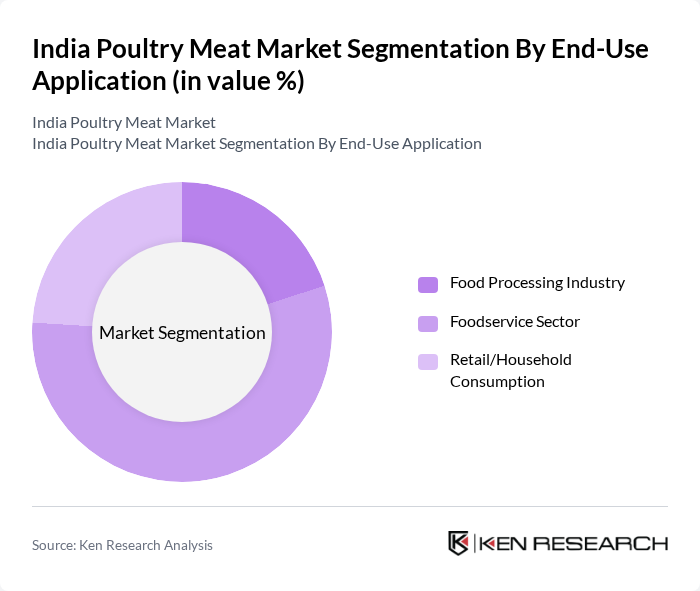

By End-Use Application:The end-use application segmentation includes Food Processing Industry, Foodservice Sector, and Retail/Household Consumption. The foodservice sector is the largest segment, driven by the proliferation of restaurants, cafes, and quick-service outlets, as well as the rising popularity of online food delivery platforms. The food processing industry is also significant, supported by the demand for processed meat products such as nuggets and sausages. Retail and household consumption continues to grow as urban consumers seek convenient and hygienic meal options.

The India Poultry Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Venky's India Ltd., Suguna Foods Pvt. Ltd., Godrej Agrovet Ltd., Skylark Hatcheries Pvt. Ltd., Sneha Farms Pvt. Ltd., IB Group, Srinivasa Farms, Mulpuri Group, RM Hatcheries (RM Group), Simran Farms Ltd., Bharati Poultry Pvt. Ltd., Indbro Research and Breeding Pvt. Ltd., National Egg Coordination Committee (NECC), Hester Biosciences Ltd., CP Group (Charoen Pokphand Foods) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India poultry meat market appears promising, driven by increasing health consciousness and a shift towards sustainable practices. As consumers become more aware of nutrition, the demand for organic and free-range poultry products is expected to rise. Additionally, technological advancements in farming and processing are likely to enhance productivity and efficiency, positioning the industry for growth. The integration of e-commerce platforms will further facilitate access to poultry products, catering to evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Chicken Meat Turkey Meat Duck Meat Others (Geese, Quail, Guinea Fowl) |

| By End-Use Application | Food Processing Industry Foodservice Sector Retail/Household Consumption |

| By Distribution Channel | Traditional Retail Stores Modern Retail Stores Online Retail Others (Specialized Meat Shops, Foodservice Establishments) |

| By Region | Maharashtra Haryana West Bengal Tamil Nadu Andhra Pradesh Uttar Pradesh Telangana Kerala Karnataka Punjab Orissa Bihar Madhya Pradesh Gujarat Rajasthan Others |

| By Product Form | Fresh / Chilled Frozen Processed (Nuggets, Sausages, Deli Meats, Burgers) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Farm Operations | 120 | Poultry Farm Owners, Farm Managers |

| Poultry Feed Suppliers | 60 | Feed Mill Managers, Sales Representatives |

| Retail Meat Outlets | 50 | Store Managers, Meat Department Supervisors |

| Veterinary Services | 40 | Veterinarians, Animal Health Technicians |

| Consumer Insights | 100 | Household Consumers, Health-Conscious Shoppers |

The India Poultry Meat Market is valued at approximately USD 6.5 billion, driven by increasing consumer demand for protein-rich diets, urbanization, and the growth of quick-service restaurants and food delivery platforms.